Sustainable funds close October at $302.4 billion, giving up $19.5 billion due largely to market declines[1]

For only the second time so far this year, the total net assets of the universe of sustainable funds, including mutual funds, ETFs and ETNs, registered a month-over-month decline. The 1,100 sustainable funds ended the month of October with $302.4 billion in assets under management versus $321.9 billion at the end of September. The month-over-month decline in the amount of $19.5 billion is attributable to market depreciation that was estimated to account for an even larger $23.1 billion but for positive flows. While the severe market reversal, as reflected by the S&P 500’s decline of 6.84%, took its toll, some of the pull-back due to market movement was offset by the largest estimated monthly net cash inflow into sustainable funds so far this year–an estimated $3.45 billion in net new money. At the same time, repurposed funds contributed an additional $122.8 million.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”reg” ihc_mb_template=”4″ ]

Mutual fund assets stood at $293.6 billion as of the end of October while ETFs and ETNs closed the month at $8.9 billion, registering declines of $19.1 billion (6.1%) and $413.0 million (4.5%), respectively, relative to last month. The relative proportion of the two segments remain unchanged at about 97% and 3%, respectively. Assets sourced to institutional only mutual funds/share classes, 416 in total, versus all other funds, declined by $6.9 billion, or 6.3%, to $103.4 billion. The investor group accounts for 34.2% of the segment’s assets, versus $110.3 billion at the end of September.

Fund Groups: Three fund groups added, bring total to 123

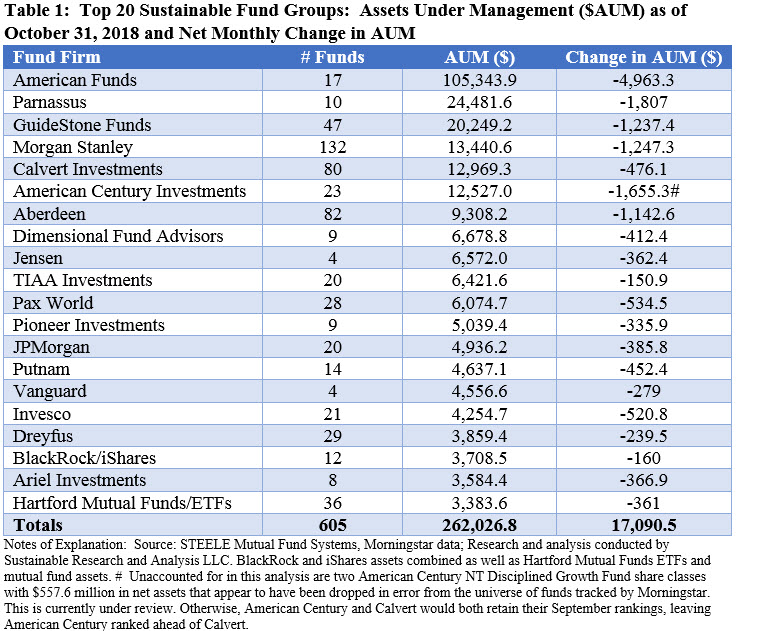

At the end of October, the universe of explicitly designated mutual funds and ETFs/ETNs were sourced to 123[2] fund groups or firms, up three fund groups since the previous month. The firms that comprise the top 20 fund groups remained unchanged, accounting for $261.8 billion or 87% of the segment’s net assets versus $321.9 billion at the end of September. This percentage also did not shift when compared to last month. Refer to Table 1.

October’s severe market decline erased $17.1 billion from this top 20 segment’s assets under management (AUM), and none of the firm’s was spared. Still some firms experienced more modest declines in AUM and this contributed to some shifts within the rankings of the top firms. More specifically, Calvert Investments, TIAA Investments and iShares, which combines iShares and BlackRock, each shifted up by in the rankings by one or two notches due to relative gains in net assets[3].

