ESG Model portfolios: Each of the three portfolios lagged behind their conventional benchmarks in May with returns ranging from -0.06% to -5.80%

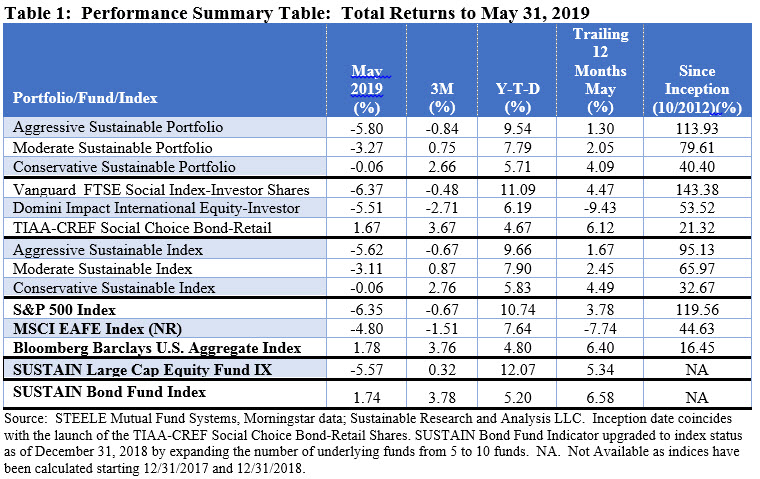

During a challenging and volatile month when the three model portfolios along with their corresponding conventional indices posted negative returns, two of the three model portfolios trailed their comparative benchmarks driven by the below benchmark performance of the underlying funds. The Aggressive Sustainable Portfolio (95% stocks/5% bonds), Moderate Sustainable Portfolio (60% stocks/40% bonds) and Conservative Sustainable Portfolio (20% stocks/80% bonds) recorded total returns of -5.80%, -3.27% and -0.06%, respectively. Refer to Table 1.

The Vanguard FTSE Social Index Investor Shares and Domini Impact International Equity-Investor both produced negative returns of -6.37%, -5.51% and fell short of their conventional indices. In the case of Vanguard, the differential was a mere 2 basis points (bps) while the Domini fund lagged by 71 bps. TIAA-CREF Social Choice Bond-Retail, on the other hand, recorded a positive total return for the month with a gain of 1.67% but missed matching its Bloomberg Barclays US Aggregate Index by 11 basis points.

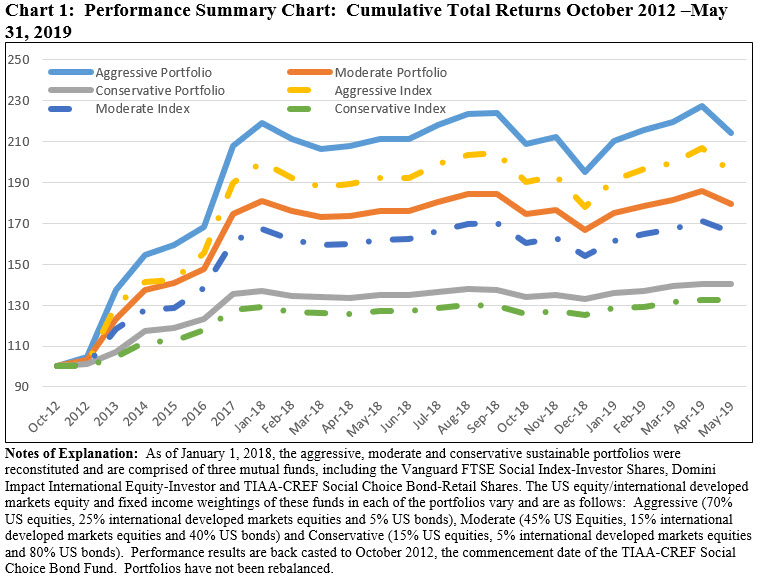

The underperformance of the three model portfolios extends to the trailing 3-month, year-to-date and twelve-month intervals, however, they continue to maintain their lead over their designated benchmarks for the longer since inception interval that commenced in October 2012. Refer to Chart 1.

Major US stock indexes closed the month of May down in excess of 6%, recording their worst monthly performance since December 2018

The negative performance of the three model portfolios occurred during a month when the major US stock indexes closed down in excess of 6%, their first calendar month decline for the year and the worst monthly performance since December 2018. This was being attributed to shifting investor sentiment motivate by concerns that the decade-long US economic growth cycle may be coming to an end as companies curtail spending and higher tariffs around the world are expected to hurt sales and corporate earnings. The drop on Friday, the last trading day in May, came after President Trump, in a move that unnerved investors, announced plans via Twitter to impose tariffs on Mexico in a bid to compel the nation’s third largest trading partner to crack down on migrants attempting to enter the US. The S&P 500 gave up 6.35% in May, to close at a level of 2752.06–roughly in line with the benchmark’s value on March 8th. Following that date, the index reached a peak on April 30, and thereafter the S&P 500 recorded 14 daily declines (64%) during 22 trading days through the end of May. The Dow Jones Industrial Average posted a similar result in May, giving up -6.32% while the technology heavy NASDAQ Composite declined -7.79%. This was roughly in line with the performance of small company stocks that gave back -7.78%. In general, growth stocks across the market cap continuum delivered better results than value-oriented stocks.