Research and analysis to keep sustainable investors up to-date on a broad range of topics that include trends and developments in sustainable investing and sustainable finance, regulatory updates, performance results and considerations, investing through index funds and actively managed portfolios, asset allocation updates, expenses, ESG ratings and data, company and product news, green, social and sustainable bonds, green bond funds as well as reporting and disclosure practices, to name just a few.

A continuously updated Funds Directory is also available to investors. This is intended to become a comprehensive listing of sustainable mutual funds, ETFs and other investment products along with a description of their sustainable investing approaches as set out in fund prospectuses and related regulatory filings.

Many questions have surfaced in recent years regarding sustainable and ESG investing. Here, investors and financial intermediaries will find materials that describe the various approaches to sustainable investing and their implementation. While sustainable investing approaches vary and they have thus far defied universally accepted definitions, many practitioners agree that they fall into the following broad categories: Values-based investing, investing via exclusions, impact investing, thematic investments and ESG integration. In conjunction with each of these approaches, investors may also adopt various issuer engagement procedures and proxy voting practices. That said, sustainable investing approaches will continue to evolve.

In addition to periodic updates regarding sustainable investing and how this form of investing is evolving, investors and financial intermediaries interested in implementing a sustainable investing approach will also find source materials that cover basic investing themes as well as asset allocation tactics.

Thoughts and ideas targeting sustainable investing strategies executed through various registered and non-registered sustainable investment funds and products such as mutual funds, Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), closed-end funds, Real Estate Investment Trusts (REITs) and Unit Investment Trusts (UITs). Coverage extends to investment management firms as well as fund groups.

Omicron lands in November and pushes stocks lower

The uncertainty introduced by the sudden appearance of the Omicron COVID 19 variant was swiftly reflected in stock prices that reversed course after reaching new highs in November just ahead of the Thanksgiving holiday. The S&P 500 gave up -0.7%, with much of the downward pricing pressure taking place during the last three trading days…

Share This Article:

The Bottom Line: The sudden appearance of Omicron pushes most major indices lower while selected ESG indices continue to outperform over the intermediate to long-term.

Just about all major indices ended lower in November following the sudden appearance of Omicron

