Three new fund launches bring to six the number of green bond funds as of November 2018

Just in the last month, green bond funds doubled in number, with the launch of green bond mutual funds or exchange traded funds (ETFs) by Allianz Global Investors, BlackRock and Teachers Advisors. This brings to six the number of green bond funds available to investors that now include four mutual funds as well as two ETFs. While some of these have likely been in the works for some time, it may be that the latest fund introductions were timed to take advantage of recent headlines and environmental concerns to stimulate demand from interested and concerned investors for fund products dedicated to reducing greenhouse gas emissions, promoting alternative energy, and addressing climate adaptation and mitigation strategies, to mention just a few. Green bonds and green bond funds that invest in green bonds are very clearly aligned with such considerations.[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ] The new green bond funds offer additional investment choices for financial intermediaries and investors. That said, the small but growing band of existing and new green bond funds are not identical and these should be subjected to a thoroughly evaluation before investing. Key product considerations are the management firm, the fund’s mandate and investment approach, fund specific characteristics such as fund size and expense ratios as well as the fund’s investment track record, to the extend there is one.

Recent developments and publication of climate reports offer severe warnings

Recent developments, headlines and environmental related concerns include (1) the severe weather events and natural disasters that featured prominently in the last year or so, with record breaking hurricanes, torrential monsoon rains, fires, such as the twin wildfires in California, and historic flooding that claimed lives and destroyed property in the Caribbean, South Asia and the US, (2) the publication of several authoritative scientific research reports on the status of global warming and climate change. The reports conclude that the world continues to emit historic levels of carbon dioxide and other greenhouse gas emissions. Further, the reports update previous assessments and offer dire warnings of the devastating impacts resulting from global warming and the intensity as well as speed with which these impacts are occurring—even as some skeptics still push back on the science and implications of climate change, (3) the convening in Katowice, Poland of COP 24, or the 24th Conference of the Parties to the United Nations Framework Convention on Climate Change, and the agreement reached by climate negotiators to bolster the 2015 Paris Climate Agreement. Included in the agreement are transparent reporting requirements for greenhouse gas emissions and some progress toward curbing such releases, and (4) the continuing backlash in the US in response to the current Administration’s environmental policies and initiatives, such as the threat to withdraw from the Paris Climate Agreement, environmental regulatory rollbacks in areas such as fossil fuels, Clean Power Act, tailpipe emissions, clean water and renewable energy, or at COP 24 the siding with Russia, Saudi Arabia and Kuwait in blocking endorsement of a landmark study on global warming.

What are green bonds?

Green bonds are equivalent to other fixed income securities, both taxable and tax-exempt, except that these types of bonds raise funds specifically to finance new and existing projects with environmental benefits. Green bonds include securities issued by sovereigns, development or supranational banks, corporations, states, cities and local government entities, such as water, sewer or transportation authorities. Green bonds are issued in the form of senior unsecured obligations, project finance or revenue bonds, notes as well as securitizations that collateralize projects or assets whose cash flows provide the first source of repayment. In the future, new green bond structures are likely to be introduced. Also, green bonds, like all other bonds, vary as to credit quality, ranging from investment grade to non-investment grade; and they are issued in varying maturities that can range from short-to-long term as well as different rates of interest or yields. Regardless of structure, green bonds are generally issued pursuant to a set of voluntary guidelines or a set of best practices in the form of a framework known as the Green Bond Principles (GBP)[1]. The GBP framework, which emphasizes disclosure and transparency, includes criteria for the use of proceeds, the issuer’s process for project evaluation, the management of proceeds and reporting both at the time of issue and on a periodic basis thereafter. Still, there are variations around the interpretation and application of these Green Bond Principles that may lead to some uncertainties. The offerings can be informed and the potential uncertainties mitigated, but not eliminated entirely, by relying on external independent reviews for assurances or certifications.

Ready To Gain A Competitive Edge? In-depth sustainable investment management analysis, research, opinions and sustainable fund ratings

Green bond proceeds may be used to finance a variety of project categories aimed at addressing key areas of environmental concern such as climate change, natural resource depletion, loss of biodiversity and/or pollution control. While not limited to these, the following categories will generally qualify for the ultimate investment of proceeds: renewable energy, energy efficiency, pollution prevention and control, sustainable management of living natural resources, terrestrial and aquatic biodiversity conservation, clean transportation, sustainable water management, climate change adaptation, and eco-efficient products, production technologies and processes.

