The Bottom Line: It’s premature to boast about the outperformance of sustainable mutual funds and ETFs based on the February to March 2020 market rout.

Introduction and Conclusion: It’s premature to boasting about the outperformance of sustainable funds during the recent market rout

In the last several weeks, a number of articles, asset management company testimonials, remarks on the part of investment firm executives as well as research reports have been boasting about the outperformance of sustainable investing strategies and, in particular, ESG attributes in investing during the recent March 2020 downturn. While this may be the case for some investment strategies, absolute results are still negative and in the double digit range and variations from benchmark are narrow. More importantly, however, advocacy for sustainable investing has been anchored in the belief that this approach is consistent with long-term value creation. It is still premature to establish causation and it seems contradictory to focus on short-term returns when investors should be encouraged to consider and evaluate the performance of sustainable funds over several market cycles. Relying on short-term results is likely to lead to disappointment and, equally pertinent, it’s still not entirely clear at this juncture that long-term results attributed to similarly managed sustainable funds can achieve any better investment results relative to conventional counterparts. Three indices tracked by Sustainable Research and Analysis reflect mixed results in the near-term and something short of conventional index beating returns over two and three year time intervals based on the availability of data.

Recent performance testimonials boast about the outperformance of sustainable investing strategies and ESG attributes

By way of illustration, a statement appearing on the Mirova Asset Management website reports that the Mirova International Sustainable Equity Fund outperformed its index during the COVID-19 market turbulence that occurred between February 19th and March 20th. Mirova is a Paris-based asset manager that provides “its clients with investment solutions that aim to reconcile financial performance with positive environmental and social impact.”

Another example, Bloomberg in a March 13, 2020 analysis revealed that, in the current volatile market, the average ESG fund declined less than the S&P 500 and, also, that older ESG funds have been outperforming newer ESG funds. Bloomberg goes on to observe that this outcome suggests that managers at older ESG funds have more experience investing through an ESG lens than do the newcomers, and so are able to execute more effectively.

Morningstar has also published research that promotes the first quarter 2020 performance of sustainable funds relative to conventional funds in an article published on April 3, 2020 entitled “Sustainable Funds Weather the First Quarter Better Than Conventional Funds.” According to Morningstar’s research covering a universe of 206 funds, “seven out of 10 sustainable equity funds finished in the top halves of their Morningstar categories; and 24 of 26 environmental, social and governance-tilted index funds outperformed their closest conventional counterparts. According to this research, the twenty-six index funds posted an average decline of -18.51% versus -19.60% total return recorded by the iShares Core S&P ETF 500, the same result as the S&P 500 Index, or a differential of 109 bps. Sustainable index international and emerging market equity funds delivered even better average results relative to their corresponding conventional benchmarks.

Performance of three Sustainable (SUSTAIN) Fund indices offer a more nuanced picture