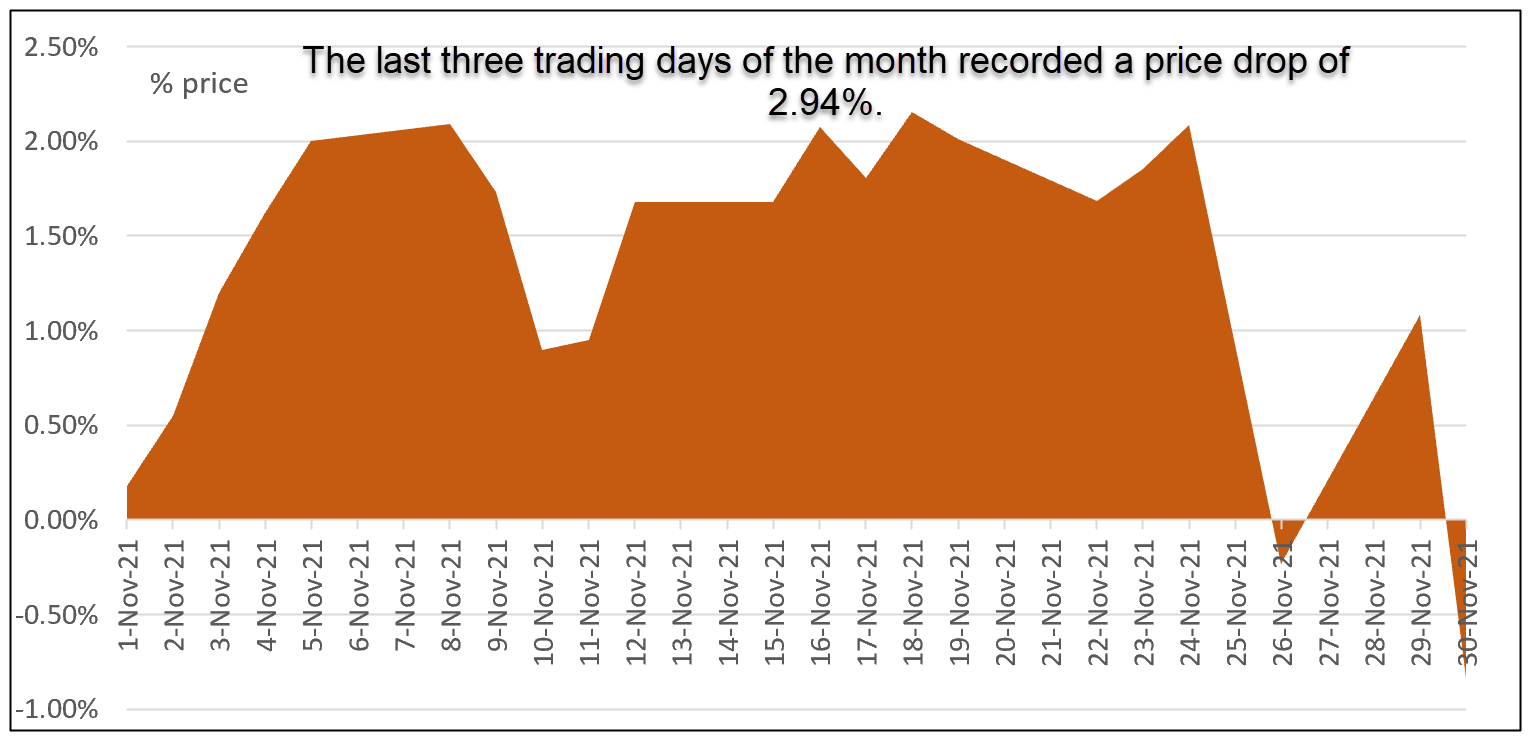

The uncertainty introduced by the sudden appearance of the Omicron COVID 19 variant was swiftly reflected in stock prices that reversed course after reaching new highs in November just ahead of the Thanksgiving holiday. The S&P 500 gave up -0.7%, with much of the downward pricing pressure taking place during the last three trading days of the month. Of 21 trading sessions, seven registered declines and the last three trading days recorded a price drop of -2.94%. Refer to Chart 1. The Dow Jones Industrial Average (DJIA) posted a sharper November decline of -3.5%. while the NASDAQ Composite along with large cap growth stocks were exceptions. These posted gains of 0.3% and 1.5%, respectively. Large cap stocks outperformed small caps, and growth stocks were better performers relative to value stocks. Commodities aside, microcap stocks according to the Russell Microcap Growth Index ended the month at the lowest end of the range with a total return of -6.5%. Industry sector results were also largely negative and varied across the market capitalization range. The best sector results were achieved by large cap Information Technology companies, up 4.4%, while small cap Energy sector stocks posted a -13% decline.

Global and international benchmarks were almost entirely negative across the board, declining by wider margins relative to the US. The MSCI ACWI ex USA Index registered a -4.5% decline while the MSCI EAFE closed 2 bps lower at -4.7%. Emerging markets were also in the red but indicated a lower -4.1% drop. Taiwan achieved a positive 2.2% return while Russia, the worst performing emerging market, dropped -10.9%.

After posting negative results for three consecutive months, investment grade intermediate-term bonds, per the Bloomberg US Aggregate Bond Index, added 30 bps. 10-year Treasury yields had been ratcheting up due to inflation concerns and the anticipated actions by the Federal Reserve to accelerate the winding down of their bond-buying stimulus program ahead of raising short-term interest rates. Yield rose 10 bps to 1.67% on November 23rd and then reversed course as quickly as stocks, dropping 24 bps to end the month at 1.43%.

Chart 1: Cumulative price performance of the S&P 500 Index-November 2021

Source: Yahoo finance/S&P Global

Selected sustainable securities market indices turned in mixed results in November and trailing twelve months while sustaining long-term outperformance

Of seven selected sustainable securities market indices, including six equity benchmarks (two of which both track the US equity market) and one bond index, three indices outperformed their conventional counterparts and one matched. Outperformers included the Bloomberg MSCI ESG Focus Aggregate Bond Index, the S&P 500 ESG Index and the MSCI USA Small Cap ESG Index that beat their counterpart conventional securities market indices by 1 bp, 83 bps and 94 bps, respectively. The Small Cap ESG index benefited from its lower level of exposure to the Energy sector, 2.52%, versus 4.1% given the outsized -13.0% drop in the performance of small cap energy stocks.

Three indices trailed. These include two international indices, the MSCI ACWI ex USA ESG Index and the MSCI Emerging Markets ESG Index that lagged by 20 bps and 84 bps, in that sequence, as well as the MSCI USA ESG Index that underperformed by 66 bps.