For sustainable investors generally, thematic-oriented or impact investors, in particular, green bonds are uniquely suited to meet environmentally-oriented sustainable objectives. This is because they are specifically intended to achieve positive environmental and other societal benefits. Further, issuers make commitments to disclose, in the form of periodic reporting, usually annually, the allocation of proceeds and their expected environmental impacts, either in quantitative and/or qualitative terms, and their yields as well as pricing are equivalent to any other bond issued by the same issuer. Put another way, green bonds, at least in the primary market, trade in line with their non-green counterparts.

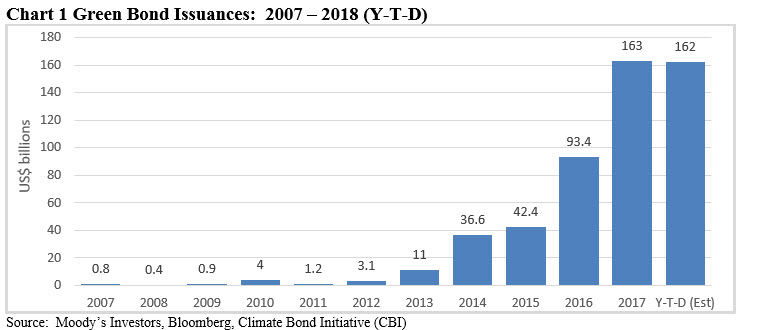

Green bonds have grown rapidly, mobilizing capital for use in achieving climate solutions; $162 billion issued through mid-2018 and an estimated $519 billion since inception

The issuance of green bonds across the world has been expanding rapidly in recent years. Last year issuance reached $163 billion and this year green bonds volume is expected to exceed that level given that $162 billion has been issued through mid-December. Refer to Chart 1. Since their introduction in 2007, an estimated $519 billion in green bonds have been issued by hundreds of issuers across the globe, including development banks, such as the World Bank, sovereigns, such as France and Poland, sub-sovereigns and municipalities, which may include taxable and tax exempt instruments, and corporations, and in the form of project finance transactions and securitizations, such as automobiles and residential mortgages.

A key reason for the growth and development of green bonds is their role in mobilizing capital toward climate solutions. The success of the UN Paris climate agreement that was negotiated at the end of 2015 and went into effect in November 2016 which aims to reduce greenhouse gas emissions to net zero levels between 2055 and 2070 so as to achieve a targeted 2° or even lower 1.5° Centigrade limit on the warming of the earth’s surface temperatures to avoid catastrophic climate change will require an unprecedented allocation of capital, measured in trillions of dollars a year. To this end, green bonds are gaining attention for their potential role in mobilizing capital toward climate solutions. Although traditional finance techniques will also have to be mobilized for this effort, the need to finance climate solutions in combination with growing investor demand should continue to lift green bond issuance beyond 2018.

