ESG Bond ETF Also Has No Mutual Fund Counterpart in the Sustainable Investing Sphere

At the beginning of October, Nuveen Fund Advisors, LLC, a unit of Teachers Insurance and Annuity Association of America (TIAA), announced the launch of NuShares ESG U.S. Aggregate Bond ETF (NUBD), an index tracking exchange-traded fund that seeks to replicate the investment results of the Bloomberg Barclays MSCI US Aggregate ESG Select Index which, in turn, is derived from the Bloomberg Barclays US Aggregate Bond Index[1]. The fund, which is now listed on NYSE Arca, invests in a broad-based portfolio of US investment grade bonds that satisfy certain environmental, social and governance (ESG) criteria while at the same time excluding various bonds of companies that are involved in controversial business activities. This is the first broad-based investment grade fixed income ESG oriented ETF within a still tiny universe of fixed income ESG oriented ETFs and one for which there is no mutual fund equivalent in the market today. [ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]

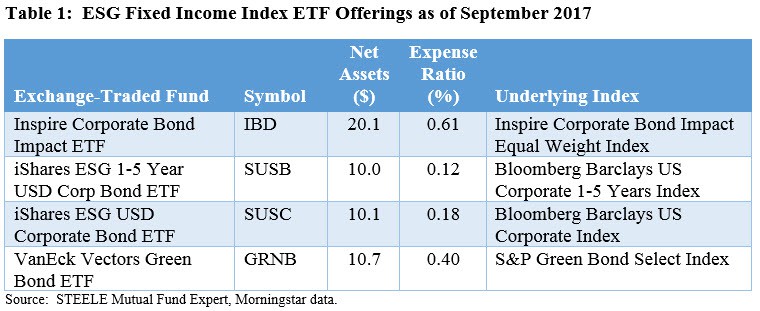

This marks the eighth sustainable oriented ETF launched by Nuveen since December 13, 2016, but it is the firm’s first fixed income fund. Attractively priced at 0.20% or 20 bps, the ETF is also the first to seek to replicate the broad investment grade US bond market by covering US government securities, debt securities issued by US corporations, residential and commercial mortgage-backed securities, asset-based securities and US dollar-denominated debt securities issued by non-U.S. governments and corporations. In doing so, NUBD extends coverage beyond the corporate sectors covered by the two iShares ESG fixed income ETFs launched by BlackRock in June of this year, namely the iShares ESG 1-5 Year USD Corp. Bond ETF (SUSB) and USD Corporate Bond ETF (SUSC). That said, the residential and commercial mortgage-backed securities as well as asset-based securities to be held in the fund are not evaluated and selected on the basis of ESG scores.

NUBD joins a short list of sustainable fixed income index ETFs. It is only the fifth ESG oriented fixed income ETF index tracker fund available in the US and the first ETF to track the Bloomberg Barclays MSCI US Aggregate ESG Select Index.

ESG Index Focuses on Bonds from Issuers that Exhibit ESG Leadership

The Bloomberg Barclays MSCI US Aggregate ESG Select Index, which was launched by MSCI and Barclays in January 2013, uses a rules-based methodology. The methodology seeks to provide investment exposure that generally replicates the Bloomberg Barclays US Aggregate Bond Index through a portfolio of securities adhering to predetermined ESG criteria developed by MSCI[2]. The index is composed of US government securities, debt securities issued by US corporations, residential and commercial mortgage-backed securities, asset-based securities and U.S. dollar-denominated debt securities issued by non-U.S. governments and corporations. The Bloomberg Barclays US Aggregate Bond Index is the most widely used benchmark for purposes of tracking the performance of the US investment grade bond market.

To qualify for inclusion in the index, corporate and US government securities that satisfy certain ESG criteria, based on ESG performance data collected by MSCI and evaluated to determine how well companies and other issuers with corporate like operations, manage environmental, social and governance risks and opportunities. These companies and other issuers are assigned an overall rating calibrated using a seven point scale from ‘AAA’ to ‘CCC.’ Generally, issuers with a rating of BBB or above are eligible for inclusion in the index.

Of each key issue relative to industry peers. ABS and MBS are included in the index without reference to ESG criteria; other securities for which ESG performance data is not available are excluded from the index. Corporate debt and government securities that meet a minimum ESG rating threshold are eligible for inclusion in the Index.

With respect to corporate debt securities, ESG performance is measured on an industry-specific basis, with assessment categories varying by industry. Environmental assessment categories can include a company’s impact on climate change, natural resource use, and waste management and emission management. Social evaluation categories can include a company’s relations with employees and suppliers, product safety and sourcing practices. Governance assessment categories can include governance practices and business ethics. The ESG criteria also consider how well a company adheres to national and international laws and regulations as well as commonly accepted global norms related to ESG matters.