The MSCI EAFE ESG Index posted a decline of -4.65%, identical to the performance of its EAFE conventional counterpart.

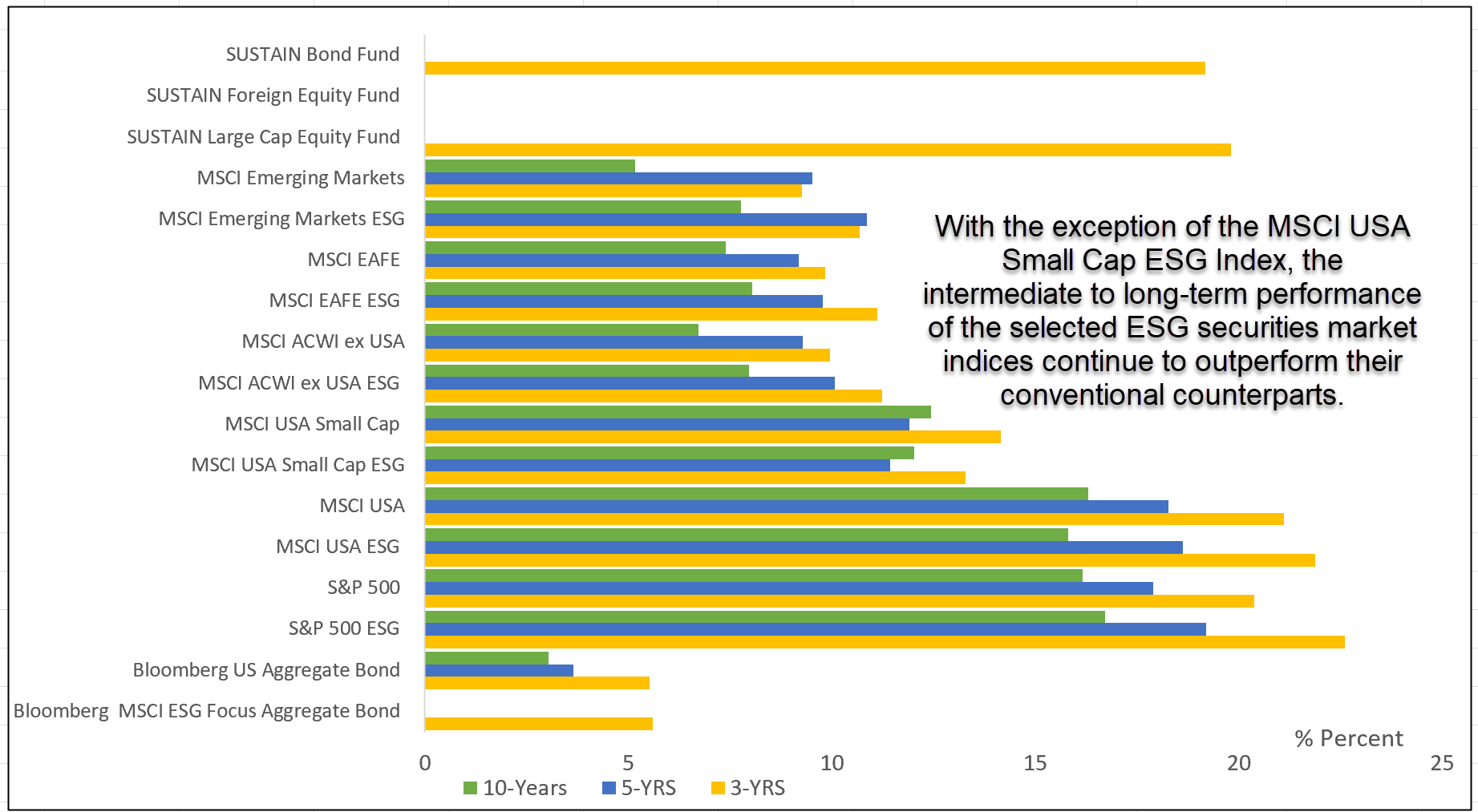

Excepting for the MSCI USA Small Cap ESG Index, intermediate and long-term ESG index results continue to offer investors a consistent performance advantage. Refer to Chart 2.

Chart 2: Selected sustainable indices intermediate and long-term total return performance results to November 30, 2021 Notes of Explanation: Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. MSCI USA Small Cap returns are price only. Sources: MSCI, S&P Global, Sustainable Research and Analysis LLC.

Notes of Explanation: Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. MSCI USA Small Cap returns are price only. Sources: MSCI, S&P Global, Sustainable Research and Analysis LLC.