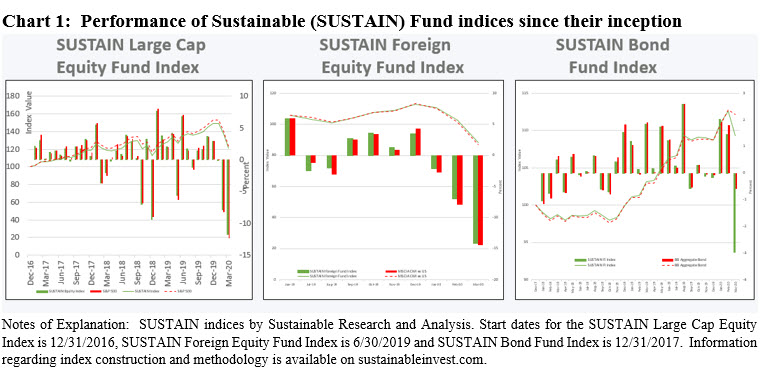

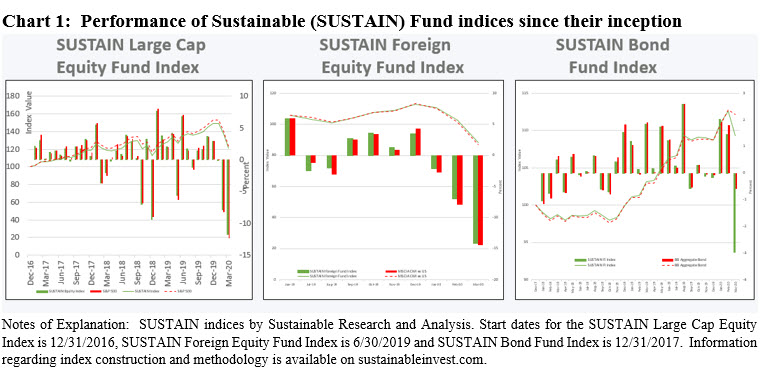

Two fund indices maintained by Sustainable Research and Analysis that track the performance of sustainable US large cap funds and foreign equity funds (world funds) also portray similar near-term outcomes. The Sustainable (SUSTAIN) Large Cap Equity Fund Index, an index that tracks the performance of the ten largest funds investing in large cap equities that employ an ESG integration strategy[1] beat the S&P 500 by 59 basis points (bps) in March as six funds outperformed the conventional benchmark. The SUSTAIN Large Cap Equity Fund Index also led the S&P 500 for the first quarter and trailing 12-months by 72 bps and 1.15%, respectively. At the same time, the SUSTAIN Index trailed behind the S&P 500 by 2.12% over the 39-month interval since inception as of December 31, 2016. Refer to Chart 1.

Another of our indices, the Sustainable (SUSTAIN) Foreign Equity Fund Index, outperformed its conventional counterpart by 28 bps in March and led the MSCI ACWI, ex USA conventional benchmark by 1.47% and 1.38% for the quarter as well as the eight months since inception. The SUSTAIN Foreign Equity Fund Index has been calculated only since June 30, 2019 due to a limitation in the number of similarly managed funds prior to that date.

The same conclusion, however, can’t be ascribed to the performance of fixed income funds. According to the Sustainable (SUSTAIN) Bond Fund Index that tracks the performance of the ten largest intermediate investment-grade bond funds that pursue similar sustainable investing strategies, bond funds trailed their conventional index by 2.39% in March. The Sustainable (SUSTAIN) Bond Fund Index recorded a -2.98% total return in March versus a total return of -0.59% posted by the Bloomberg Barclays US Aggregate Bond Index. This was the widest gap between the two indices observed since we launched the SUSTAIN Bond Fund Index as of December 2017, in large part attributable to credit quality variations between the two indices. The same index also lagged in the first quarter, coming in at 0.44% versus the 3.15% delivered by the conventional index. Since inception, a gap of -2.87% has been recorded between the SUSTAIN Bond Fund Index and its conventional counterpart.

Conclusion: Caution is advised and investment results of sustainable funds should be evaluated over a longer time period

While it’s promising that some similarly managed sustainable funds have outperformed their conventional benchmarks, investors should be cautious regarding the long-term performance prospects of these investment vehicles and their results should be evaluated over a longer time period, i.e. at least one-to-two complete market cycles. In the meantime, investor expectations should be tempered. Subject to sustainable strategy variations, it’s more likely to be the case that actively managed sustainable funds will perform in line with conventional fund counterparts over a complete market cycle while also contributing in the process to long-term value creation and, hopefully, positive societal outcomes.

[1] May be combined with related approaches, for example, negative screening (exclusions), impact, and engagement.

Performance of Sustainable Funds During Recent Market Rout–Proceed with Caution

The Bottom Line: It’s premature to boast about the outperformance of sustainable mutual funds and ETFs based on the February to March 2020 market rout.

Share This Article:

The Bottom Line: It’s premature to boast about the outperformance of sustainable mutual funds and ETFs based on the February to March 2020 market rout.

Introduction and Conclusion: It’s premature to boasting about the outperformance of sustainable funds during the recent market rout

In the last several weeks, a number of articles, asset management company testimonials, remarks on the part of investment firm executives as well as research reports have been boasting about the outperformance of sustainable investing strategies and, in particular, ESG attributes in investing during the recent March 2020 downturn. While this may be the case for some investment strategies, absolute results are still negative and in the double digit range and variations from benchmark are narrow. More importantly, however, advocacy for sustainable investing has been anchored in the belief that this approach is consistent with long-term value creation. It is still premature to establish causation and it seems contradictory to focus on short-term returns when investors should be encouraged to consider and evaluate the performance of sustainable funds over several market cycles. Relying on short-term results is likely to lead to disappointment and, equally pertinent, it’s still not entirely clear at this juncture that long-term results attributed to similarly managed sustainable funds can achieve any better investment results relative to conventional counterparts. Three indices tracked by Sustainable Research and Analysis reflect mixed results in the near-term and something short of conventional index beating returns over two and three year time intervals based on the availability of data.

