Through its subsidiary, Mirova Asset Management, Natixis Global Asset Management has launched a green bond mutual fund that will be available to US investors. This represents the 3rd green bond fund on offer in the US.

In an announcement dated February 28, 2017, Natixis stated that it has introduced the Mirova Global Green Bond Fund. Consisting of three share classes (Class A, Class N and Class Y), the fund will invest in green bonds issued by companies, banks, supranational entities, development banks, agencies, regions and governments around the world. Mirova is strongly positioned to offer such a fund.

Assessment

Low Conviction

Synopsis

The firm, based in Paris, specializes in [ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]

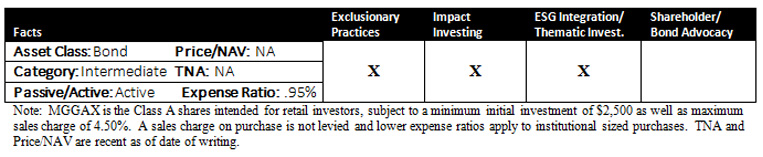

responsible investing on a global scale, which includes environmental, social and governance analysis (ESG). It has $6.8 billion in assets under management (as of 12/31/2016) and $44 billion in voting and engagement. The firm also has been managing a green bond fund offered in Europe since January 2016. As reported by Mirova, the firm retains a team of about 60 multidisciplinary experts include specialists in thematic investment management, engineers, financial and environmental, social and governance analysts, project financing specialists and experts in solidarity finance. So the absence of a track record for this new fund can be offset by the firm’s experience in this sphere. At the same time, the fund’s 95 bps expense ratio (which declines to 65 bps for Class N shareholders subject to a minimum investment of $1.0 million and 70 bps for Class Y shares subject to a $100,000 initial investment, except certain retirement plans, IRAs, Wrap fee programs and clients of RIAs) is below median but falls into the lower tier or second quartile but is richly priced for retail investors who are also subject to a maximum 4.50% sales charge1.

Mirova Global Green Bond Fund – ESG Analysis

The Mirova Global Green Bond Fund aims to provide total return, through a combination of capital appreciation and current income, by investing in green bonds. The fund is dedicated to financing environmental transition projects while potentially benefitting investors with global diversification and sustainable value.The fund will invest at least 80% of its net assets in green bonds which are the same as all other fixed income instruments, except that the proceeds are used to finance projects intended to achieve a positive environmental impact. The fund primarily invests in fixed-income securities issued by companies, banks, supranational entities, development banks, agencies, regions and governments. In deciding which securities to buy and sell, Mirova selects securities based on their financial valuation profile and an analysis of the global environmental, social and governance impact of the issuer or the projects funded with the proceeds from the securities. Following the evaluation of a security, the portfolio managers value the security based, among other factors, on what they believe is a fair spread for the issue relative to comparable government securities, as well as historical and expected default and recovery rates. The portfolio managers will re-evaluate and possibly sell a security if there is a deterioration of its ESG quality and/or financial rating, among other reasons.

Green bonds are usually issued to finance specific projects intended to generate an environmental benefit while offering a potential market return in line with conventionally fixed income securities. Beyond fundamental security analysis, Mirova independently analyzes each green bond it selects on the basis of its commitments to the use of proceeds, an analysis of the general practices of the issuer and of the management of the environmental and social risks during the life cycle of the projects, and reporting and disclosure practices. The fund invests in securities of issuers located in no fewer than three countries, which may include the U.S. Under normal circumstances, the Fund will invest at least 40% of its assets in securities of issuers located outside the U.S. and the Fund may invest up to 20% of its assets in securities of issuers located in emerging markets.

The fund may invest up to 20% of its assets, at the time of purchase, in securities rated below investment grade or, if unrated, securities determined by Mirova to be of comparable quality. The fund may invest in bonds of any maturity and expects that under normal circumstances the modified duration of its portfolio will range between 0 and 10. This flexibility is intended to allow the portfolio managers to reposition the fund to take advantage of significant interest rate movements. Performance is expected to derive primarily from security selection and duration is not expected to be a major source of excess return relative to the benchmark.

Alternative Mutual Fund Offerings

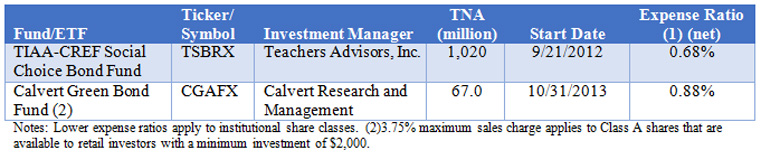

At this point, investors interested in a dedicated green bond fund have access to a limited number of options. Beyond the just launched Mirova Global Green Bond Fund, only two funds that are invested in at least around 10% of net assets in green bonds are currently available in the market. While the TIAA-CREFF Social Choice Bond Fund offers the best management/price combination, this fund is not a dedicated green bond fund and only about 9.5% of the fund’s total assets are currently invested in green bonds.

Green Bond Mutual Funds

Additional managed fund options are likely in the future. For example, New York investment advisory firm Van Eck Associates Corporation revealed recently that it is planning to launch a green bond ETF designed to replicate the performance of a green bond index. The announcement was in the form of a SEC registration statement filed on 10 November 2016. The fund has not been listed for trading as of the date of this writing.

Bottom Line

While the management company brings a solid track record in managing ESG assets generally and green bonds in particular, the fund’s moderate 95 bps expense ratio charged to retail investors via the Class A shares, which falls outside the lowest to-lower range applicable to intermediate corporate funds, and the application of the maximum sales charge of 4.50% makes this fund an expensive option for retail investors. For now at least, retail investors may wish to consider the TIAA-CREFF Social Choice Bond Fund or direct purchases of highly rated taxable or tax-exempt green bonds. That said, the Mirova fund is a more attractive option for institutional investors not subject to a maximum sales charge

[/ihc-hide-content]