The three new sustainable fund groups that were added in October along with their repurposed funds include Quaker Funds whose two fund entries are managed by Community Capital Management[4] and Zvnbrgn Funds managed by Zevenbergen Capital Investments. A third firm, KBI Global Investors (North America) Ltd., was added to the segment with the launch of a new fund in October, the KBI Global Investors Aquarius Fund. See further details below.

Fund Flows: Inflows/outflows

Within the universe of the top 20 firms as listed in Table 1, the following fund firms and funds experienced the smallest estimated declines in net assets and some of the largest inflows, after accounting for market movement:

- TIAA-CREF. With its 20 fund offerings and $6.4 billion in net assets at the end of October (excluding Nuveen with its 8 funds and $405.3 million), the firm gave up just $150.9 million or 2.4%, the smallest net decline across the 20 firms. Market movement to the downside was offset by institutional inflows into the Social Choice Equity Institutional Shares ($76.4 million) and Social Choice Bond Fund Institutional Shares ($61.7 million).

- BlackRock. The firm, offering both sustainable mutual funds as well as ETFs, end the month with $3.6 billion in assets under management, for a drop of $160 million or 4.4%. Three ETFs saw large inflows, including iShares ESG MSCI EM ETF ($320.4 million), iShares MSCI ACWI Low Carbon Target ETF ($161.7 million), and iShares MSCI EAFE ESG Optimized ETF ($103.1 million). At the same time, the iShares Global Clean Energy ETF experienced outflows estimated at $355.5 million.

- Vanguard. The firm’s Vanguard FTSE Social Index Fund ended October with $4.5 billion in net assets, having given up $305 million to market movement and inflows/outflows. Inflows into the Investor Share class in the amount of $59.4 million were offset by outflows from the Institutional Share class in the amount of $54.8 million.

At the same time, the following fund firms and funds experienced the largest declines in assets under management, attributable either to market movement, negative or positive flows or repurposed funds, or some combination these factors:

- American Funds Washington Mutual. The net assets of this $105.3 billion fund, which excludes companies deriving a majority of their revenues from alcohol or tobacco products, declined by almost $5.0 billion from $110.3 billion at the end of September 2018. Much of the decline can be attributed to market movement, however, the fund saw estimated inflows into its F2 and R6 share classes, in particular, in the combined amount of $803.4 million. As of the end of October, the fund accounts for 34.8% of the sustainable segment’s assets under management as compared to 34.3% last month.

- Parnassus Funds. The net assets for this $24.5 billion funds firm dropped by $1.8 billion due to a combination of market movement and fund flows during a month when the average total return across the firm’s four equity funds and eight shares classes posted a better than S&P 500 decline of 6.7%. The firm actually benefited from fund inflows into the Parnassus Core Equity Investor fund that attracted an estimated $100.2 million and Parnassus Endeavor Investor shares that experienced and estimated $83.8 million in net inflows.

- Morgan Stanley. While sustainable assets under management across the entire fund group recorded a month-over-month decline of $1.2 billion due to market movement, the third largest drop after American Funds, a detailed analysis shows that the group’s decline would have been even greater were it not for inflows during the month. Three institutional funds in particular, with global or international mandates, posted the largest estimated inflows. These included the Morgan Stanley Institutional Global Opportunities Fund, a $2.5 billion fund that attracted an estimated $78.4 million, the Morgan Stanley Institutional International Equity Fund, a $2.9 billion fund that attracted $58.5 million and the Morgan Stanley Institutional International Advantage Fund, a $587.2 million fund that attracted an estimated $41.7 million. Each of these funds discloses that the investment process integrates analysis of sustainability with respect to disruptive change, financial strength, environmental and social externalities and governance (also referred to as ESG).

