PTSAX Synopsis

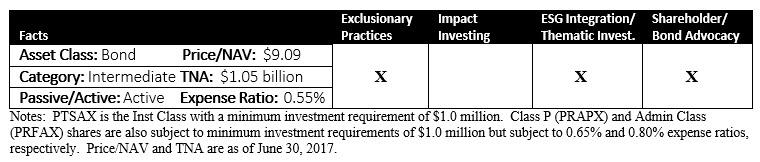

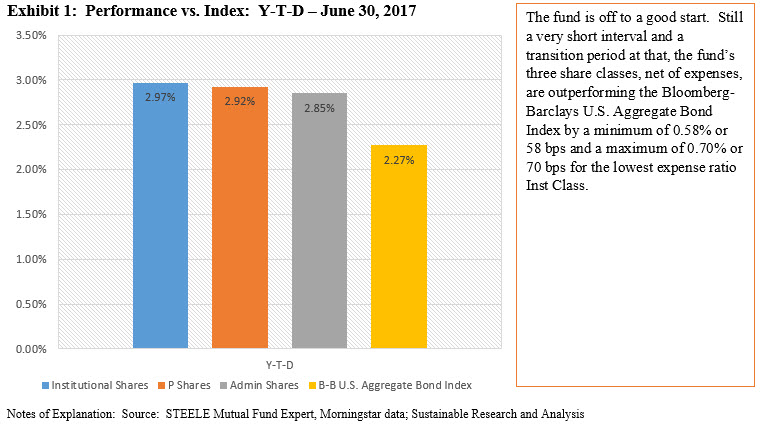

Effective January 6, 2017 the PIMCO Total Return Fund, which is an intermediate-term diversified investment grade portfolio of fixed income instruments, including non U.S. dollar denominated securities, changed its name to the PIMCO Total Return ESG Fund and at the same time modified its investment strategy to take into account the efficacy of an issuer’s environmental, social and governance (ESG) practices, to exclude securities issued by certain issuers (exclusionary strategies) from the portfolio and to engage proactively with issuers to encourage them to improve their ESG practices. The fund’s one, five and 10-year performance results have been above benchmark. But its ESG strategy is newly adopted and without the benefit of a track record. The outcome will take some time to become evident so it’s not as yet possible to evaluate the firm’s strategy implementation. That said, factors that contribute to the High Conviction assessment are PIMCO’s formidable fixed income franchise, the explicit nature of the newly adopted ESG strategy and the fact that the firm is dedicating resources to the ESG initiative which, when combined with the fund’s $1.0+ billion in net assets (assuming no defections), should give the team a strong headwind to implement the strategy. So far, the fund’s year-to-date performance exceeds that of its Bloomberg-Barclays U.S. Aggregate Bond Index benchmark. But as in the past, the fund’s future results have to overcome higher than median expense ratios, the lowest of which is 0.55% applicable to the Inst Class shares and higher for the Class P and Admin Class shares. The fund is not directly open to retail investors given that the three share classes are each subject to $1.0 million initial investments.

PIMCO Total Return ESG Fund Detailed Analysis

The fund, which is managed by Pacific Investment Management Company LLC (PIMCO), a member of the Allianz Group and one of the top 10 asset managers in the world with about $1.6 trillion in assets under management, seeks to achieve a maximum total return, consistent with the preservation of capital and prudent investment management. It generally invests at least 65% of its total assets in a diversified portfolio of fixed income instruments, including bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. The fund will invest primarily in investment grade securities, but may invest up to 20% of its total assets in high yield securities, including mortgage-related securities. The fund may also invest, within limits, in securities denominated in foreign currencies, in U.S. dollar-denominated securities of foreign issuers, and in securities and instruments that are economically tied to emerging market countries. These types of exposures are expected to contribute to the fund’s higher volatility profile relative to its designated Bloomberg-Barclays U.S. Aggregate Bond Index benchmark.

The fund’s average portfolio duration normally varies within two years (plus or minus) of the portfolio duration of the securities comprising the Bloomberg Barclays U.S. Aggregate Index which, as of May 31, 2016, was 5.35 years.

