The Bottom Line: Long-term performance through September continues to support portfolios informed by or indexed to ESG screened international benchmarks, however, their advantage is narrowing.

0:00

/

0:00

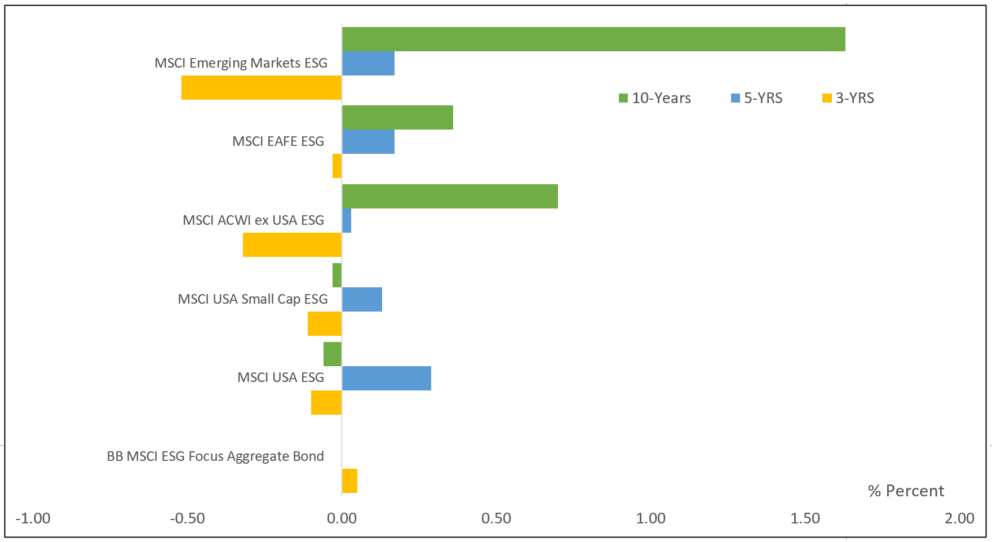

Intermediate-to-long-term performance differential: Selected ESG screened indices vs. conventional indices: Trailing 3, 5 and 10-years to September 30, 2022 Notes of Explanation: The six MSCI ESG indices include the MSCI USA ESG Leaders Index consisting of large and mid-cap companies, MSCI USA Small Cap ESG Leaders Index, MSCI ACWI ex USA Leaders Index consisting of large and mid-cap companies in developed and developing countries, MSCI EAFE ESG Leaders Index consisting of large and mid-cap companies in developed markets. MSCI Leaders indices are constructed to provide exposure to companies with high ESG scores relative to their sector peers. Intermediate term covers 3 and 5 years. Long-term=10 years. Data source: MSCI

Notes of Explanation: The six MSCI ESG indices include the MSCI USA ESG Leaders Index consisting of large and mid-cap companies, MSCI USA Small Cap ESG Leaders Index, MSCI ACWI ex USA Leaders Index consisting of large and mid-cap companies in developed and developing countries, MSCI EAFE ESG Leaders Index consisting of large and mid-cap companies in developed markets. MSCI Leaders indices are constructed to provide exposure to companies with high ESG scores relative to their sector peers. Intermediate term covers 3 and 5 years. Long-term=10 years. Data source: MSCI

Observations:

- The outperformance of ESG screened indices, a consideration in promoting the alpha generating properties of ESG versus conventional investing in 2021, continued to narrow in September. This observation is based on the tracking of six selected MSCI ESG Leaders indices and their performance, including two US stock indices, three international and one fixed income index.

- The reality of higher interest rates and high inflation fueled by high employment and strong demand triggered a decline of 9.27% in the MSCI USA Index (large and mid-cap companies) in September while the Bloomberg Aggregate US Bond Index gave up 4.32%. All but one industry sector posted negative results. Against this backdrop, three of five selected US and international ESG screened equity indices comprised of companies with high ESG scores relative to sector peers and one bond fund index lagged behind their conventional counterparts, for a total of four underperforming indices of six. This is the third month in a row during which four or more of the same six indices trailed, and the sixth month so far in 2022.

- The US-oriented benchmarks, the MSCI USA ESG Leaders Index and the MSCI USA Small Cap ESG Leaders Index, exceeded the total return performance of their conventional counterparts in September by 31 basis points (bps) and 92 bps, respectively. Both indices lagged last month but retain a performance advantage over the 1-year term. That said, the two indices delivered mixed results in the intermediate 3-year and 5-year time periods while falling behind over the ten- year time horizon to September 30, 2022.

- The three international indices, including the MSCI ACWI ex USA ESG Leaders Index, the MSCI Emerging Markets ESG Leaders Index and the MSCI EAFE ESG Leaders Index, fell behind their conventional counterparts in September by 65 bps, 97 bps and 53 bps, respectively. The indices now also trail over the 1-year and 3-year time periods but continue to lead with narrower margins over 5-years and 10-years.

- As for fixed income, the Bloomberg MSCI ESG Focus Aggregate Bond Index posted the sharpest monthly decline so far this year, giving up -4.34% versus -4.32% for the Bloomberg US Aggregate Bond Index. It’s also off by 2 bps over the previous twelve-month interval but leads by 5 bps over the trailing 3-years. The index was launched less than five years ago.

- While long-term results continue to support ESG screened international benchmarks, the leads posted by the international indices, in particular, relative to conventional benchmarks have been shrinking by a minimum of 50% over the 10-year and 5-year terms since January 2021.