90 new funds with $2.6 billion in assets launched in 2018

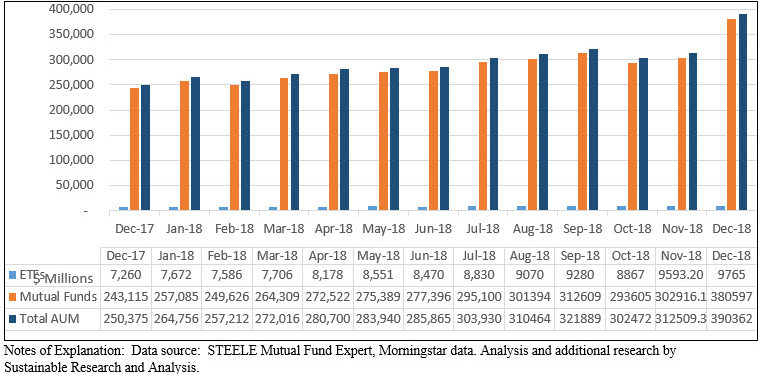

In 2018 new sustainable fund launches included some 90 funds, consisting of mutual funds and corresponding share classes as well as exchange traded funds (ETFs) that were valued at $2,588.8 million as of December 31, 2018. These funds contributed to the growth in the sustainable funds segment that reached $390.4 billion as of the same date, the highest level ever, with the addition of almost $140 billion in 2018. Refer to Chart 1. This is up from $250 billion at year-end 2017, or a top line increase of 56%. The net increase is attributable to three factors, including market movement, fund re-brandings and net cash flows. By far, the largest contributor to the increase is attributable to the rebranding or repurposing of existing funds, which added $155.9 billion, net cash inflows that netted an estimated $11.45 billion in assets while market movement depressed the value of assets by an estimated $27.4 billion.

Sustainable mutual funds and ETFS

Mutual funds dominated the roster of new fund offerings, accounting for 71 funds and share classes and $1,914.6 million in assets, as compared to 19 ETFs with $674.2 million in assets[1]. Within this universe, equity funds prevailed. 63 mutual funds and ETFs were launched with $1,932.3 million in assets under management investing in US, equities, international equities as well as specific market sectors or themes. The remainder was comprised of bond products, 27 mutual funds and ETFs in total with $656.5 million in net assets. In all cases, the values are as of December 31, 2018.

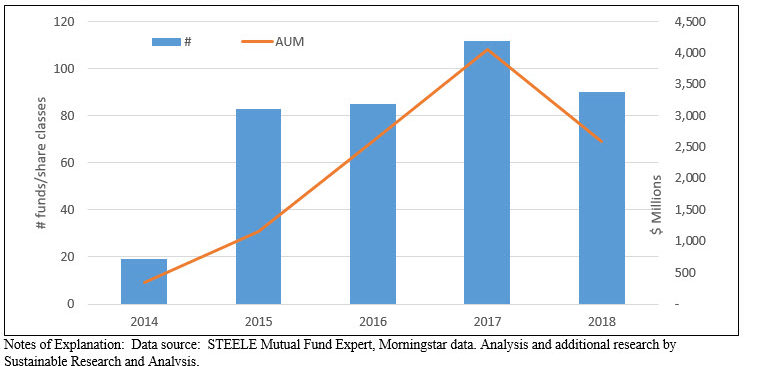

2017 still leads in new fund formations and assets over the previous five years

This was not the best year for new sustainable fund formations as that designation belongs to 2017 when a total of 112 new mutual funds and their share classes as well as ETFs came to market with a value of $4,060.5 million of December 31, 2017. This past year came close to but exceeded 2016 when a total of 85 funds were launched with about $2.6 billion in net assets at year-end 2016. Achieving an absolute level of precision with these numbers is difficult, particularly on the mutual funds side. One issue has to do with the significant number of re-brandings, the act of shifts existing funds into the segment by amending offering documents to reflect the formal adoption of a sustainable strategy. Refer to Chart 2.