Recent performance testimonials boast about the outperformance of sustainable investing strategies and ESG attributes

By way of illustration, a statement appearing on the Mirova Asset Management website reports that the Mirova International Sustainable Equity Fund outperformed its index during the COVID-19 market turbulence that occurred between February 19th and March 20th. Mirova is a Paris-based asset manager that provides “its clients with investment solutions that aim to reconcile financial performance with positive environmental and social impact.”

Another example, Bloomberg in a March 13, 2020 analysis revealed that, in the current volatile market, the average ESG fund declined less than the S&P 500 and, also, that older ESG funds have been outperforming newer ESG funds. Bloomberg goes on to observe that this outcome suggests that managers at older ESG funds have more experience investing through an ESG lens than do the newcomers, and so are able to execute more effectively.

Morningstar has also published research that promotes the first quarter 2020 performance of sustainable funds relative to conventional funds in an article published on April 3, 2020 entitled “Sustainable Funds Weather the First Quarter Better Than Conventional Funds.” According to Morningstar’s research covering a universe of 206 funds, “seven out of 10 sustainable equity funds finished in the top halves of their Morningstar categories; and 24 of 26 environmental, social and governance-tilted index funds outperformed their closest conventional counterparts. According to this research, the twenty-six index funds posted an average decline of -18.51% versus -19.60% total return recorded by the iShares Core S&P ETF 500, the same result as the S&P 500 Index, or a differential of 109 bps. Sustainable index international and emerging market equity funds delivered even better average results relative to their corresponding conventional benchmarks.

Performance of three Sustainable (SUSTAIN) Fund indices offer a more nuanced picture

Two fund indices maintained by Sustainable Research and Analysis that track the performance of sustainable US large cap funds and foreign equity funds (world funds) also portray similar near-term outcomes. The Sustainable (SUSTAIN) Large Cap Equity Fund Index, an index that tracks the performance of the ten largest funds investing in large cap equities that employ an ESG integration strategy[1] beat the S&P 500 by 59 basis points (bps) in March as six funds outperformed the conventional benchmark. The SUSTAIN Large Cap Equity Fund Index also led the S&P 500 for the first quarter and trailing 12-months by 72 bps and 1.15%, respectively. At the same time, the SUSTAIN Index trailed behind the S&P 500 by 2.12% over the 39-month interval since inception as of December 31, 2016. Refer to Chart 1.

Another of our indices, the Sustainable (SUSTAIN) Foreign Equity Fund Index, outperformed its conventional counterpart by 28 bps in March and led the MSCI ACWI, ex USA conventional benchmark by 1.47% and 1.38% for the quarter as well as the eight months since inception. The SUSTAIN Foreign Equity Fund Index has been calculated only since June 30, 2019 due to a limitation in the number of similarly managed funds prior to that date.

The same conclusion, however, can’t be ascribed to the performance of fixed income funds. According to the Sustainable (SUSTAIN) Bond Fund Index that tracks the performance of the ten largest intermediate investment-grade bond funds that pursue similar sustainable investing strategies, bond funds trailed their conventional index by 2.39% in March. The Sustainable (SUSTAIN) Bond Fund Index recorded a -2.98% total return in March versus a total return of -0.59% posted by the Bloomberg Barclays US Aggregate Bond Index. This was the widest gap between the two indices observed since we launched the SUSTAIN Bond Fund Index as of December 2017, in large part attributable to credit quality variations between the two indices. The same index also lagged in the first quarter, coming in at 0.44% versus the 3.15% delivered by the conventional index. Since inception, a gap of -2.87% has been recorded between the SUSTAIN Bond Fund Index and its conventional counterpart.

Conclusion: Caution is advised and investment results of sustainable funds should be evaluated over a longer time period

While it’s promising that some similarly managed sustainable funds have outperformed their conventional benchmarks, investors should be cautious regarding the long-term performance prospects of these investment vehicles and their results should be evaluated over a longer time period, i.e. at least one-to-two complete market cycles. In the meantime, investor expectations should be tempered. Subject to sustainable strategy variations, it’s more likely to be the case that actively managed sustainable funds will perform in line with conventional fund counterparts over a complete market cycle while also contributing in the process to long-term value creation and, hopefully, positive societal outcomes.

[1] May be combined with related approaches, for example, negative screening (exclusions), impact, and engagement.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact