Model portfolios: Robust equity markets in December and the Vanguard FTSE Social Index Fund Investor Shares outperformance lifted the results achieved by the aggressive and moderate sustainable model portfolios beyond their conventional benchmarks while the conservative model portfolio lagged

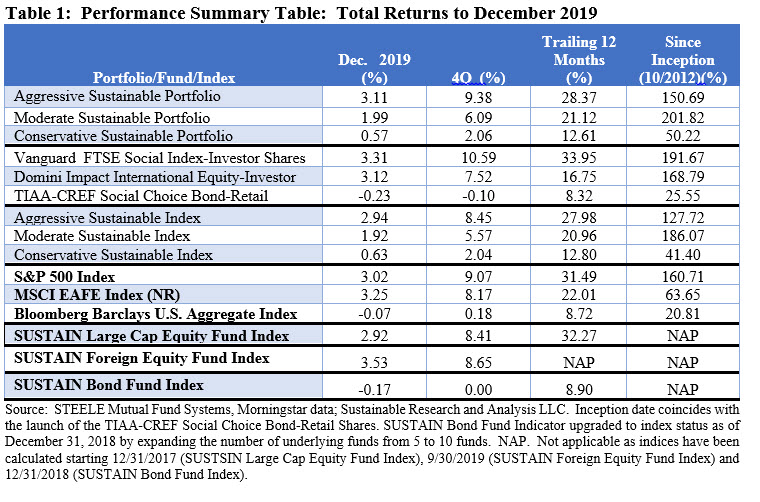

For the second consecutive month, the Aggressive Sustainable Portfolio (95% stocks/5% bonds) and Moderate Sustainable Portfolio (60% stocks/40% bonds) outperformed their conventional indices by 17 basis points (bps) and 7 bps, in that order. The Conservative Sustainable Portfolio (20% stocks/80% bonds), on the other hand, underperformed, trailing its conventional benchmark by 6 bps. Refer to Table 1. [ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]

That said, each of the three model portfolios topped their benchmark over the trailing three-months while both the aggressive and moderate portfolios also closed calendar year 2019 with returns in excess of their benchmarks. The Conservative Sustainable Portfolio fell behind by 19 bps for the year.

To varying degrees, the portfolios benefited from the performance of the Vanguard FTSE Social Index Fund Investor Shares. The fund beat the S&P 500 in December and ended the year 2.46% ahead, having recorded the best annual performance since 2009. The fund, whose monthly standard deviation is in line with the S&P 500, has also beaten the index over the last three, five and ten year intervals with average annual returns of 17.14%, 12.42% and 14.38%, respectively, versus the S&P 500 at 15.27%, 11.7% and 13.56%. At the same time, the heavily bond tilted Conservative Portfolio was hampered by the below benchmark results achieved by the TIAA-CREF Social Choice Bond Fund-Retail Shares in 2019. The fund fell behind the Bloomberg Barclays US Aggregate Index by 40 bps—a less common outcome for a fund that continues to outperform its benchmark by 15 bps and 19 bps over the trailing 3-year and 5-year intervals.

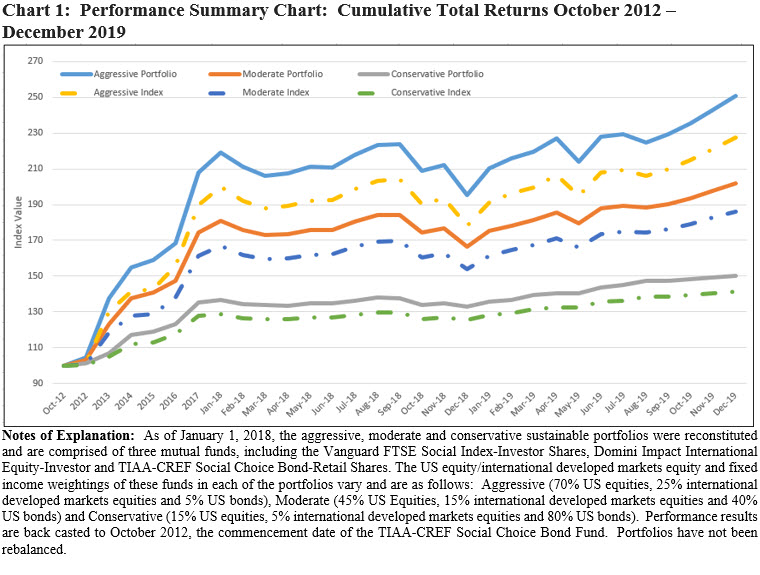

Since their inception date of October 2012, the three model portfolios continue to outperform by wide margins ranging from 22.97% to 8.82%. Refer to Chart 1.

Stock and bond markets worldwide posted excellent returns in 2019 bolstered by strong December gains: S&P 500 added 3.0% while the Dow Jones Industrial Average and Nasdaq Composite recorded 1.9% and 3.6% increases

Stock and bond markets worldwide posted excellent returns in 2019. The major US stock indices ended the last day of the year on a positive note, bolstered by encouraging news that the US China Phase 1 trade agreement will be signed on January 15 and signaling a significant de-escalation of trade tensions between the two nations that have affected markets throughout the year both positively and negatively. This factor, combined with interest rate cuts, Fed liquidity, easing anxiety regarding the strength of the US economy and prospects that the longest expansion in US history will continue, moved markets higher in December notwithstanding lingering geopolitical as well as domestic political uncertainties linked to the President’s impeachment proceedings. The S&P 500 posted a total return gain of 3.02%, while the Dow Jones Industrial Average and Nasdaq Composite recorded 1.9% and 3.6% increases. Outside the US, developed and emerging market equities posted even stronger returns, with the MSCI ACWI ex USA (Net) gaining 4.3% and emerging markets climbing 7.5%. Across other asset classes, investment-grade bonds continued to decelerate and dropped -0.1% while gold and energy, in that order, recorded increases of 3.6% and 6.9%. Within the Energy sector, natural gas was the only commodity to fall back, giving up -3.0%.[/ihc-hide-content]