Investing in green bonds via mutual funds and ETFs

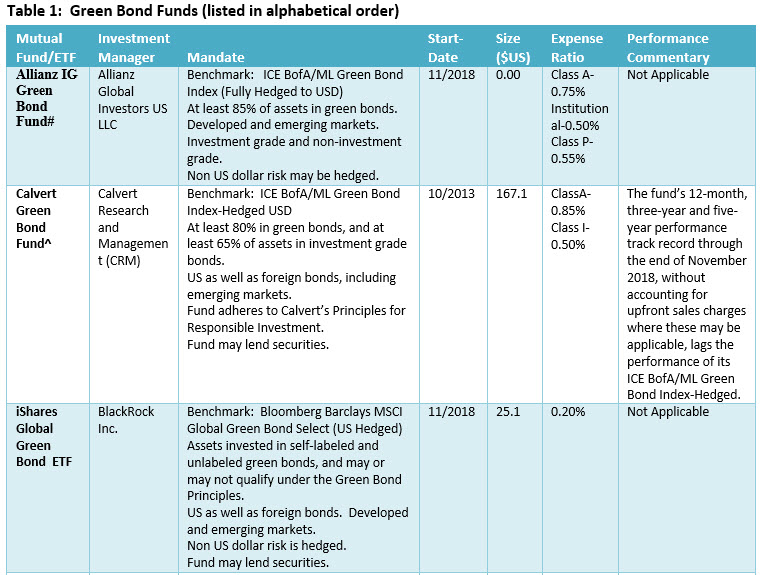

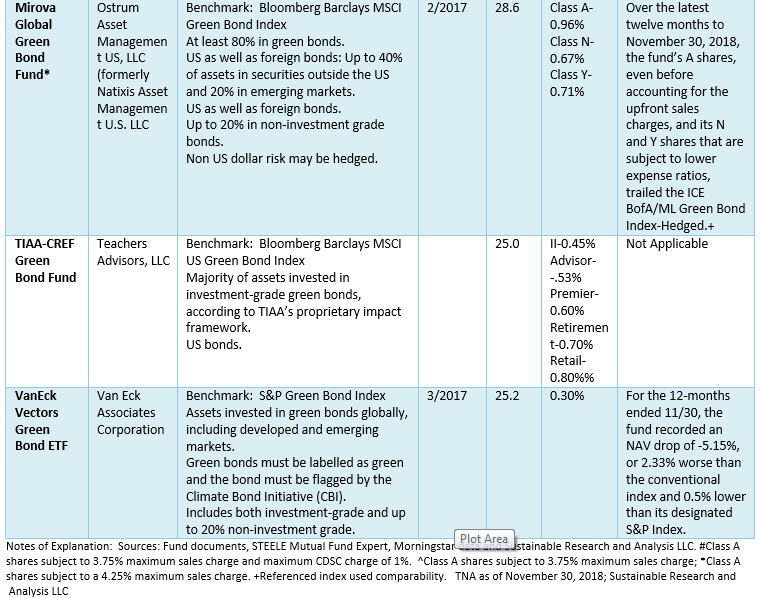

While purchasing individual green bonds is an option for some investors, albeit one that requires scale and is research intensive, an alternative for investors interested in green bonds is to invest in a green bond mutual fund and/or ETF. Until October of this year, individual or institutional investors seeking a dedicated green bond fund were limited to three options. These are the Calvert Green Bond Fund, Mirova Global Green Bond Fund and VanEck Vectors Green Bond ETF. In addition to more detailed information that appears in Table 1, the following in brief are comments regarding each fund:

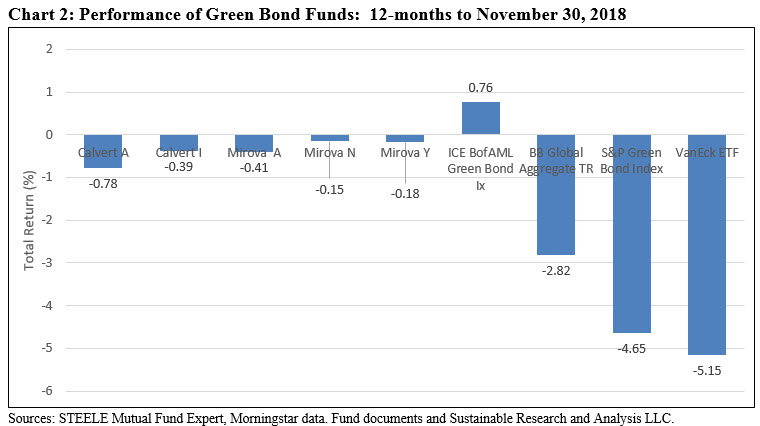

- The Calvert Green Bond Fund is the oldest and largest dedicated green bond fund that invests in US as well as foreign bonds, both investment-grade as well as non-investment-grade. At $167.1 million in net assets, this fund is the only one to have reached scale that, in turn, mitigates liquidity risk and permits the achievement of diversification. Another positive is that the fund’s shareholder base is dominated by more stable institutional investors that account for $124.2 million or 74% of the fund. Individual investors are disadvantaged as they are subject to an expense ratio of 0.85% on top of a maximum upfront sales charge of 3.75% that detract from the fund’s performance. The fund’s 12-month, three-year and five-year performance track record through the end of November 2018, without accounting for upfront sales charges where these may be applicable, lags the performance of its ICE BofA/ML Green Bond Index-Hedged. At the same time, the fund’s two share classes, again without accounting for upfront sales charges, exceeded the performance of the boarder-based investment-grade Bloomberg Barclays Global Aggregate Index over the tailing 12-month and five-year intervals, however, the reverse is true for the three-year period. Refer to Chart 2.