Variety of sustainable approaches adopted by new mutual funds and ETFs, but a majority in 2018 emphasized ESG integration strategies

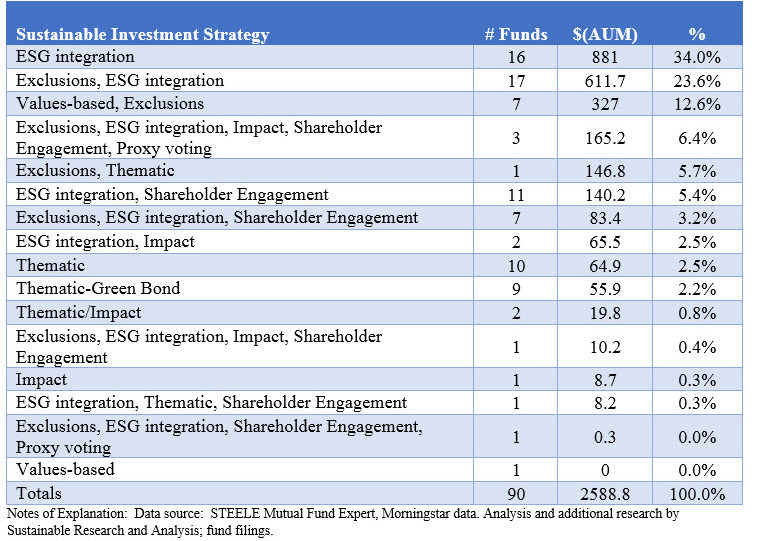

Leading the new sustainable funds landscape in 2018 are investment vehicles that have adopted ESG integration strategies along with funds that combine two or more strategies on top of ESG integration. New funds that have adopted ESG integration strategies number 16 with $881 million in net assets, or 34% of new funds by net assets at the end of 2018. ESG integration is often times combined with negative screening or exclusions for companies operating, for example, in the tobacco and alcohol spheres which may, in turn, vary by how these are defined. Such funds add 17 to the total and have sourced $611.7 million by year-end 2018, or 24%. As is the case more generally, some of the new funds in 2018 that employ ESG integration strategies also extend their approach to encapsulate some combination of impact, thematic considerations, shareholder engagement and proxy voting approaches. A combined total of 26 such funds came to market in 2018, with about $473.0 million in assets under management.

A values-based approach combined with exclusions was adopted by seven funds with a combined value of $327 million at the end of 2018. Also, 19 thematic funds, including nine green bond funds, were launched in 2018. These stood at $120.8 million as of December 31, 2018. Refer to Table 1 for a comprehensive list of new funds classified by their sustainable investing strategies.

Listing of new funds in 2018 classified by their sustainable investing strategies

The availability of at least the four broad-based strategies, and an even larger combination of two or more of these that are further multiplied when these strategies are actually implemented at the security and portfolio level we likely leads to a baffling number of options and contributes to confusion, particularly in the absence of clear explanations around how these strategies are implemented and greater transparency on their portfolio effects, performance results and impact outcomes. This means that investors have to spend more time understanding the approach each manager is taking and expected outcomes and this could be leading to sustainable investing paralysis.

Detailed explanations covering these strategies can be found in the Investment Research/The Basics tab.

127 Management firms now offer sustainable funds versus 107 firms in 2017

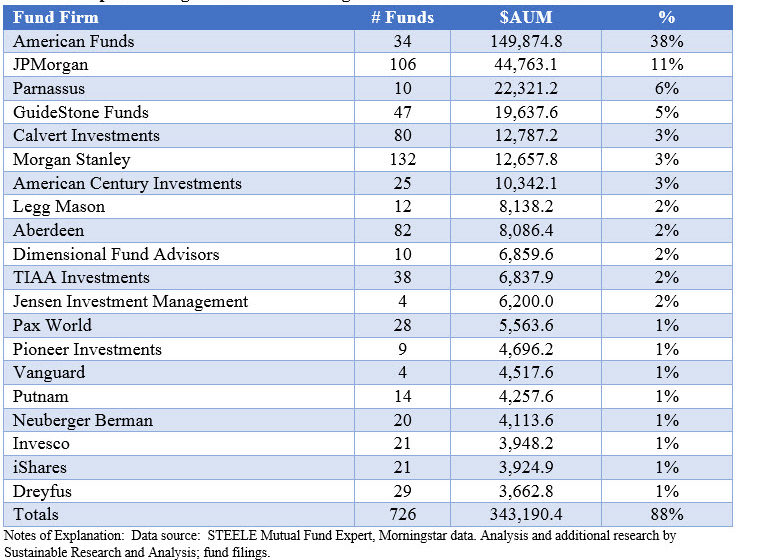

At the end of 2018, 127 firms were offering designated sustainable mutual funds and ETFs. This compares to 107 firms at the end of 2017, or an increase of 20 firms (19% gain). The largest 20 fund firms account for almost 89% of the assets in the sustainable segment and manage $343.2 billion in assets between them. That a slight decline from the 90.3% level of concentration at the end of 2017. Refer to Table 2.