Excluded from the Index are Companies with Significant Activities in Controversial Businesses

Index rules generally exclude companies with significant activities in certain controversial businesses, such as those involving alcohol, tobacco, nuclear power, gambling, firearms and other weapons and, based on data availability, bonds of issuers with any ownership of fossil fuel reserves and high carbon emitters based on annual MSCI established thresholds. So issuers in the independent oil and gas producer, integrated oil and gas producer and metals and mining sectors are ineligible for inclusion in the index. With respect to government securities, US and non-US governments receive ESG ratings based on the government issuer’s performance on six ESG risk factors: natural resources, environmental externalities & vulnerability, human capital, economic environment, financial governance and political governance.

Eligible securities are then market value weighted within each sector, with sector weights in the index adjusted to mirror the sector exposure of the non-ESG oriented Bloomberg Barclays US Aggregate Bond Index.

NUBD generally uses a representative sampling strategy to achieve its investment objective, meaning it generally invests in a sample of the securities in the Aggregate Bond Index whose risk, return and other characteristics resemble the risk, return and other characteristics of the index as a whole.

The index is rebalanced and reconstituted monthly. ESG ratings employed by the index are generally updated annually, but may be reviewed more frequently in the index provider’s discretion. The fund makes corresponding changes to its portfolio shortly after any index changes are made public.

Index Constituents and Performance

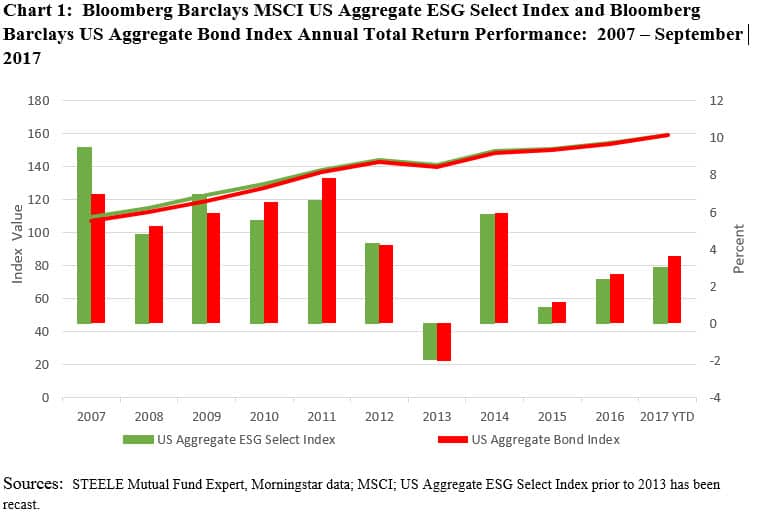

As of August 31, 2017, the ESG version of the index covered 6,070 investment-grade bonds (72% are actually AAA rated or equivalent) with an effective duration of 5.77 years, including US Treasuries that account for 37.1% of the fund by market value, securitized debt 30.5%, corporate debt 25.4% and government related debt 7.1%. At the time of its launch, the performance of the index was back-cast to the calendar year 2007. Based on their performance results starting in 2007 and continuing through the end of the third quarter 2017, the two indexes have achieved almost identical results with the ESG version of the index recording a cumulative 59.02% total rate of return gain versus 59.51% for the Bloomberg Barclays US Aggregate Bond Index. Refer to Chart 1. The widest 2.51% deviation occurred in 2007 based on backcasting the index to that date, otherwise, the results achieved by the two indexes are fairly closely aligned with a 98% correlation when the first year is excluded from the calculation. Thus, the fund offers investors an opportunity to achieve market-based results while at the same time investing in bonds of firms that have been highly ranked based on their ESG management practices, their international normative standards of corporate behavior and various exclusions.

At $ 18.2 Billion, Fixed Income ESG Offerings Have Gained Limited Traction To-Date

The fixed income sustainable investing sphere has been slow to gather investor interest and assets under management, as viewed through the prism of mutual fund offerings as well as ETFs and ETNs. The net assets of sustainable funds, including mutual funds, ETFs and ETNs stood at $217.9 billion as of September 2017. Of this sum, fixed income funds, comprising mutual funds and ETFs, held about $18.2 billion or 8.4% of the total invested in sustainable funds. Excepting for four sustainable fixed income index tracking ETFs, now five with the newest addition, all sustainable fixed income mutual funds are actively managed.

To-date, only four sustainable ETFs have been launched and operating. Refer to Table 1. The earliest of these, the VanEck Vectors Green Bond ETF, tracking the S&P Green Bond Index, was launched on March 3, 2017 and has attracted $10.7 million in assets. The other three funds were launched in July of this year and these have drawn in only $40.2 million, for a combined total of $50.9 million. Nuveen now adds another $40.05 million as of October 2, 2017. These ETFs are offered at expense ratios ranging from a low of 0.12% or 12 bps to a high of 0.61% or 61 bps. At 0.20% or 20 bps, NUBD is between 2 and 8 bps higher than the two iShares funds that track different underlying indexes.

On the mutual funds side, sustainable index fixed income funds are as yet not available.

[1] Previously called the Barclays Capital Aggregate Bond Index.

[2] MSCI Inc. is a publicly listed company and provider of investment decision support tools, including ESG research products and services.

[/ihc-hide-content]