Sustainable investment funds post an average -1.98% decline in November

Sustainable investment funds, including mutual funds and ETFs covering all asset classes, a total of 1,201 funds with $408.8 billion in assets (per Morningstar), recorded an average decline of -1.98%. Returns spanned a range of 18.85%. The best performing fund was the $111.9 values-based Quantified Common Ground Fund Investment Class Shares (QCGDX), up 4.71%. The fund invests primarily in common stocks and bonds of issuers that are compliant with both environmental, social and governance and Biblically Responsible Investing standards by employing an exclusionary approach. At the other end of the range as the -14.14% posted by the $10.3 Direxion Daily Global Clean Energy Bull 2X Shares ETF (KLNE). The thematic exclusionary fund employs leverage and tracks the performance of companies in developed markets linked to the global clean energy business pursuant to a revised S&P Global index methodology effective as of October 18, 2021. The fund has been affected by a downturn in the clean-energy sector in part due to some uncertainties linked to government support for wind and solar companies. Other thematic funds in the sector were also laggards in November. Refer to the funds in the Funds Directory tab for further details on each fund’s sustainable investing approach.

Sustainable (SUSTAIN) fund indices lagged their conventional benchmark counterparts in November

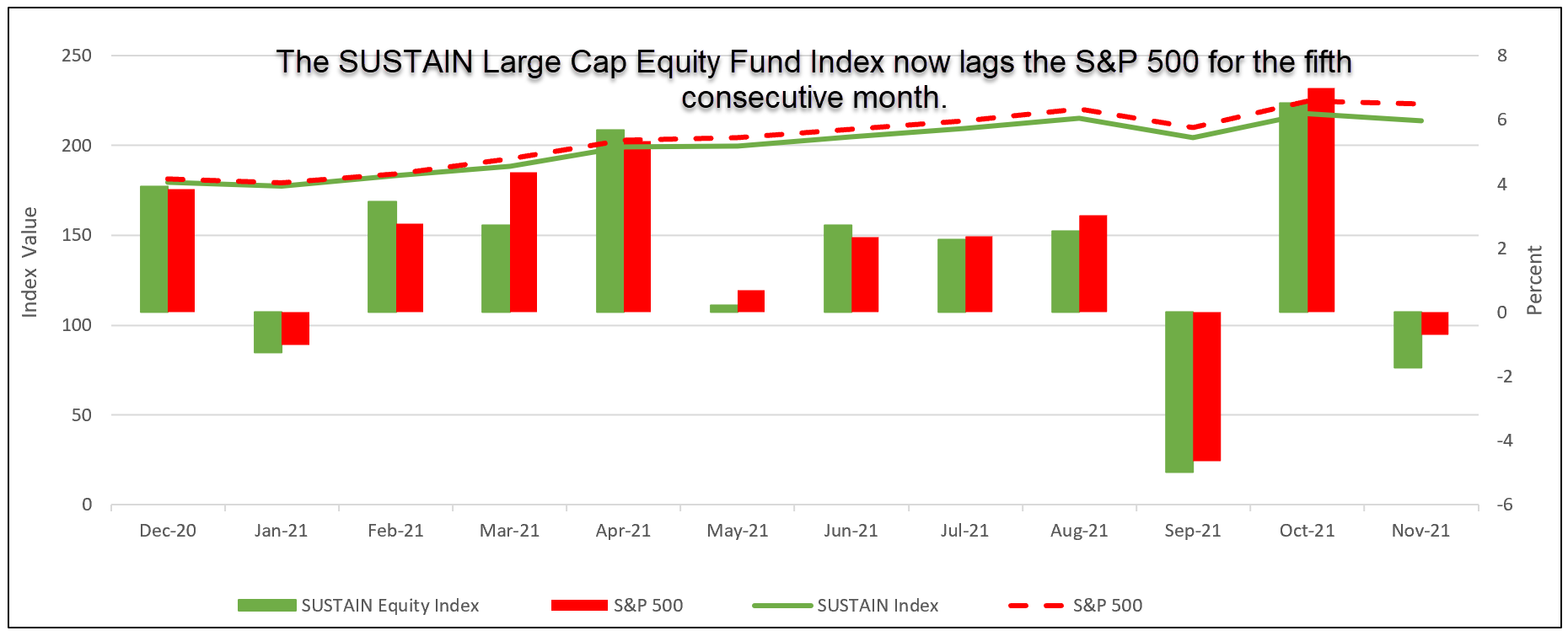

The Sustainable (SUSTAIN) Large Cap Equity Fund Index backtracked in November and gave up some of its strong October gain by posting a decline of -1.73% for a large 1.03% negative variance relative to the S&P 500. This was the fifth consecutive lagging month that now places the SUSTAIN Index behind for the quarter, year-to-date interval, 12-months and trailing three-years. Refer to Chart 3.

