The Bottom Line: Difficult market conditions in the first quarter led to very poor monthly and quarterly performance results and reduced issuance of green bonds.

Summary

Green bond funds, consisting of active and passively managed green bond mutual funds and green bond ETFs, invest in “green” bonds whose proceeds are used principally for climate mitigation, climate adaptation or other environmentally beneficial projects, such as, but not limited to, the development of clean, sustainable or renewable energy sources, commercial and industrial energy efficiency, or conservation of natural resources. Green bond fund assets across the seven-fund category declined by $12.6 million in March, a drop of 0.9%, to end the first quarter with $1,426.3 million in net assets. Heightened volatility and uncertainties in the first quarter dragged down the prices of investment-grade intermediate bonds by the widest level in more than 10-years. Green bond funds were not spared but, with an average return of -2.35%, the small green bond funds segment outperformed. Q1 results also impacted intermediate-term outcomes. Finally, difficult market conditions influenced sustainable bond issuance in the first quarter and the volume of green bonds dropped to $110.4 billion.

Green bond fund assets decline in March to $1,426.3 million; Franklin Municipal Green Bond Fund to close

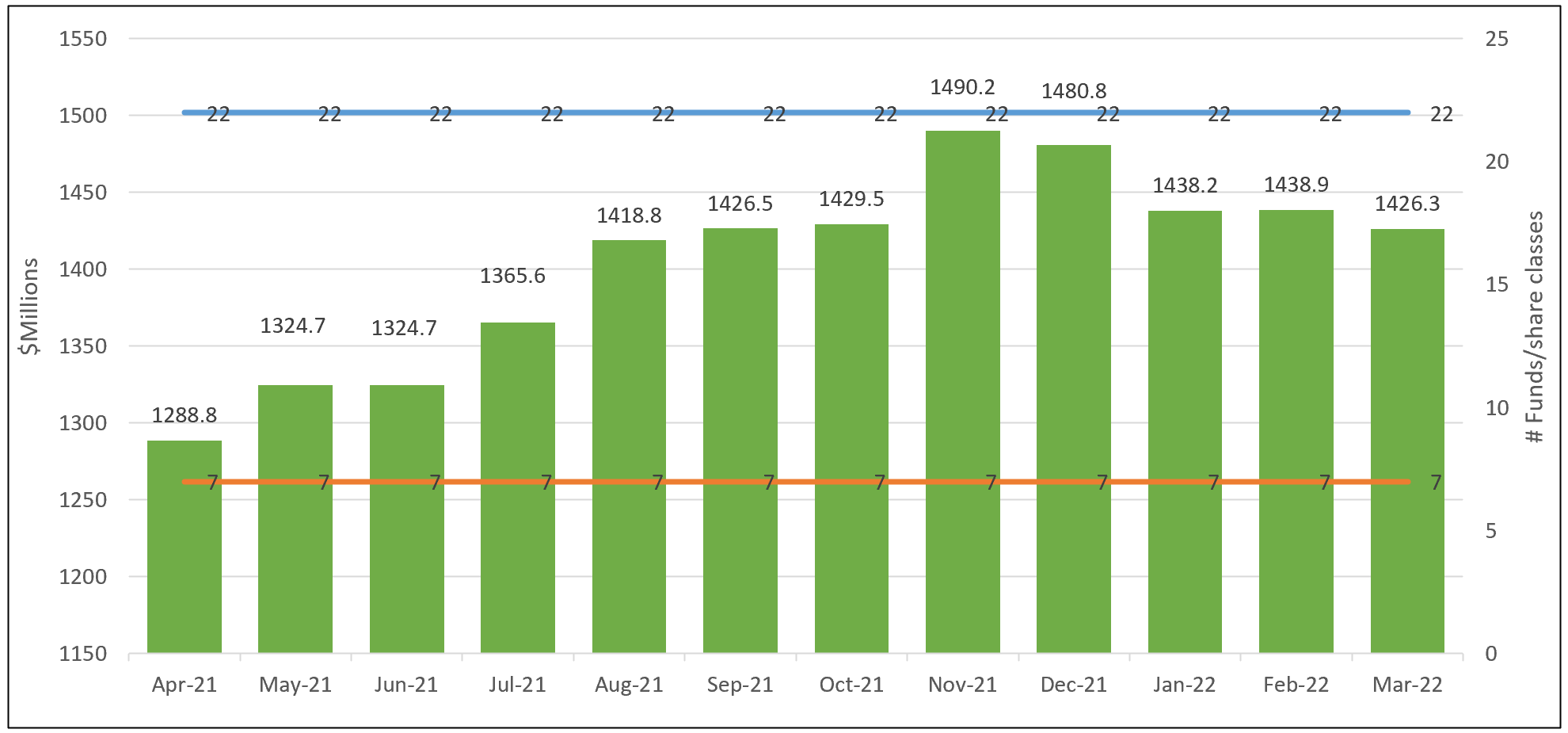

After managing to eke out a slight gain in net asset of $618,994 the previous month, green bond fund assets declined by $12.6 million in March, a drop of 0.9%, to end the first quarter with $1,426.3 million in net assets. Over the first quarter of the year, green bonds funds gave up $54.5 million, registering a net decline of 3.7%. Refer to Chart 1. There were some but otherwise mostly limited withdrawals and much of the drawdown was attributable to the total return declines registered by all seven green bond funds in March. One exception was the TIAA-CREF Green Bond Fund that experienced an increase of $28.3 million, almost entirely reflecting a $28.6 million net addition into the institutional share class. The same fund also recorded a sizable $19.6 million net gain in February, almost entirely into the same TIAA-CREF Green Bond Fund Institutional Share Class (TGRNX), and for the first time since its inception now exceeds a combined total of $100 million in assets.

On February 28, 2022, Franklin Advisers announced that the Franklin Municipal Green Bond Fund will be liquidated on or about May 6, 2022, and that effective at the close of market on April 1, 2022, the fund will be closed to all new investors and new investments. Shareholders of the fund will have their shares redeemed in full and the proceeds will be delivered to them. At $9.6 million by the end of March, the fund, which was launched on October 1, 2019, did not gain much traction. Following its closure, the number of green bond funds will drop to six.