Repurposed funds: Two fund firms, 4 funds and $122.5 million in net assets

Two fund firms repurposed 4 funds, consisting of 8 share classes with total net assets in the amount of $122.5 million. These are as follows:

- Quaker Funds. This Berwyn, Pennsylvania based fund group repurposed the Quaker Impact Growth Fund and Quaker Small-Cap Value Fund, both of which are managed by Community Capital Management, Inc. The funds, with total net assets in the amount of $81.4 million, invest in companies that may have positive impact attributes or specific impact characteristics and maintain neutral posture toward environmental, social and governance (ESG) related risk. The funds exclude certain industries and companies, such as fossil fuel exploration and production, any activity related to coal, tobacco, chemical manufacturing, weapons and prison management, to mention just a few. In addition, the adviser uses an internally developed investment process to seek to develop a fully integrated portfolio of securities that includes environmental, social and governance (ESG) factors that in the opinion of the adviser can deliver strong financial performance while simultaneously having positive, long-term economic and sustainable impact. For further details regarding the full scope and implementation of the adviser’s ESG approach, refer to Investment Research tab/The Basics/Sustainable Investment Glossary.

- Zvnbrgn Funds. Managed by Zevenbergen Capital Investments LLC, this Seattle, Washington-based firm repurposed two mutual funds, the Zevenbergen Genea Fund and Zevenbergen Growth Fund, and shifted $41.4 million. The adviser’s fundamental approach to stock selection embeds consideration of material environmental, social, and governance (ESG) issues. While not a primary factor for the funds’ inclusion or exclusion, the adviser believes that ESG analysis is innate to its core research approach and helps the investment team form a clearer understanding of potential business benefits and risks. The investment strategy incorporates formal research review of company-specific ESG factors in the decision-making process.

New Funds: Six funds and/or share classes with $87.9 million in net assets

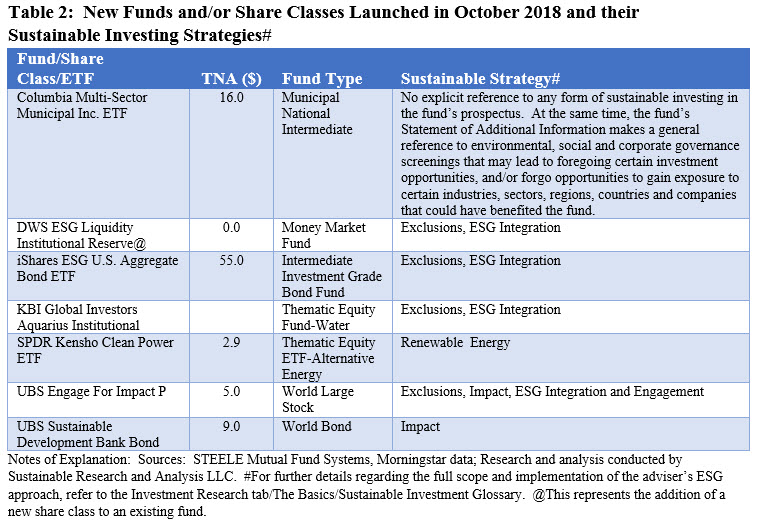

In addition to the newly launched KBI Global Investors Aquarius Fund, a thematic fund managed by KBI Global Investors (North America) Ltd. that invests in the equity securities of companies who whose main business is in the water-related resource sector that are also subject to the adviser’s ESG risk analysis, six new funds and/or share classes were launched, including three ETFs. These funds contributed $87.9 in net assets. Most notable was the iShares ESG US Aggregate Bond ETF which now offers sustainable investors through the iShares platform a core investment-grade intermediate term fund option for purposes of constructing a diversified investment portfolio. The fund was launched with $55 million in net assets and is priced at a very attractive 0.1%.

Table 2 displays the new funds that were launched in October along with their sustainable investing strategies.

[1] Refer to footnote 3.

[2] BlackRock and iShares are combined into a single fund group while Franklin is excluded.

[3] Unaccounted for in this analysis are two American Century NT Disciplined Growth Fund with $557.6 million in net assets that appear to have been dropped in error from the universe of funds tracked by Morningstar. This is currently under review. If this is indeed in error, American Century and Calvert would both retain their September rankings.

[4] Quaker Funds has been added as a new fund group, even as the two repurposed funds are managed by Community Capital Management Inc. already manages the CRA Qualified Investment Fund.