Eight of the ten constituent funds registered results that lagged the S&P 500 and only one fund ended the month in positive territory. This was the Parnassus Core Equity Fund Investor Shares (PRBLX), up 0.24%. In tenth position was the Hartford Capital Appreciation Fund A (ITHAX) that recorded a -3.27% decline.

Chart 3: SUSTAIN Large Cap Equity Fund Index Performance Results: December 2020 – November 30, 2021

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

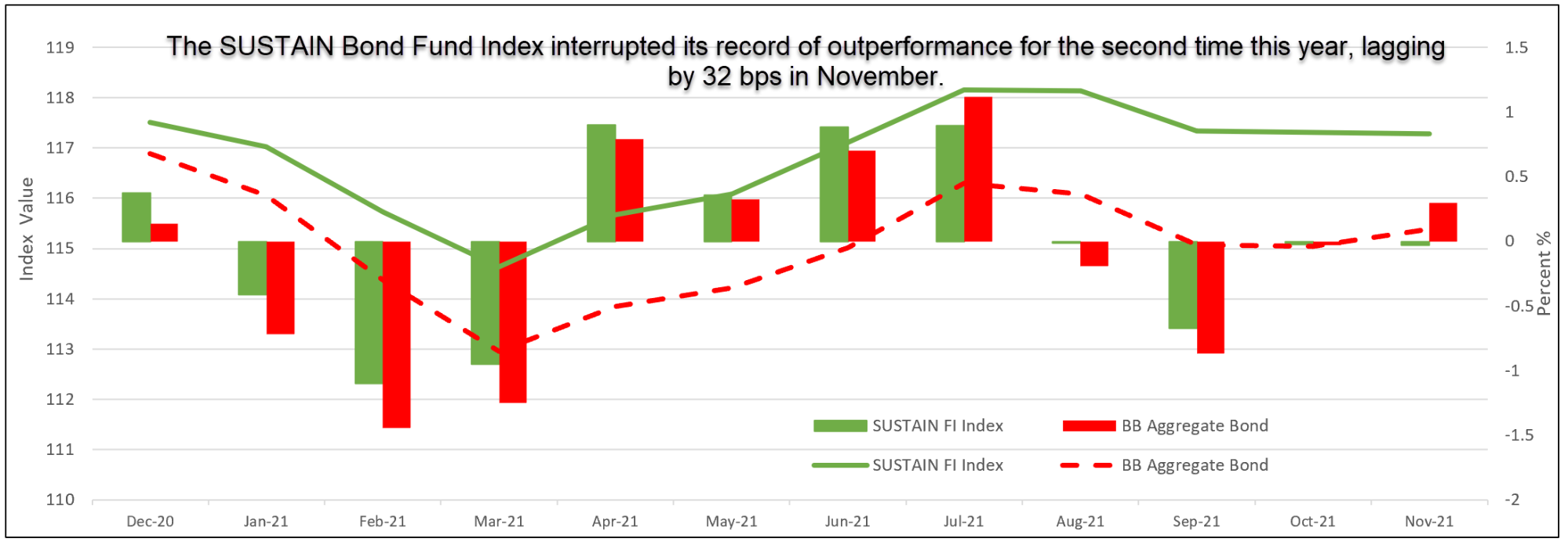

Sustainable (SUSTAIN) Bond Fund Index again interrupted its record of monthly outperformance, recording a negative differential of 32 bps

Having interrupted its 15-month streak of monthly outperformance in July of this year, the Sustainable (SUSTAIN) Bond Fund Index resumed its record of monthly outperformance in

August and now in November has again interrupted its record by giving up -0.03% versus a gain of 0.30% posted by the conventional Bloomberg US Aggregate Bond Index. Refer to Chart 4.

Only one of ten constituent funds outperformed, led by Goldman Sachs Core Fixed Income Fund P (GAKPX) that was up 0.34%. Lagging the field was the Neuberger Berman Strategic Income Fund I (NSTLX), off -1.02%.

