Research and analysis to keep sustainable investors up to-date on a broad range of topics that include trends and developments in sustainable investing and sustainable finance, regulatory updates, performance results and considerations, investing through index funds and actively managed portfolios, asset allocation updates, expenses, ESG ratings and data, company and product news, green, social and sustainable bonds, green bond funds as well as reporting and disclosure practices, to name just a few.

A continuously updated Funds Directory is also available to investors. This is intended to become a comprehensive listing of sustainable mutual funds, ETFs and other investment products along with a description of their sustainable investing approaches as set out in fund prospectuses and related regulatory filings.

Many questions have surfaced in recent years regarding sustainable and ESG investing. Here, investors and financial intermediaries will find materials that describe the various approaches to sustainable investing and their implementation. While sustainable investing approaches vary and they have thus far defied universally accepted definitions, many practitioners agree that they fall into the following broad categories: Values-based investing, investing via exclusions, impact investing, thematic investments and ESG integration. In conjunction with each of these approaches, investors may also adopt various issuer engagement procedures and proxy voting practices. That said, sustainable investing approaches will continue to evolve.

In addition to periodic updates regarding sustainable investing and how this form of investing is evolving, investors and financial intermediaries interested in implementing a sustainable investing approach will also find source materials that cover basic investing themes as well as asset allocation tactics.

Thoughts and ideas targeting sustainable investing strategies executed through various registered and non-registered sustainable investment funds and products such as mutual funds, Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), closed-end funds, Real Estate Investment Trusts (REITs) and Unit Investment Trusts (UITs). Coverage extends to investment management firms as well as fund groups.

Markets rose in April while sustainable fund indices outperformed

The Bottom Line: Markets rose in April as economic activity and corporate earnings rebounded; ESG securities market indices diverged while sustainable mutual fund indices outperformed.

Share This Article:

The Bottom Line: Markets rose in April as economic activity and corporate earnings rebounded; ESG securities market indices diverged while sustainable mutual fund indices outperformed.

Market Summary

• Economic activity in the US rebounded strongly, fueling first quarter corporate earnings that beat analyst expectations, both in number and magnitude, and was on track to set a new year-over-year record.

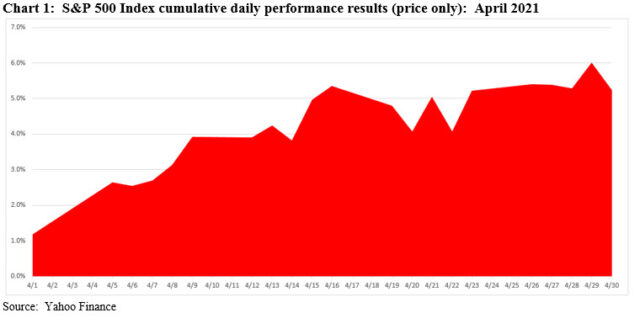

• The S&P 500 added 5.34%, rising through mid-April and staying there. Refer to Chart 1. This was the best monthly return since November 2020 when the same index recorded an increase of 10.95%.

• Growth outperformed value stocks, but that did not extend to mid-caps; at the same time, small cap stocks lagged. The Russell 2000 Index recorded a total return gain of 2.1%.

• Global stocks registered a gain of 4.4% in April, pushed higher by US markets.

• Europe, according to the MSCI EAFTE Index, recorded an increase of 4.7% with France’s 6.2% gain in the lead.

• Emerging markets added 2.5%, led by Brazil that was up 6.5%.

• Investment-grade fixed income rebounded in April as long-term rates declined, dropping from 1.74% to 1.65% based on 10-year Treasuries. For the first time so far this year, intermediate investment-grade bonds posted positive results, gaining 0.79% according to the Bloomberg Barclays Aggregate US Bond Index. The same benchmark is still in negative territory at -2.61% year-to-date.

ESG securities market indices: Near-term results diverge while intermediate-to-long term records covering foreign indices outperform

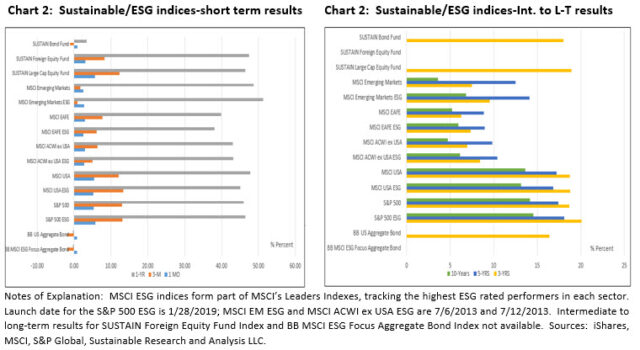

• The MSCI Emerging Markets ESG Leaders Index outperformed by 26 bps in April while three MSCI ESG Leaders developed market benchmarks trailed their conventional counterparts. For 3-, 5- and 10-year intervals, the results achieved by ESG benchmarks are fairly consistent. Foreign ESG indices continue to outperform while a similar index tracking US firms fails to do so consistently. Refer to Chart 2.

