October Summary

The three sustainable model portfolios ended the month of October lower, with results corresponding to their risk profiles and also the performance of their underlying mutual funds. In each instance, model portfolios outperformed their designated benchmarks. This was within the context of an abrupt shift in sentiment and momentum that moved the S&P 500 Index down -6.84% in October to register not only its third loss so far this year but also the biggest monthly decline since September 2011. During the same interval, the Sustainable (SUSTAIN) Large Cap Equity Fund Index posted a drop of -7.0%. This is the steepest drop since calculation of the SUSTAIN Index commenced as of December 31, 2016. The broad bond market also ended lower, but registered a limited -0.79% decline that was slightly beaten by sustainable fixed income funds. Sustainable funds in general registered an average loss of -6.4% and performance of mutual funds and ETFs/ETNs ranged from a high of 0.35% to a low of -23.8%. While the severe market reversal took its toll on sustainable fund assets under management that ended the month with $302.4 billion versus $321.9 billion at the end of September, some of the decline due to market movement was offset by the largest estimated monthly net cash inflow into sustainable funds so far this year–an estimated $3.45 billion in net new money.

Investors pivoted from positive to negative on the sustainability of the nine-year old bull market

Investors pivoted from positive to negative on the sustainability of the nine-year old bull market, focusing instead on a range of new as well as continuing concerns, from geopolitical risks, such as recent events in Saudi Arabia, Italy, Turkey, and even Germany, to local political anxieties in the US and uncertainties heading into the November 6th mid-term elections, to economic considerations, including the unresolved trade dispute with China, the slowing Chinese economy, inflation as well as interest rate jitters. Perhaps most importantly, however, the reversal may be reflecting tempered investor expectations with regard to corporate earnings. For the third quarter through the end of October, with about 74% of the companies in the S&P 500 reporting actual financial results combined with estimated results for companies that had yet to report, the year-over-year earnings growth rate for the third quarter, according to FactSet Research, stood at 24.9% which is above the estimate of 19.3% at the end of the quarter. At this level, the growth rate for the third quarter will be the second highest earnings growth rate since third quarter 2010. But looking ahead, a slightly slower earnings growth rate of 21% is projected for the fourth quarter 2018 and a more moderate 9% growth rate in calendar year 2019.

After peeking on September 20, 2018, the S&P 500 reversed course and came within 12 basis points (bps) on October 29th of moving into correction territory. Positive returns recorded on both October 30 and October 31, during which index gained 2.7%, averted this outcome. All but two S&P sectors scored positive results. These include the defensive Utilities and Consumer Staples sectors that were up 3.09% and 3.01%, respectively. The eight remaining sectors suffered declines ranging from -0.37% recorded by the Real Estate sector, -11.86% posted by the Energy sector and -12.75% sustained by the Consumer Discretionary sector.

