Model portfolios: Sustainable model portfolios exceeded or matched the performance of their conventional benchmarks in October

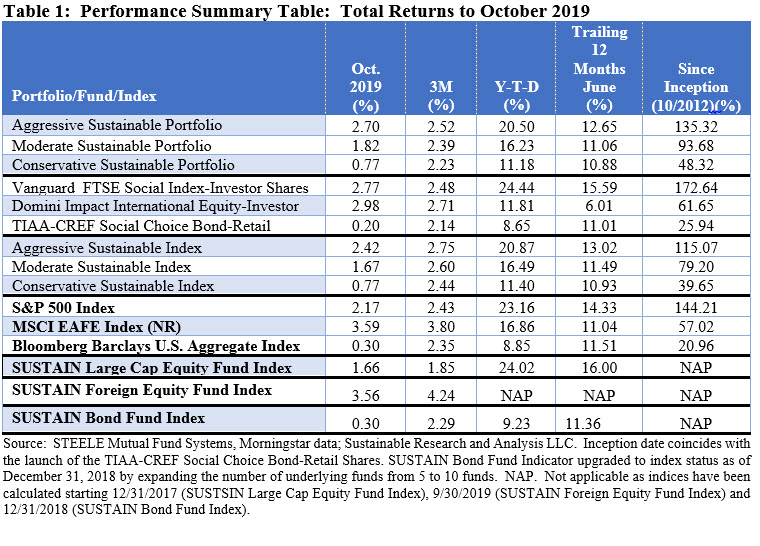

The aggressive and moderate sustainable model portfolios both outperformed their conventional indices, reversing last month’s declines, while the conservative portfolio matched results. To varying degrees, the three portfolios benefited from the outperformance delivered by the Vanguard FTSE Social Index Investor Shares relative to the S&P 500 Index. The fund posted a total return of 2.77%, or 0.60% higher than the conventional S&P 500 Index that gained 2.17% in October. The fund outpaces the S&P 500 over the last twelve months and, since the inception date of the model portfolios as of October 2012, the fund has eclipsed the conventional index by a significant 28.43%. Refer to Table 1.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]

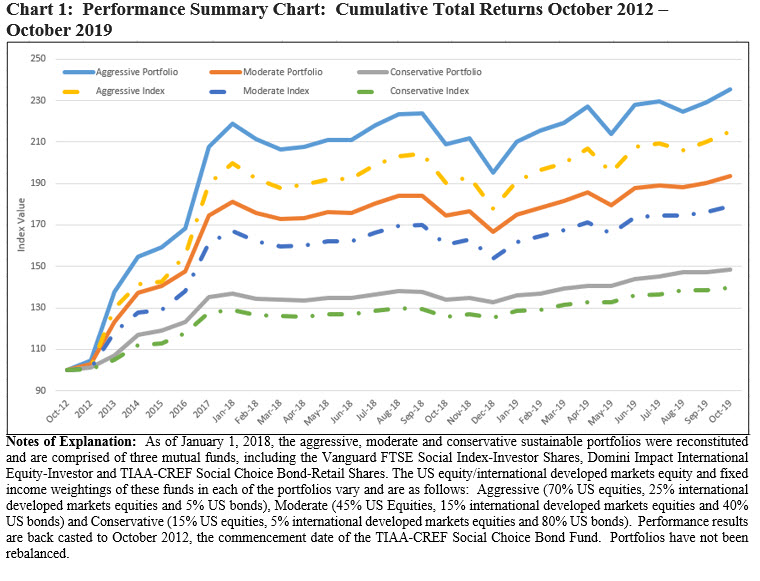

The Aggressive Sustainable Portfolio (95% stocks/5% bonds) was boosted by its 70% exposure to the Vanguard FTSE Social Index Investor Shares. The Portfolio gained 2.70% versus 2.42% recorded by the index, for a 28 basis points (bps) differential. Counterbalanced by its exposure to the lagging Domini Impact International Equity Investor Shares, this was only the fourth non-consecutive month so far this year that the portfolio achieved a gain. As a consequence, the Aggressive Portfolio lags behind its customized conventional index over the quarter, year-to-date period and trailing 12-months. Still, the Aggressive Sustainable Portfolio, largely weighted by domestic equity and foreign securities, continues to outpace its index since inception by 20.25%. Refer to Table 1 and Chart 1.

The Moderate Sustainable Portfolio (60% stocks/40% bonds) registered a gain of 1.82% versus 1.67% for the index, besting the index by 15 bps. Like its riskier Aggressive Sustainable Portfolio counterpart, it trails its conventional index for the quarter, year-to-date and 12-month intervals through the end of October, but the Portfolio continues to outperform by 14.48% since inception. Refer to Table 1 and Chart 1.

The Conservative Sustainable Portfolio (20% stocks/80% bonds) managed to match its conventional index as both returned 0.77% in October. While the TIAA-CREF Social Choice Bond Fund Retail Shares and Domini Impact International Equity Fund Investor Shares both registered positive results for the month, the underlying funds fell behind their corresponding indices. In line with the other two model portfolios, the relative performance of the Conservative Sustainable Portfolio lagged behind its conventional index over the trailing three months, year-to-date and 12-month intervals. The Conservative Sustainable Portfolio, however, also continues to outperform since inception by a more modest 8.67%. Refer to Table 1 and Chart 1.

Market recovers in second half of October to post strong 2.17% return while foreign markets performed even better

The model sustainable portfolios exceeded or matched their conventional benchmarks during the course of a month that produced capital markets returns ranging from highs of 8.05% posted by European emerging markets to 7.73% recorded by NASDAQ biotech stocks and 4.97% for Japanese stocks to lows between -2.48% and -1.27% achieved by utilities and energy stocks, the broad US stock market delivered a positive 2.17% total return in October, the fifth best month so far this year. But the path to achieving this gain was not linear. The S&P 500 was in the red after ten trading days through October 14 when, at close, it recorded a month-to-date decline of -0.356% as it labored through geopolitical and economic uncertainties at home and abroad ahead of earnings season. Thereafter, investor pessimism was overcome in response to an announcement that the US and China had reached a “phase one” agreement pursuant to which China would buy more US farm goods while the US reciprocates by holding off on the imposition of new tariffs on October 15. Still, trade negotiations can turn on a dime and unless an agreement is executives, China-US trade will continue to cast a shadow over the market. Further, worries about the slowing US economy retreated somewhat after companies began to report better than expected third quarter results. Stocks moved decisively higher as earnings season shifted into high gear. With 71% of S&P 500 companies reporting by November 1st, 76% reported earnings above consensus estimates. That said, it should be noted that expectations for third-quarter earnings were low as analysts had revised their estimates lower over the summer due to economic concerns. For more details regarding the performance of markets and sustainable funds in October, refer to Sustainable Indices Matched or Trailed Returns for the Month of October 2019.

[/ihc-hide-content]