• The Bloomberg Barclays MSCI US Aggregate ESG Focus Index closely tracked its non-ESG counterpart for intervals up to 1-year.

• Using a different ESG scoring methodology and based on backcasting prior to 2019, the S&P 500 ESG Index outperformed over intervals to 10-years.

Sustainable (SUSTAIN) indices outperformed in April

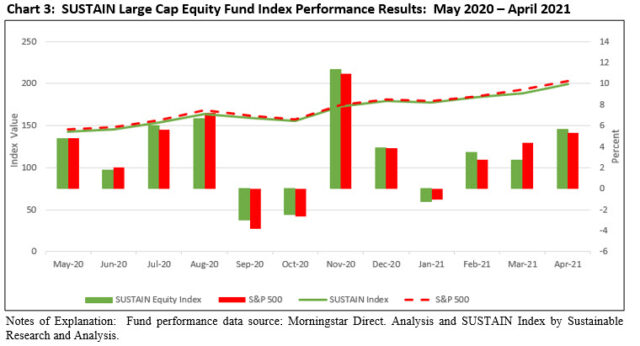

• The Sustainable (SUSTAIN) Large Cap Equity Fund Index added 5.68% in April and outpaced the S&P 500 by 34 bps but lagged behind the S&P 500 ESG Index by 15 bps. The SUSTAIN equity fund index achieved its results on the performance of seven funds that eclipsed the S&P 500 with returns ranging from 5.38% recorded by the BlackRock Advantage Large Cap Core Fund Institutional shares to 7.47% achieve by the T. Rowe Price Blue Chip Growth Fund. The SUSTAIN Large Cap Equity Fund Index continues to lead the S&P 500 on a trailing 12-month and three-year basis. Refer to Chart 3.

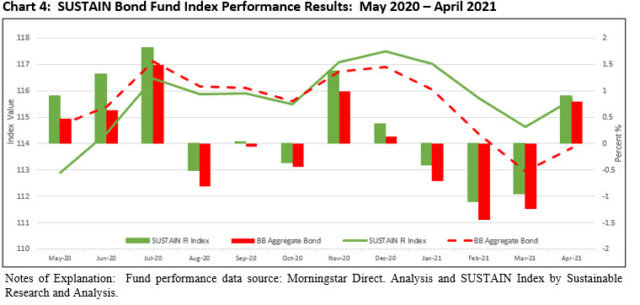

• The Sustainable (SUSTAIN) Bond Fund Index extended its streak of monthly outperformance to 13-months, adding 0.90% in April versus 0.79% registered by both the conventional Bloomberg Barclays US Aggregate Bond Index and its ESG counterpart benchmark, for a positive differential of 11 bps. Nine of the ten fund constituents beat the conventional index with returns ranging from 81 bps achieved by JPMorgan Core Bond Fund R6 to 1.1% registered by the Neuberger Berman Strategic Income Fund I. The SUSTAIN Bond Fund Index also widened its outperformance over the trailing 12-months and 3-years to 3.64% and 1.63%, respectively. Refer to Chart 4.

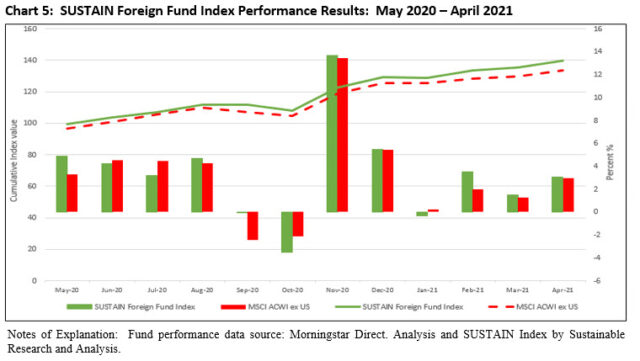

• The Sustainable (SUSTAIN) Foreign Fund Index posted a gain of 3.07% versus 2.94% registered by the MSCI ACWI ex USA Index, for a positive differential of 12 bps. The differential was an even wider 36 bps relative to the equivalent ESG Leaders Index. This marked the third month in a row of outperformance for the SUSTAIN Foreign Fund Index, which benefited from gains ranging from 3.03% captured by Harbor Diversified International All Cap Fund Retirement shares to 6.08% realized by the Morgan Stanley Institutional International Advantage Fund I. The SUSTAIN Foreign Fund Index also led for the trailing 3-month and 12-month intervals. Refer to Chart 5.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact