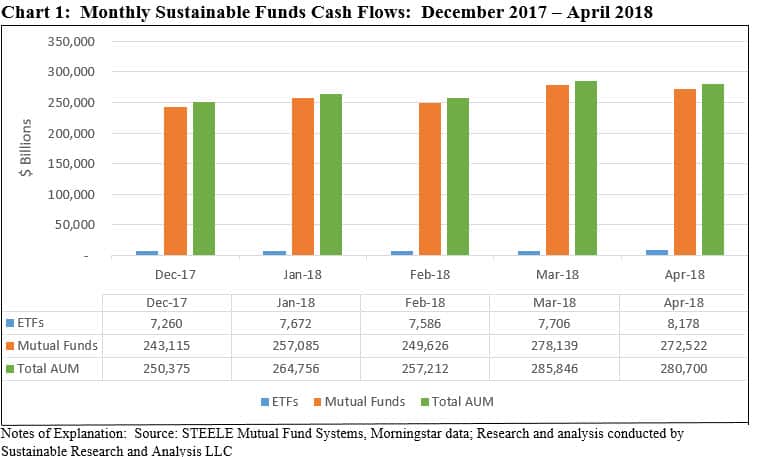

Monthly Sustainable Assets Under Management Reach $280.7 Billion

Sustainable funds, including mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs), a total of 956 funds/share classes, ended the month of April with $280.7 billion in assets under management (AUM). This represents an increase of $8,685 million or 3.2% relative to March 31, 2018 and a gain of $30.3 billion since December 31, 2017. The number of funds ticked up by 47 versus 909 funds last month. The increases in the number of funds and assets is largely attributable to the repurposing of seven Morgan Stanley managed institutional funds (39 share classes) with $8,177.8 billion in assets. Refer to Chart 1.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”reg” ihc_mb_template=”4″ ]

Mutual funds continue to dominate the sustainable segment, accounting for 885 funds/share classes, with $272.5 billion in net assets or 97.1% of the assets in the sustainable investing segment. ETFs stood at $8.2 billion across 69 funds while an additional product offering in the form of an ETN adds another $19 million in net assets. The sustainable segment is also dominated by equity funds and various other non-fixed income funds that, on a combined basis, represent $260.5 billion in AUM, or 93%, versus fixed income funds that ended April with $20.2 billion.

Retail investors dominate the sustainable funds universe, representing $190.3 billion, or 68% of the segment’s assets versus institutional investors that weigh in with $90.4 billion.

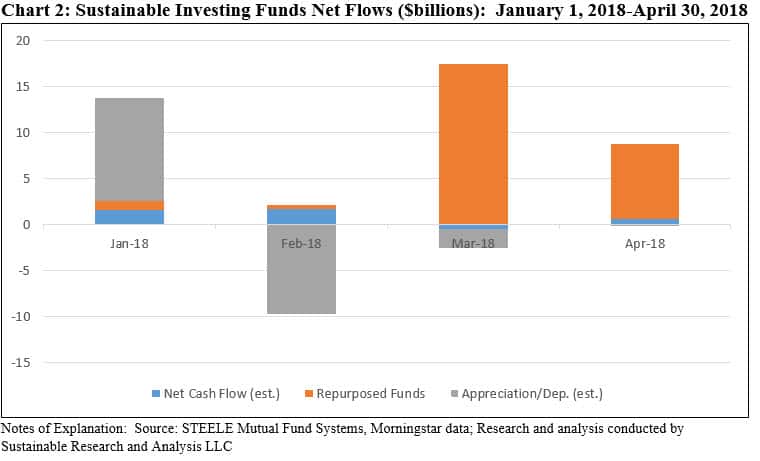

April Net Cash Flows Dominated by Repurposed Funds

Sustainable funds posted an average total return in April that was almost flat at -0.043%. Returns ranged from an average low of -0.57% recorded by fixed income ETFs to an average high of +0.59% generated by all non-fixed income ETFs. Mutual funds produced average returns that fell within that range. It is estimated that funds gave up $65.4 million due to market deprecation during the month. This was offset by the addition of $8,177.8 million attributable to the repurposing of seven Morgan Stanley funds, comprising 39 share classes, all of which adopted ESG integration practices. Based on this data, it is further estimated that sustainable funds experienced net positive inflows of $572.2 million, or an increase of 0.21% for the month.

Since the beginning of the year, cash inflows contributed an estimated $3.3 billion, or 1.3% of the gains achieved while repurposed funds added $27.0 billion. Market depreciation reduced AUM by a combined estimated $685 million. Refer to Chart 2.