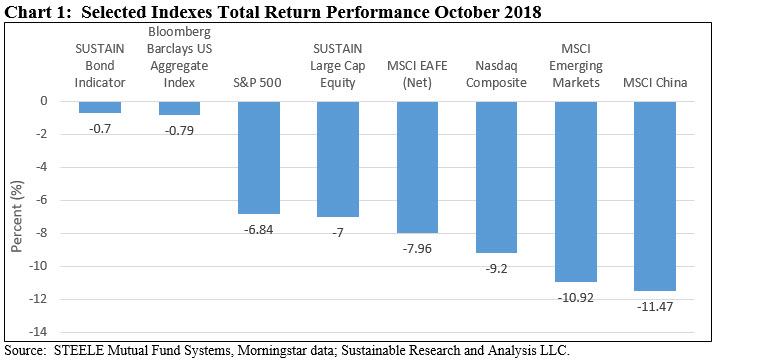

While the S&P 500 gave up 6.84%, the Dow Jones Industrial Index dropped -5.1% in its biggest monthly percentage fall since January 2016. The technology heavy Nasdaq was the worst-performing major benchmark, dropping -9.2% in October for the biggest fall since November 2008. The performance of technology stocks also dragged down large cap growth oriented indexes that posted steeper declines relative to value oriented benchmarks. The S&P 500 Growth Index, for example, was down -8.08% while its value counterpart was down -5.33%, for a difference of 275 basis points. Stocks outside the US were also trading at some of the lowest valuations in more than 2-years. Latin America was the exception in October, recording an outlier gain of 3.46%, according to the MSCI Emerging Markets Latin America Index versus other geographic regions. Optimism over presidential elections in Brazil, an International Monetary Fund funding facility for recession-hit Argentina, and a new trade deal between Mexico, the United States and Canada seemed to carve out the region from concerns about global growth and trade that punished other emerging markets. The MSCI Emerging Markets Asia Index registered a decline of -10.92% while MSCI China was down -11.47%. Refer to Chart 1.

Fixed income investors were not spared as bonds didn’t offer any ballast during the turmoil

Fixed income investors were not spared as bonds didn’t offer any ballast during the turmoil. Intermediate-term investment grade bonds, as measure by the Bloomberg Barclays US Aggregate Index posted a decline of -0.79% on the back of rising rates, as 10-Year Treasury yields moved up by 10 basis points from 3.05% to 3.15% at October 31st. On the other hand, 90-day Treasury Bills posted a gain of 0.19%.

For the third month in a row, the SUSTAIN Large Cap Equity Fund Index lagged behind the S&P 500 by a slight margin of 17 basis points after posting its -7.0% decline

For the third month in a row, the SUSTAIN Large Cap Equity Fund Index lagged behind the S&P 500 by a slight margin of 17 basis points after posting its -7.0% decline. Only four of the ten funds that comprise the index outperformed the conventional S&P 500.

Since its inception as of December 31, 2016, the SUSTAIN Large Cap Equity Fund Index trails the S&P 500 by 4.89%. Refer to Abrupt Shift in Sentiment Also Impacts Sustainable Equity Funds in October.

The Sustainable (SUSTAIN) Bond Fund Indicator outperformed the conventional index by 9 basis points to end the month

Against a backdrop of concerns about US inflation and interest rates, 10-Year Treasury yields moved up by 10 basis points from 3.05% to 3.15% at October 31st and the Bloomberg Barclays US Aggregate Index posted a decline of -0.79%. This was the benchmark’s sixth monthly drop so far this year and the third worst, bringing the year-to-date performance to a negative -2.38%. The Sustainable (SUSTAIN) Bond Fund Indicator moved lower as well, but outperformed the conventional index by 9 basis points to end the month 0.70% lower while also continuing to exceed the Bloomberg Barclays US Aggregate Index by increasing margins on a year-to-date and trailing twelve-month basis with its returns of -1.19% and -1.72%, respectively.

Model portfolios reflect the severity of October’s downturn, posting results ranging from -2.73% to -6.65% that correspond to their risk profiles

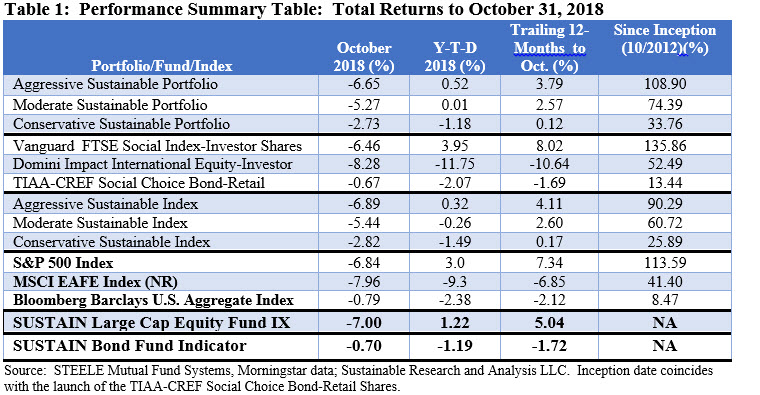

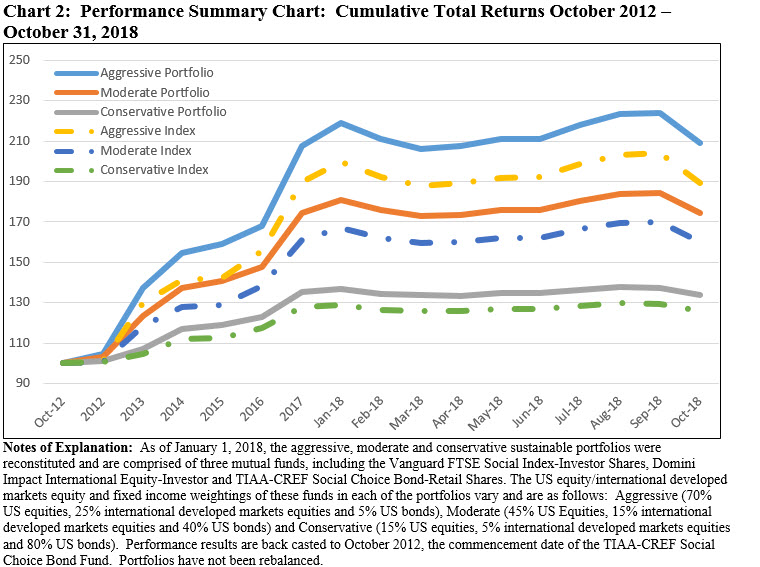

The Aggressive Sustainable Portfolio (95% stocks/5% bonds), Moderate Sustainable Portfolio (60% stocks/40% bonds) and the Conservative Sustainable Portfolio (20%/80%) produced total returns in September that range from a -2.73% to -6.65%. Portfolio results correspond to their risk profiles and also the performance of their underlying mutual funds that in the case of both the TIAA-CREF Social Choice Bond Retail and Vanguard FTSE Social Index Investor outperformed their designated conventional securities benchmark. In turn, the model portfolios outperformed its designated benchmark as the three underlying funds fell behind in September. Refer to Table 1.

For the year-to-date interval, the model portfolios outperform their respective benchmarks but this is not the case for the trailing twelve months. That said, the absolute and relative results since inception as of October 2012 remain strong and while the relative performance differentials dipped in August they remained unchanged in October. Refer to Chart 2.

Sustainable funds register average loss of -6.4% and performance ranged from a high of 0.35% to a low of -23.8%

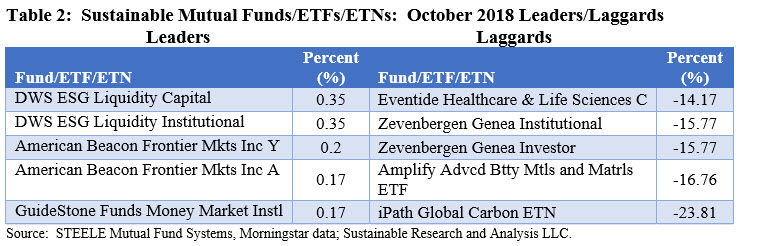

Sustainable mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs) posted an average loss of -6.4% while the median loss was even lower at -7.4%. This is based on a universe consisting of 1,100 sustainable funds[1] that registered performance results for the entire month of October. The average return recorded by sustainable funds for the month not only registered the lowest outcome so far this year, but also the fewest number of funds, 26 in total or 2.4%, achieved results ≥0.00%. The next lowest average return was recorded in February when sustainable funds gave up -3.38%.

With its return of 0.35%, the best performing fund in October turns out to be a money market mutual fund managed by DWS (formerly Deutsche Asset Management) that was repurposed in September. Last month, DWS reconfigured the firm’s existing $358.7 million DWS Variable NAV Money Market Fund consisting of two share classes by formally amending the fund’s prospectus to describe its use of ESG criteria, combined with exclusionary screens, as part of a company’s security selection process. This is the second only sustainable money market fund in operation today, the first one being the GuideStone Money Market Fund, a values-based offering by Guidestone Funds. Refer to Table 2.

At the other end of the range is the -23.81% return delivered by the iPath Global Carbon ETN, a $8.2 million exchange-traded note that provides exposure to the global price of carbon by referencing the price of carbon emissions credits from the world’s major emissions related mechanisms. This highly volatile ETN also recorded a loss of -6.3% last month and has been erasing its outstanding 12-month results. That said, the index is still up an eye popping 138.51% over the trailing 12-months.

The recently launched $6.4 million Amplify Advanced Battery Metals and Materials ETF posted another steep decline, dropping -16.76% this month following a -9.67% decline last month on the back of weak metals and mining prices and increased volatility.

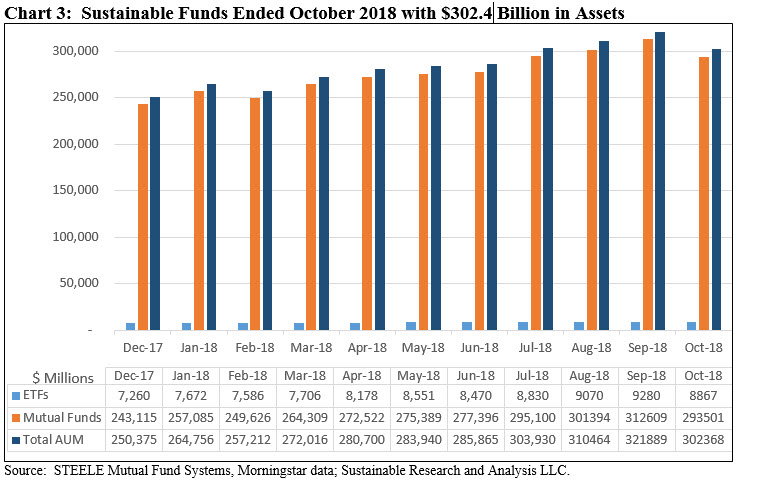

Sustainable funds close October at $302.4 billion, giving up $19.5 billion due largely to market declines

For only the second time so far this year, the net assets of the universe of sustainable funds registered a month-over-month decline. The 1,100 sustainable funds ended the month of October with $302.4 billion in assets under management versus $321.9 billion at the end of September. The month-over-month decline in the amount of $19.5 billion is attributable to market depreciation that was estimated to account for an even larger $23.1 billion. While the severe market reversal took its toll, some of the decline due to market movement was offset by the largest estimated monthly net cash inflow into sustainable funds so far this year–an estimated $3.45 billion in net new money. At the same time, repurposed funds contributed an additional $122.8 million. Refer to Chart 3.

Mutual fund assets stood at $293.6 billion as of the end of October while ETFs and ETNs closed the month at $8.9 billion, registering declines of $19.1 billion (6.1%) and $413.0 million (4.5%), respectively, relative to last month. The relative proportion of the two segments remain unchanged at about 97% and 3%, respectively. Assets sourced to institutional only mutual funds/share classes, 416 in total, versus all other funds, declined by $6.9 billion, or 6.3%, to $103.4 billion. The investor group accounts for 34.2% of the segment’s assets, versus $110.3 billion at the end of September.

At the end of October, the universe of explicitly designated mutual funds and ETFs/ETNs were sourced to 123[2] fund groups or firms, up three fund groups since the previous month. The three new firms include Community Capital Management (Quaker Funds)[3] that repurposed two mutual funds with four share classes for a total of $81.4 million, Zevenberger that also repurposed two mutual funds and shifted $41.4 million as well as KBI Global Investors (North America) Ltd. The firm launched a new fund in October, the KBI Global Investors Aquarius Fund.

In addition to the KBI fund, six new funds/share classes were launched, including three ETFs. Most notable was the iShares ESG US Aggregate Bond ETF which now offers sustainable investors through the iShares platform a core investment-grade intermediate term fund option for purposes of constructing a diversified investment portfolio. The fund was launched with $55 million in net assets and is priced at a very attractive 0.1%.

[1] 1,105 funds reported performance results for the full month of September 2018, including five share classes offered by the Franklin Select US Equity Fund with $103.8 million in assets that are excluded from the October analysis as their most recent prospectus does not reflect the adoption of a sustainable strategy or approach.

[2] BlackRock and iShares are combined into a single fund group while Franklin is excluded.

[3] Quaker Funds has been added as a new fund group, even as the two repurposed funds are managed by Community Capital Management Inc. already manages the CRA Qualified Investment Fund.