- The Mirova Global Green Bond Fund is managed by the second largest European manager of open-end SRI funds and social business funds and an affiliate of Ostrum Asset Management (formerly Natixis), was introduced more recently, in February 2017. Also pursuing a mandate similar to Calvert’s, the fund has only managed to attract $28.6 million since inception and retail investors are subject to a high 0.96% expense ratio on top of an even higher maximum sales charge of 4.25%. Another potential issue that invites further due diligence is the firm’s announcement on November 14, 2018 that, effective immediately, Christopher Wigley, the fund’s co-portfolio manager since inception and the firm’s green bond face to the public for some years, is no longer managing the fund. While the fund is likely to remain on course, it does raise some questions that invite further inquiry. Over the latest twelve months, the fund’s A shares, even before accounting for the upfront sales charges, and its N and Y shares that are subject to lower expense ratios, trailed the ICE BofA/ML Green Bond Index-Hedged. On the other hand, as was the case with Calvert, fund’s three share classes, again without accounting for upfront sales charges where applicable, exceeded the performance of the boarder-based investment-grade Bloomberg Barclays Global Aggregate Index over the tailing 12-month period. Refer to Chart 2.

- The VanEck Vectors Green Bond ETF was launched by Van Eck Associates in March of 2017. This index fund seeks to track the performance of the S&P Green Bond Index. It now manages $25.2 million and recently lowered its expense ratio from 0.40% to 0.30% in anticipation of the additional competition in the category. In addition to its small size, the fund’s performance through November 30, 2018 trails its underlying benchmark by 50 bps. Refer to Chart 1.

With the launch of the latest funds, individual and/or institutional investors interested in a dedicated green bond fund now have six options from which to choose. Table 1 offers a complete listing of these funds, a brief description of their mandates, fund sizes, expense ratios and performance commentary. Based on the information covered in Table 1, the following observations are relevant for consideration in assessing each fund’s risk profile, attributes and investor alignment:

- All six funds are offered by established investment management firms, although in the case of Mirova as noted earlier, the lead portfolio manager recently departed.

- Only the Calvert Green Bond Fund has been in operation for an interval of three years or longer.

- Two of the six funds are passively managed funds while the other four are actively managed mutual funds.

- One fund, the TIAA-CREF Green Bond Fund’ restricts its investments to US bonds while the mandate adopted by the other five funds allow these to invest in securities of issuers outside the US.

- Funds investing in non-US dollar securities are exposed to currency risk which may be hedged.

- Five funds invest in green bonds issued in emerging markets.

- Five of the six funds can invest in below investment-grade bonds.

- Expense ratios vary and range from a high of 96 basis points to a low of 20 bps.

- Performance histories are limited and are at this point only available for three funds. That said, firms like Allianz, BlackRock and TIAA-CREF have burnished their credentials in this market segment as they have been active in the green bonds market for some years now and they have invested in these instruments through other investment vehicles.

- New funds may be restricted by their ability to achieve a diversified portfolio and may be exposed to some liquidity risk until they reach scale, roughly at $50 million in net assets.

- Unlike the underlying green bond issuers that may offer varying levels of disclosure as to environmental outcomes and impacts, portfolio level disclosures as to outcomes and impact across the three existing green bond funds is lacking. Based on disclosures made in annual and semi-annual reports, none of the existing green bond funds offer such information for the benefit of investors seeking to understand the impact of their investments. Corollary literature offered by these firms on their websites do not offer supplemental impact disclosures. It remains to be seen whether the existing funds or the new funds will offer investors more transparency on portfolio level environmental outcomes and impacts.

[1] Refer to Green Bond Principles (GBP). See http://www.icmagroup.org/Regulatory-Policy-and-Market-Practice/green-bonds

[/ihc-hide-content]