The profile of the largest firms has shifted in the last year as more of the traditional or mainstream firms established a presence in the sustainable sphere by repurposing existing funds. Firms like Legg Mason, Aberdeen, Jensen, Pioneer Investments, and Dreyfus moved into the top 20 tier, while firms like Ariel, Amana, and Domini trended lower. At the same time, firms like JP Morgan and Morgan Stanley moved up in their rankings.

An increasing number of mainstream mutual fund firms are launching new sustainable investment products, either newly minted mutual funds and/or ETFs or they are entering the sphere by repurposing or re-branding existing funds. Some firms that have been active in the sphere before 2018, such as American Funds, American Century and DFA, to mention just a few, launched additional products in 2018. At the same time, a number of mainstream managers launched new funds or repurposed existing ones. Firms that fall into this category include, for example, Aberdeen, Federated, Jensen Investments, Goldman Sachs, Putnam, Pioneer and Franklin Templeton.

Additional general observations regarding new fund formations in 2018

General observations

- The number and type of sustainable index funds were expanded so as to permit the creation of broad-based diversified sustainable portfolios, with the introduction of investment options to include small cap, investment-grade intermediate bond, European, Asian and Far East (EAFE), Emerging markets and all countries, outside the US.

- The expansion in the number and type of thematic funds, including funds linked to affinity groups: NAACP, UN Sustainable Development Goals, Women’s Empowerment, Advanced Batteries, Clean Energy and Clean Power, and just recently announced Vegan Climate ETF.

- The introduction of sustainable target-date funds by Natixis, adding to the funds that had been available from GuideStone Funds.

Equity fund observations

- Goldman Sachs launched the Goldman Sachs JUST U.S. Large Cap Equity ETF in June of 2018. By the end of the year, the ETF was the most successful new equity fund based on year-end assets under management. This is a values-based fund with an impact theme that invests in a universe of companies comprising the Russell 1000 Index but are further qualified based on an annual ranking of issuers compiled by the Just Capital Foundation, Inc.

- Federated launched the Federated Hermes SDG Engagement Equity Fund. The fund, which has not been funded as of November 30, 2018, seeks to invest in companies that contribute to positive societal impact aligned to the United Nations Sustainable Development Goals (the UN Sustainable Development Goals. In addition to fundamental financial indicator criteria, the fund’s adviser may consider engagement criteria such as assessment of company management competence, integrity, and vision, as well as exposure to one or multiple UN Sustainable Development Goals. Federated has wasted no time to launch a sustainable investing product managed by Hermes, its recently acquired firm. Hermes is now majority owned by Federated Investors since its 60% acquisition from the BT Pension Scheme closed in the third quarter.

- Vanguard launched its first ESG ETFs that, by the end of the year, had accumulated a combined $166.5 million. The Vanguard ESG US Stock ETF and ESG International Stock ETF track the performance of the FTSE US All Cap Choice Index and FTSE Global All Cap ex US Choice Index. Unlike Vanguard’s successful FTSE Social Index Fund with $4.4 billion in net assets at year-end 2018, the two funds rely largely on excluding certain companies whereas the approach to ESG pursued by the Vanguard FTSE Social Index Fund largely employs an ESG integration strategy while also excluding certain companies.

Fixed income fund observations

- Green bond funds. Three new green bond funds were launched, thereby doubling the number of green bond funds. Green bond mutual funds and/or exchange traded funds were introduced by Allianz Global Investors, BlackRock and Teachers Advisors. This brings to six the number of green bond funds available to investors, including four mutual funds offering 12 share classes across a range of targeted investors and corresponding expense ratios as well as two ETFs.

- In addition to a green bond fund, TIAA also launched the Short-Duration Impact Bond Fund. This fund brings to market another important shorter-term option for investors and complements the very successful Social Choice Bond Fund by offering to investors the raw ingredients necessary to build a complete investment program around actively managed sustainable fixed income funds. It also complements short-duration products introduced by Hartford and Calvert.

- Also competing in the short-duration space, DWS (formerly Deutsche Asset Management) made its sustainable investing debut by repurposing the firm’s existing $358.7 million DWS Variable NAV Money Market Fund consisting of two share classes. This is the second only sustainable money market fund, the first one being the GuideStone Money Market Fund, a values-based offering by Guidestone Funds. That said, the DWS ESG Liquidity Fund, formerly called the DWS Variable NAV Money Market Fund, is the first money fund to employ ESG criteria, combined with exclusionary screens, as part of a company’s selection process.

[1] 3 funds launched by BNP Paribas ($34.3 million) are under review and are excluded from this analysis.