The fund has adopted a set of exclusionary practices, an ESG integration strategy and issuer engagement approach to improve ESG practices that are clearly set out in the fund’s prospectus. These are described more fully, as follows:

Exclusionary practices

The fund will not invest in the securities of any issuer determined to be engaged principally in the manufacture of alcoholic beverages, tobacco products or military equipment, the operation of gambling casinos, the production of coal, or in the production or trade of pornographic materials. In addition, the fund will not invest in the securities of any issuer determined to be engaged principally in the provision of healthcare services or the manufacture of pharmaceuticals, unless the issuer derives 100% of its gross revenues from products or services designed to protect and improve the quality of human life, as determined on the basis of available information. To the extent possible on the basis of available information, an issuer will be deemed to be principally engaged in an activity if it derives more than 10% of its gross revenues from such activities. In addition, the fund will not invest directly in securities of issuers that are engaged in certain business activities in or with the Republic of the Sudan.

ESG Integration

The fund may avoid investment in the securities of issuers whose business practices with respect to the environment, social responsibility, and governance (ESG) are not to PIMCO’s satisfaction. In determining the efficacy of an issuer’s ESG practices, PIMCO will use its own proprietary assessments of material ESG issues and may also reference standards as set forth by recognized global organizations such as entities sponsored by the United Nations.

Shareholder/Bond holder engagement

PIMCO may engage proactively with issuers to encourage them to improve their ESG practices. PIMCO’s activities in this respect may include, but are not limited to, direct dialogue with company management, such as through in-person meetings, phone calls, electronic communications, and letters. Through these engagement activities, PIMCO seeks to identify opportunities for a company to improve its ESG practices, and will endeavor to work collaboratively with company management to establish concrete objectives and to develop a plan for meeting these objectives. The fund may invest in securities of issuers whose ESG practices are currently suboptimal, with the expectation that these practices may improve over time either as a result of PIMCO’s engagement efforts or through the company’s own initiatives. It may also exclude those issuers that are not receptive to PIMCO’s engagement efforts, as determined in PIMCO’s sole discretion.

PTSAX Performance Track Record

While the PIMCO Total Return fund has been operating since May 1, 1999, its new ESG mandate only became effective January 6, 2017. Under the prior mandate, with the exception of the three-year period through June 30, 2017, the fund has delivered strong net returns relative to the Bloomberg-Barclays U.S. Aggregate Bond Index albeit with somewhat higher levels of volatility.

While still in a transition period, the fund is off to a good start in 2017 and it is outperforming the Bloomberg-Barclays U.S. Aggregate Bond Index on a year-to-date basis. See Exhibit 1.

Funds’ Expense Ratios

The fund’s expense ratios are above the median for an institutionally oriented fund. Of its three share classes, the lowest is subject to a 0.55% expense ratio. This places the fund’s fees above median for a universe of institutionally oriented corporate fixed income funds and on the cusp of the third quartile. The expense ratios of the P Class and Admin Class, at 0.65% and 0.80% rank even worse and fall into the fourth quartile[1].

PIMCO Total Return ESG Fund (PTSAX) Bottom Line

With its minimum investment of $1 million, the fund is not available to retail investors on a direct basis. Further, while PIMCO Total Return has been operating since 1 May 1999, the fund’s modified investment strategy that takes into account the efficacy of an issuer’s environmental, social and governance (ESG) practices, to exclude securities issued by certain issuers (exclusionary strategies) from the portfolio and to engage proactively with issuers to encourage them to improve their ESG practices, has only been in effect since January 6, 2017. The fund’s one, five and 10-year performance results have been above benchmark. But its ESG strategy is newly adopted and without the benefit of a track record and the outcomes will take some time to become evident so it’s not as yet possible to evaluate the firm’s strategy implementation. That said, factors that contribute to the High Conviction assessment are PIMCO’s formidable fixed income franchise, the explicit nature of the newly adopted ESG strategy and the fact that the firm is dedicating resources to the ESG initiative which, when combined with the fund’s $1.0+ billion in net assets (assuming no defections), should give the team a strong headwind to implement the strategy. So far, the fund’s year-to-date performance exceeds that of its Bloomberg-Barclays U.S. Aggregate Bond Index benchmark. But as in the past, the fund’s future results have to overcome higher than median expense ratios, the lowest of which is 0.55% applicable to the Inst Class shares and higher for the P Class P and Admin Class shares.

[1] Based on an analysis of expense ratios applicable to 123 institutional funds as of June 30, 2017. Refer to the article entitled Stratifying Expense Ratios: An Explanation.