Chart 4: SUSTAIN Bond Fund Index Performance Results: December 2020 – November 30, 2021

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

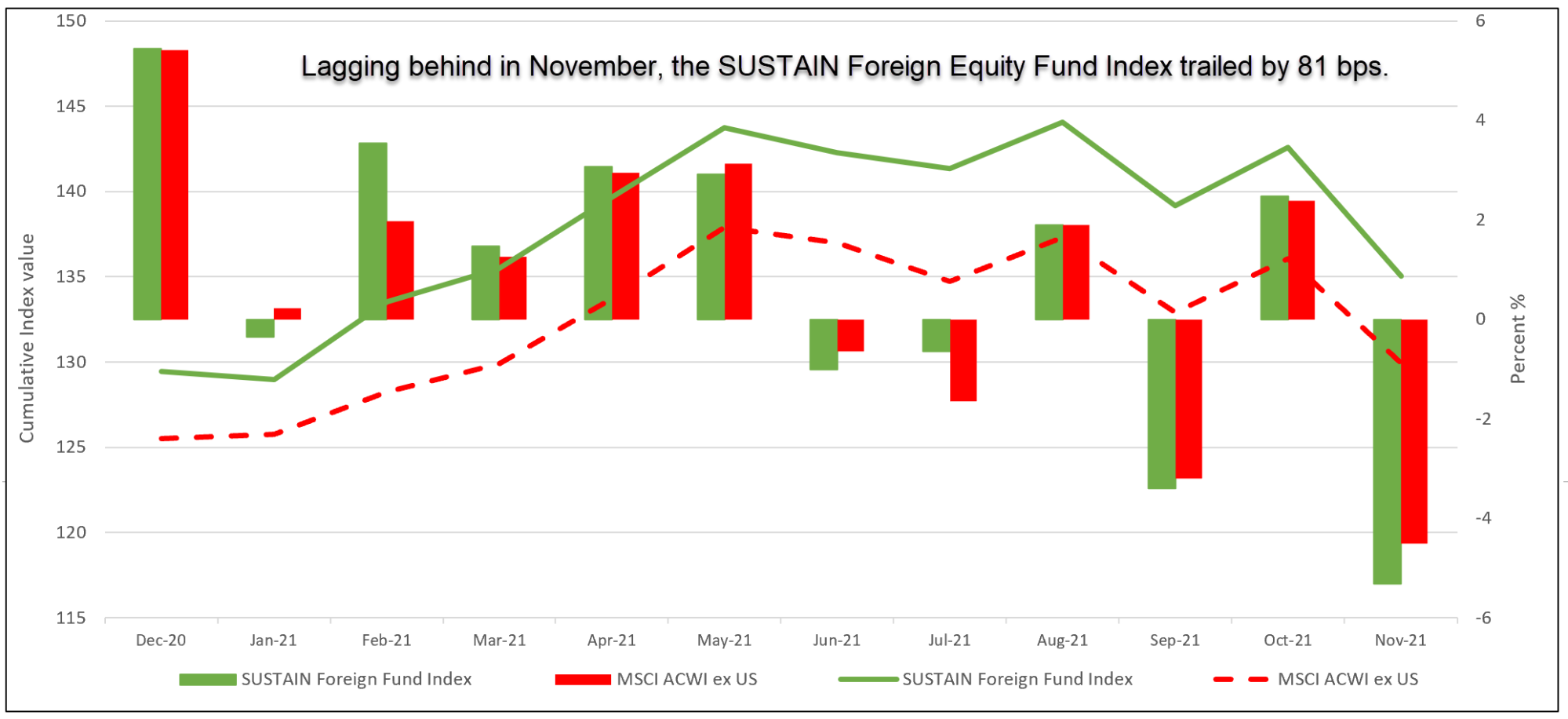

Sustainable (SUSTAIN) Foreign Fund Index gave up -5.3%, 81 bps behind the MSCI ACWI ex USA Index

Nine of the ten constituent funds that comprise the SUSTAIN Foreign Fund Index trailed the -4.5% posted by the MSCI ACWI ex USA Index in November. The Hartford International Opportunities Fund Y (HAOYX) led with a decline limited to -3.93%. At the other end of the range, the BlackRock International Investment Fund A (MDILX) dropped -7.5%. Refer to Chart 5.

That said, the SUSTAIN Foreign Fund Index remains well ahead for the trailing 12-months and since inception as of June 2019.

Chart 5: SUSTAIN Foreign Fund Index Performance Results: December 2020 – November 30, 2021

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact