Model portfolios: Each of the three portfolios lagged behind their conventional benchmarks in April with returns of 0.82%, 2.32% and 3.53%; but longer-term results continue to outperform

The three model portfolios trailed their comparative benchmarks in April even as two of the three underlying funds outperformed their designated benchmark while the third lagged and detracted from the overall performance of the portfolios. Vanguard FTSE Social Index Investor Shares and TIAA-CREF Social Choice Bond-Retail, both exceeded the total return results achieved by their corresponding conventional indexes by 25 basis points (bps) and a tiny 0.36 bps, respectively. On the other hand, Domini Impact International Equity-Investor trailed its MSCI EAFE (Net) benchmark by 90 basis points.

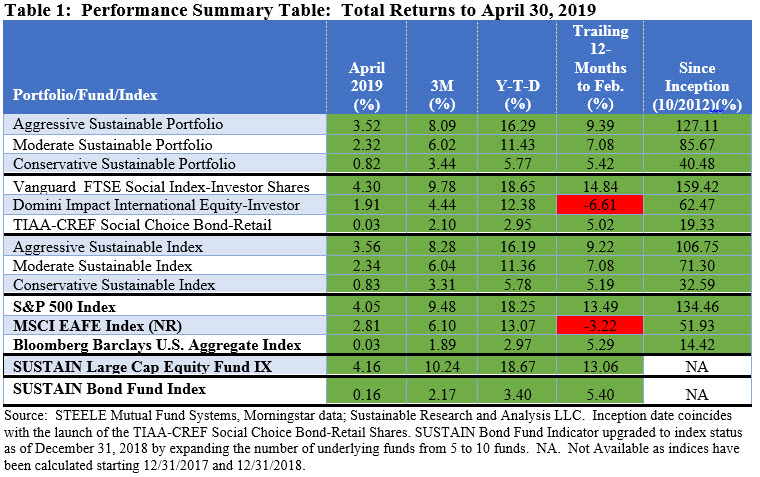

The Aggressive Sustainable Portfolio (95% stocks/5% bonds), Moderate Sustainable Portfolio (60% stocks/40% bonds) and Conservative Sustainable Portfolio (20% stocks/80% bonds) posted total returns of 1.69%, 1.78% and 1.88%, respectively. Refer to Table 1.

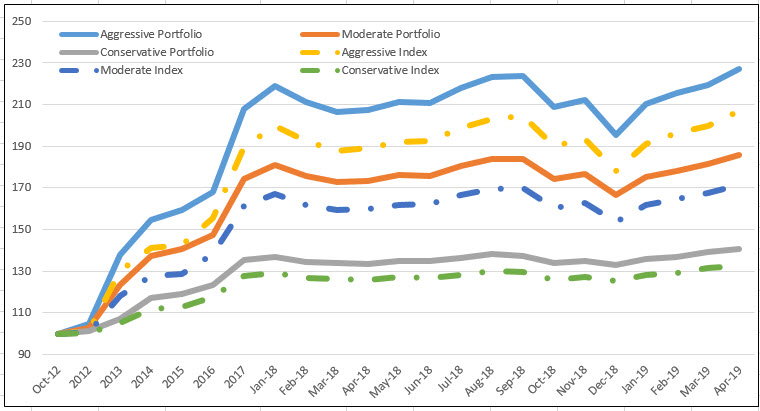

While all three model portfolios beat their designated benchmarks in March, this was not the case in January and February of this year when only two of the three portfolios outperformed. Similar outcomes were achieved over the previous three months and year-to-date intervals, but the absolute returns posted by the model portfolios have been impressive. On a year-to-date basis, for example, the portfolios are up from 5.77% to 16.29%, depending on their assumed risk profiles. Further, the model portfolios continue to maintain their lead over their designated benchmarks for the longer trailing 12-month and since inception intervals. Refer to Chart 1.

Performance Summary Chart: Cumulative Total Returns October 2012 –April 30, 2019

Chart 1:

Notes of Explanation: As of January 1, 2018, the aggressive, moderate and conservative sustainable portfolios were reconstituted and are comprised of three mutual funds, including the Vanguard FTSE Social Index-Investor Shares, Domini Impact International Equity-Investor and TIAA-CREF Social Choice Bond-Retail Shares. The US equity/international developed markets equity and fixed income weightings of these funds in each of the portfolios vary and are as follows: Aggressive (70% US equities, 25% international developed markets equities and 5% US bonds), Moderate (45% US Equities, 15% international developed markets equities and 40% US bonds) and Conservative (15% US equities, 5% international developed markets equities and 80% US bonds). Performance results are back casted to October 2012, the commencement date of the TIAA-CREF Social Choice Bond Fund. Portfolios have not been rebalanced.

Model portfolio results reflecting the strong performance of major US stock market indexes

Model portfolio results are reflecting the performance of major US stock market indexes that recorded their best four-month start to a year since at least 1999, the latest milestone fueled by a more accommodative Federal Reserve Bank and upbeat economic prospects that reversed a sharp downturn in December of last year. The S&P 500 posted a gain of 4.05% in April, the fourth consecutive monthly increase this year that pushed year-to-date results to 21.29% and 24.07% over the previous 12-months. The Dow Jones Industrial Average, up 14% since the start of the year, also registered its best four-month start since 1999. The Nasdaq Composite’s 22% advance is its best start since 1991. Large cap value stocks outperformed growth stocks by 14 basis points (bps), but the relationship is a short-lived one as large cap growth stocks exceed the performance of value stocks at least for the cumulative ten-year interval through April. At the same time, small cap stocks trailed large caps. Outside the US, stocks posted positive but slightly weaker results. Europe, as measured by the MSCI EAFE Index was up 3.58% while the broader MSCI ACWI, ex US was up 2.64% and Latin America gained 1.05%. Investment-grade intermediate bonds recorded a very slight gain of 0.03%, much below last month’s 1.92% increase, as 10-year US Treasuries ended the month with a yield of 2.51%, up 10 bps from 2.41% at the end of March.