The Bottom Line: Green bond funds reach $930.4 billion in assets at October month-end and are back on track to reach $1 billion in 2020.

October green bond funds: summary

Green bond funds recorded strong gains in assets, adding a net of $74.5 million to end October at $930.4 million. This represents the best dollar gain so far this year and a 9% month-over month increase. The October gain positions the sub-category of seven funds/22 funds and share classes to within striking distance of $1.0 billion in assets under management for the first time. This is occurring during a month when green bond issuance across the globe reached $23.1 billion, a drop relative to the $35.7 billion issued in September, but also within striking record of reaching cumulative green bond issuances of $1 trillion since the introduction of green bonds in 2007. Except for the Franklin Municipal Green Bond Fund and its four share classes, the remaining six funds and corresponding share classes outperformed the broad intermediate investment-grade Bloomberg Barclays US Aggregate Bond Index by margins ranging from 1 bps to a high of 103 bps. At the same time, none of the green bond funds outperformed the ICE BofA Green Bond Index (Hedged) which posted a one-month 0.62% gain. Also in October, social bonds received a boost when the European Union issued its first social bond, a two-part €17 billion ($20.2 billion) bond under the EU SURE instrument to help protect jobs and keep people in work.

Strong positive estimated cash flows added $74.5 million in net assets, the best gain this year

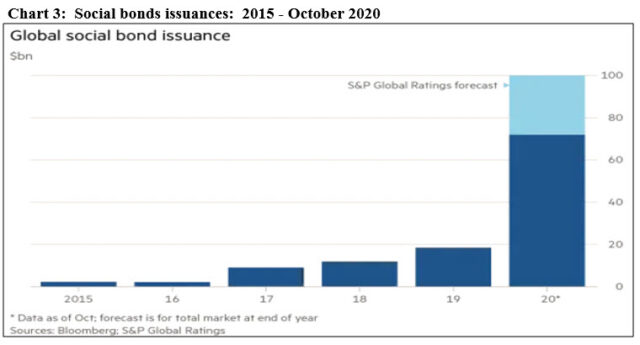

Green bond funds recorded strong gains in assets, adding a net of $74.5 million to end October at $930.4 million. Market depreciation depleted $0.24 million while positive cash flows added an estimated $74.7 million. The gains in October position the group of seven funds/22 funds and share classes to within striking distance of $1.0 billion in assets under management for the first time even as one fund, the AllianzGI Green Bond Fund with its $29.9 million or so in net assets, was liquidated in September. Refer to Chart 1.

Two funds contributed $71.7 million or 96% of the month’s net inflows. The largest of these was recorded by the Calvert Green Bond Fund, the largest and oldest green bond fund at $654.9 million. The fund saw a net increase in the amount of $44.4 million. This was almost entirely attributable to net new money of $43.3 million directed into the fund’s institutional share class with its $250,000 minimum investment requirement. The second fund, the iShares Global Green Bond ETF, realized a $28.7 million expansion in assets under management that elevated the fund’s assets to $133.5 million. The fund was launched in November 2018.

Performance results in October: Average performance trails green bonds index but beats the conventional benchmark

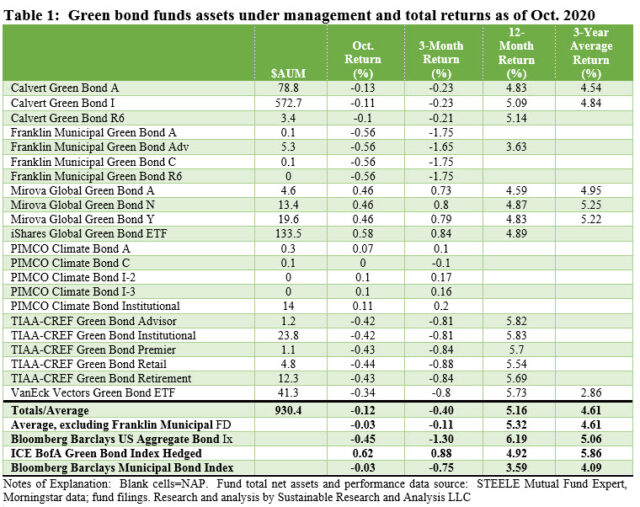

Across the board, green bond funds recorded an average decline of -0.12% in October versus -0.45% registered by the Bloomberg Barclays US Aggregate Bond Index and 0.62% posted by the ICE BofA Green Bond Index (Hedged). These results include the performance of the Franklin Municipal Green Bond Fund. When the municipal bond fund’s results are excluded, the average return achieved by the six taxable green bond funds improves, rising to -0.03% and at the same time increasing or narrowing the variation relative to the two benchmarks. Refer to Table 1.