Composition of Top 10 Sustainable Fund Groups Shifts During the Month

A total of 114 fund groups, the same as the previous month, offer sustainable investing products. The top 20 fund groups accounted for $249.3 billion in net assets, or 88.8% of the assets in the segment. This doesn’t represent a significant change from March when the top 20 fund groups managed $241.0 billion and accounted for 88.6% of assets. The composition of the group of 20 fund groups didn’t change, but there was a shift in the makeup of the top 10 fund groups. This subdivision, which represents $213.9 billion in assets, or 76.2% of assets under management, saw TIAA Investments regain a spot among the top 10 fund groups while JPMorgan, which experienced a slight asset drop, slipped to number 11. At the same time, Morgan Stanley, with the addition of its seven repurposed funds added an additional $8,177.8 million and, in the process, moved up to the 4th highest rank within the sustainable funds segment. The fund group moved ahead of Calvert Investments that, at year-end 2017, occupied the same rank but has been moving lower and ended in 6th spot at the end of April. Refer to Table 1.

Assets Also Shift within Fund Groups

As of April 27, 2018 Morgan Stanley modified the prospectus of seven institutional funds to reflect the fact that the fund’s adviser “may consider information about environmental, social and governance issues (also referred to as ESG) in its bottom-up stock selection process when making investment decisions.” According to the funds’ prospectus, the adviser may engage with company management regarding corporate governance practices as well as what the adviser deems to be materially important environmental and/or social issues facing a company. These additions extend a decision to apply similar considerations in 2017 (effective for tracking purposes as of October 2017) to seven institutional funds, for a total of 67 share classes and $3.2 billion in assets. Morgan Stanley’s sustainable funds line-up now consists of 17 funds (78 share classes) with $13.6 billion in assets, or 4.8% of the sustainable funds segment.

American Funds added $1.1 billion, Dimensional Fund Advisors gained $156.5 million while GuideStone Funds gained $146 million.

At the other end of the range, J. P. Morgan Asset Management gave up $883.2 million while Aberdeen dropped $320.0 million and Amana gave up $127.5 million.

Largest Monthly Gain Recorded by Washington Mutual Fund, up $1.1 Billion

The largest gain was recorded by the Washington Mutual Fund which added $1.1 billion in April. This American Funds offering which stands at $100.5 billion and alone represents 36.2% of the sustainable segment’s net assets, qualifies as a sustainable fund based on its policy of excluding companies that derive the majority of its revenues from alcohol and tobacco products.

Dimensional Fund Advisors gained $156.5 million, attributable to three funds, including DFA International Sustainable Core 1 ($33.1 million), US Social Core Equity 2 ($26.1 million) and US Sustainability Core 1 ($44.5 million).

GuideStone Funds gained $146 million, benefiting from an inflow of $60.3 million into its GuideStone Money Market Fund-Investor Shares.

Largest Monthly Decline Recorded by J.P. Morgan Fund

J.P. Morgan’s assets declined due to an apparently large $710.6 million withdrawal from its JP Morgan Corporate Bond Fund R6 Class. Aberdeen Investments gave up $320 million, largely attributable to a decline in the amount of $263.4 million linked to the Aberdeen Emerging Market Institutional Fund. Lastly, Amana Funds experienced combined asset drops in the Amana Growth Investor Fund as well as Amana Income Investor.

New Fund Launched by iShares MSCI USA Small-Cap ESG Optimized ETF

Only one new fund was launched in April—the iShares MSCI USA Small-Cap ESG Optimized ETF. Launched April 10, 2018 with a 17 bps expense ratio, this fund seeks to track the results of the MSCI USA Small Cap Extended ESG Focus Index. It is only the second ETF with a small company ESG focus, the first being the 40 bps NuShares ESG Small-Cap ETF that was launched last year and by now has attracted $51.5 million in net assets. The two indexes are similar, except, it seems, with regard to the exclusion of companies based on their exposure to certain controversies.

The iShares MSCI USA Small-Cap ESG Optimized ETF seeks to track the investment results of the MSCI USA Small Cap Extended ESG Focus Index which is constructed to satisfy certain ESG criteria based on company ESG profiles compiled by MSCI ESG Research, Inc. and the exclusion of companies with significant activities in certain controversial businesses, including those involving alcohol, tobacco, military weapons, firearms, nuclear power and gambling, as well as companies with certain carbon-based ownership and emissions thresholds. In addition, the index excludes companies based on certain controversies, including, among other things, issues involving anti-competitive practices, toxic emissions and waste, and health and safety, occurring within the last three years lead to a deduction from the overall management score on each issue.

Finally, the $604.6 million Guggenheim S&P Global Water ETF changed its name to the PowerShares S&P Global Water ETF. This is in connection the completion on April 9, 2018 of the previously announced acquisition by Invesco Ltd. of Guggenheim Investments’ exchange-traded funds business. This transaction will also result in the renaming of PowerShares to Invesco on or about June 4, 2018.