Chart 1: Green bond mutual funds and ETFs and assets under management – April 2021 – March 31, 2022 Notes of Explanation: Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Notes of Explanation: Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Green bond funds posted an average decline of 2.35% but beat the broader Bloomberg US Aggregate Bond Index

Concerns and uncertainties regarding the implications of the Russian invasion of Ukraine, the potential need for a faster pace of interest rate increases and a shrinking of the Federal Reserve’s balance sheet to combat higher inflation introduced heightened volatility and dragged down the prices of investment-grade intermediate bonds by the widest level in more than 10-years. Against this backdrop and in line with bond markets more generally, green bond funds posted an average decline of 2.35%, including the worst performing Franklin Municipal Green Bond Fund and its four share classes. Excluding the Franklin Fund that invests in green bonds exempt from Federal income taxes, the six remaining green bond funds produced a slightly better -2.1% average return in March. That said, all six taxable funds outpaced the Bloomberg US Aggregate Bond Index that registered a 2.78% decline, with funds maintaining shorter than benchmark maturities posting slightly better results. At the same time, the average performance of green bond funds also eclipsed the Bloomberg Global Aggregate Bond Index and also one of the two more narrowly constructed green bond indices. Refer to Table 1.

Green bond fund returns in March ranged from -1.37% to -2.48%. The best performer in March was the Mirova Global Green Bond Y (MGGYX) while the worst performance was registered by the TIAA-CREF Green Bond Fund Retail share class (TGROX).

Average year-to-date results were also dragged down by the performance of the four Franklin Municipal Green Bond Fund share classes. Excluding this fund, the average year-to-date performance of the green bond fund segment stood at -5.8% versus -5.93% recorded by the Bloomberg US Aggregate Bond Index. Returns ranged from a -6.68% registered by the iShares USD Green Bond ETF (BGRN) which as of March 1st launched its updated strategy by shifting to US dollar denominated green bonds, to a high of -5.64% achieved by both the PIMCO Climate Bond Fund Institutional (PCEIX) Calvert Green Bond Fund I (CGBIX).

Less of an impact was imposed by the Franklin Municipal Green Bond Fund over the trailing 12-months, during which green bond funds gave up an average -4.96%. Over the intermediate three and five-year intervals, green bonds posted average returns of 1.62% and 2.02%, respectively.

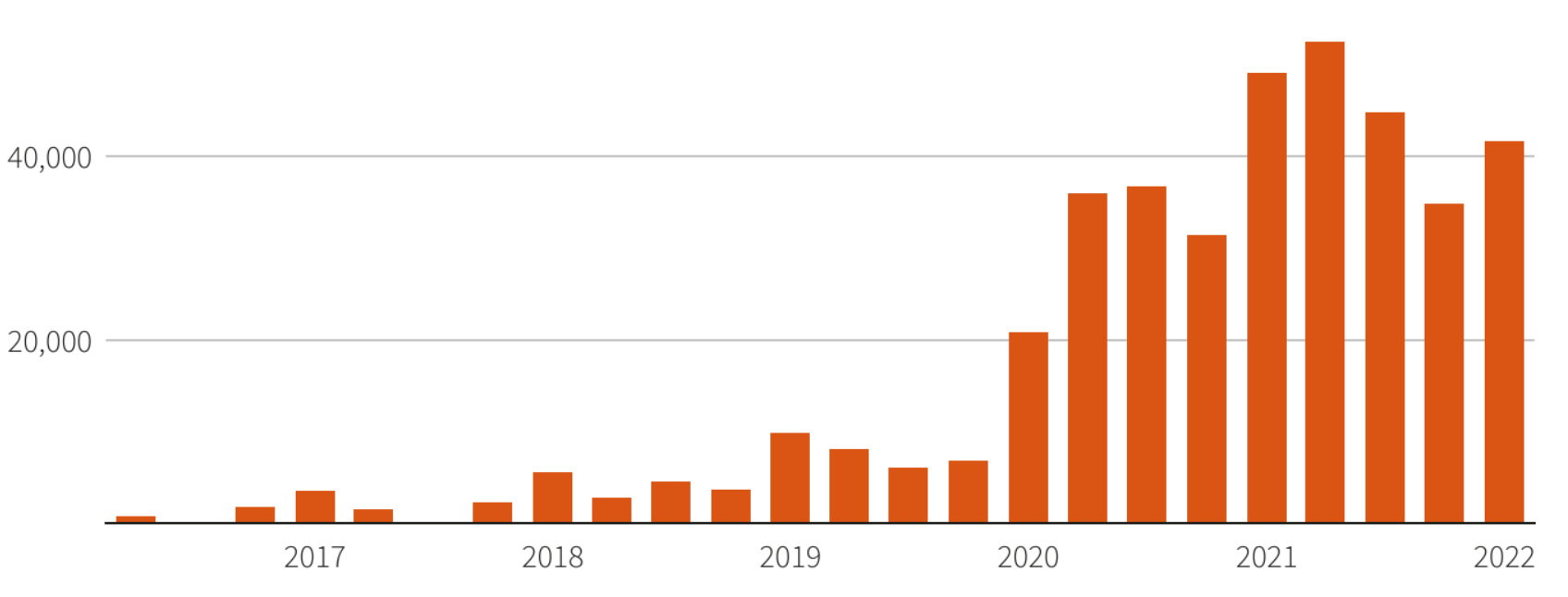

Q1 difficult market conditions impacted the issuance of sustainable bonds that dropped to $231.7 billion, for a 19% decline; green bond issuance also dropped

Difficult market conditions for both equities and bonds influenced sustainable bond issuances in the first quarter. According to Reuters, global sustainable bond issuance in the first quarter totaled $231.7 billion, recording a 19% drop over the same period in 2021. The slowdown followed record issuance of bonds linked to environmental or social goals in 2021, according to data compiled by Refinitiv. Refer to Chart 2. The drop exceeded the broader bond market’s decline in new issues that reached $2.49 trillion or a 5% decline.

At the same time, issuance of green bonds dropped to $110.4 billion¹ in the first quarter, a 7% decline from the prior year.

Chart 2: Quarterly issuance of sustainable bonds: 2007 – Present Notes of Explanation: In millions of US$. Source: Refinitiv Eikon

Notes of Explanation: In millions of US$. Source: Refinitiv Eikon

¹According to Bloomberg, Q1 green bond issuance was even lower at $93.1 billion, down 39% vs. Q1 2021.

Table 1: Green bond funds: Expense ratios, assets and performance results to March 31, 2022

Fund Name | Symbol | March 2022 TR (%) | 3- Months TR (%) | 12-M TR (%) | 3-Years TR (%) | 5-Years TR (%) | Expense Ratio (%) | AUM ($ millions) |

Calvert Green Bond A* | CGAFX | -2.17 | -5.71 | -5.47 | 1.32 | 1.79 | 0.73 | 83.4 |

Calvert Green Bond I* | CGBIX | -2.15 | -5.64 | -5.22 | 1.55 | 2.09 | 0.48 | 802.5 |

Calvert Green Bond R6* | CBGRX | -2.21 | -5.69 | -5.24 | 1.61 | 0.43 | 11.8 | |

Franklin Municipal Green Bond A** | FGBGX | -3.38 | -6.65 | -4.58 | 0.71 | 1 | ||

Franklin Municipal Green Bond Adv** | FGBKX | -3.36 | -6.6 | -4.4 | 0.46 | 8.5 | ||

Franklin Municipal Green Bond C** | FGBHX | -3.41 | -6.75 | -4.87 | 1.11 | 0.1 | ||

Franklin Municipal Green Bond R6** | FGBJX | -3.36 | -6.51 | -4.36 | 0.44 | 0 | ||

iShares Global Green Bond ETF*^ | BGRN | -2.75 | -6.68 | -6.62 | 0.69 | 0.2 | 254.8 | |

Mirova Global Green Bond A* | MGGAX | -1.43 | -6 | -7.04 | 1.03 | 1.97 | 0.93 | 6.5 |

Mirova Global Green Bond N* | MGGNX | -1.46 | -5.92 | -6.74 | 1.34 | 2.26 | 0.63 | 5.8 |

Mirova Global Green Bond Y* | MGGYX | -1.37 | -5.93 | -6.79 | 1.3 | 2.23 | 0.68 | 30 |

PIMCO Climate Bond A* | PCEBX | -2.02 | -5.73 | -4.65 | 0.94 | 0.9 | ||

PIMCO Climate Bond C* | PCECX | -2.08 | -5.9 | -5.38 | 1.69 | 0 | ||

PIMCO Climate Bond I-2* | PCEPX | -1.99 | -5.67 | -4.37 | 0.64 | 0.6 | ||

PIMCO Climate Bond I-3* | PCEWX | -2 | -5.67 | -4.42 | 0.69 | 0.1 | ||

PIMCO Climate Bond Institutional* | PCEIX | -1.99 | -5.64 | -4.27 | 0.54 | 17 | ||

TIAA-CREF Green Bond Advisor* | TGRKX | -2.46 | -5.76 | -3.73 | 2.37 | 0.55 | 3.4 | |

TIAA-CREF Green Bond Institutional* | TGRNX | -2.46 | -5.75 | -3.71 | 2.38 | 0.45 | 77.2 | |

TIAA-CREF Green Bond Premier* | TGRLX | -2.47 | -5.79 | -3.84 | 2.25 | 0.6 | 1 | |

TIAA-CREF Green Bond Retail* | TGROX | -2.48 | -5.82 | -4.06 | 2.11 | 0.78 | 7.4 | |

TIAA-CREF Green Bond Retirement* | TGRMX | -2.47 | -5.79 | -3.93 | 2.25 | 0.7 | 15.5 | |

GRNB | -2.29 | -6.02 | -5.39 | 0.86 | 1.76 | 0.2 | 98.8 | |

Averages/Total | -2.35 | -5.98 | -4.96 | 1.62 | 2.02 | 1,426.3 | ||

Bloomberg US Aggregate Bond Index | -2.78 | -5.93 | -4.15 | 1.69 | 2.14 | |||

Bloomberg Global Aggregate Bond Index | -3.05 | -6.16 | -6.4 | -.69 | 1.7 | |||

Bloomberg Municipal Total Return Index | -3.24 | -6.23 | -4.47 | 1.53 | 5.25 | |||

S&P Green Bond US Dollar Select IX | -2.31 | -6.17 | -5.27 | 1.62 | 2.17 | |||

ICE BofAML Green Bond Index Hedged US Index | -2.49 | -6.56 | -6.29 | 1.08 | 2.42 |

Notes of Explanation: Blank cells=NA. 3 and 5-year returns are average annual total returns. *Fund invests in foreign currency bonds and performance should also be compared to a more narrowly based relevant index such as the ICE BofAML Green Blond Index Hedged US or equivalent. ** Fund invests in US dollar denominated green bonds only and performance should also be compared to a more narrowly based relevant index such as the S&P Green Bond US Dollar Select Index or equivalent. ^Effective March 1, 2022, fund will shift to US dollar green bonds. Fund total net assets and performance data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and Analysis LLC