Returns in October ranged from a high of 0.58% posted by the iShares Global Green Bond ETF, the fourth best performing fund over the trailing twelve months. At the other end of the taxable range is the TIAA-CREF Green Bond Fund Retail shares that recorded a -0.44% decline. That said, the 12-month return stands at 5.54%, lagging behind the Bloomberg Barclays US Aggregate Bond Index but ahead of the more narrowly-based ICE BofA Green Bond Index (Hedged).

The Franklin Municipal Green Bond Fund which declined -0.56% in October, lagged behind the Bloomberg Barclays Municipal Bond Fund Index by 26 bps.

Over the trailing 12-months, taxable green bond funds posted an average return of 5.27%, falling short of the 6.19% generated by the Bloomberg Barclays US Aggregate Bond Index but, at the same time, exceeding the 4.92% registered by the ICE BofA Green Bond Index (Hedged). The TIAA-CREF Green Bond Fund Institutional shares led with a return of 5.83% while Mirova Global Green Bond A brought up the rear with its return of 4.59%. The Franklin Municipal Green Bond A posted a trailing 12-month 3.63% return.

Green bonds issuance reached $23.1 billion and $977.6 billion cumulative since 2007

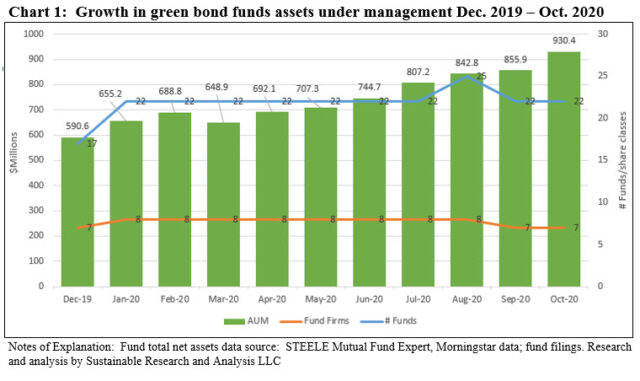

Green bond issuance across the globe reached $23.1 billion in October, a drop relative to the $35.7 billion issued in September. This brings the year-to-date green bonds volume to $192.9 billion and cumulative issuance since inception to $977.6 billion that is now within $22.4 billion striking distance of reaching cumulative green bond issuances of $1 trillion. This level is expected to be achieved in November or early December 2020. Refer to Chart 2.

Last month, $1.1 billion in green bonds, or 4.8% of global volume, were issued in the United States. This level was also lower than last month’s US issuances that accounted for $4.7 billion, or 6.8% of September’s total world-wide volume.

The allocation in the US between taxable and municipal bonds was 70%/30%, with three taxable issuers accounting for $766.5 million of October’s volume. At the same time, six municipal issuers launched $332.9 million in green bonds. These ranged from the $2 million Lakeside Municipal Utility District #3 (in Texas) insured tax refunding bonds that originally financed wastewater and drainage facilities to the $128.6 million Mountain House Financing Authority (California) to repay developers of the Mountain House Community Services District for the cost of improvements to the water system, wastewater system and storm drain system and other expenses.

Other developments: European Union boosts social bonds with a first time €17 billion ($20.2 billion) bond issuance

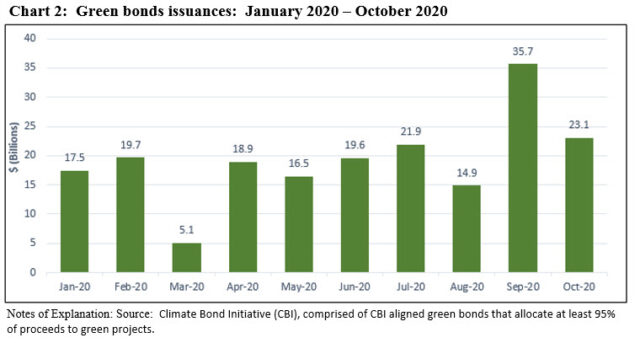

Social bonds received a boost in October when the European Union issued its first social bond, a two-part €17 billion ($20.2 billion) bond under the EU SURE instrument to help protect jobs and keep people in work. The issue consisted of two bonds, one at €10 billion due in October 2030 and €7 billion due for repayment in 2040. It was reported that investor interest was strong and that it was as much as 13-14X oversubscribed.

Issuance of social bonds which are similar to green bonds but refer to the use of proceeds for new and existing projects that address or mitigate a specific social justice issue such as employment, education, housing and healthcare, has risen fourfold so far this year from the 2019 level to $71.9 billion according to S&P Global Ratings. Stimulated by the COVID-19 pandemic, S&P also projects that social bond issuance could approach $100 billion this year. Refer to Chart 3.