The Bottom Line: Legal action against DOL rules governing climate change and other ESG factors could slow near-term adoption but not affect their long-term uptake.

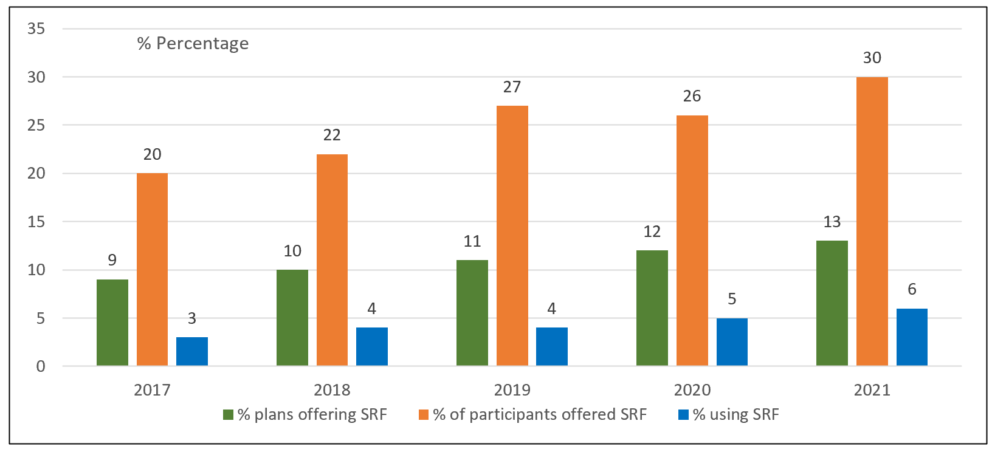

Socially responsible funds offered and used, per Vanguard qualified plans 2022 survey Notes of Explanation: Includes the offering and use of equity funds that incorporate environmental, social and governance (ESG) factors in defined contribution plans. Source: How America Saves 2022, an examination of retirement plan data from nearly 5 million defined contribution (DC) plan participants across Vanguard’s recordkeeping business.

Notes of Explanation: Includes the offering and use of equity funds that incorporate environmental, social and governance (ESG) factors in defined contribution plans. Source: How America Saves 2022, an examination of retirement plan data from nearly 5 million defined contribution (DC) plan participants across Vanguard’s recordkeeping business.

Observations:

- Just three business days before they were to take effect on January 30, 2023, 25 Republican state attorneys general along with two energy companies filed a complaint in the U.S. District Court for the Northern District of Texas against the U.S. Department of Labor (DOL) seeking a preliminary injunction and permanent relief from recently adopted rules governing how retirement plan managers can consider climate change and other ESG factors. The challenge, filed on January 26, 2023, covers a “Prudence and Loyalty in Selecting Plan Investments and Shareholder Rights” 2022 rule issued by the DOL to clarify previous regulations and to remove certain barriers for plans subject to The Employee Retirement Income Security Act of 1974 (ERISA), in particular defined contribution plans such as 401(k), 403(b) and Employee Stock Ownership Plans, to select ESG investments provided that those selections are otherwise consistent with a prudent and loyal investment decision process; and also when they exercise shareholder rights, including voting on shareholder resolutions and board nominations. The rule acknowledges that ESG factors may be material to the risk-return analysis of a portfolio and that a fiduciary analysis may often require an evaluation of the economic effects of climate change and other ESG factors.

- It should also be noted that the January 26 filing followed by nine days the release of a letter forwarded by 21 overlapping Republican state attorneys general to Institutional Shareholder Services (ISS) and Glass, Lewis & Co., two proxy voting advisory firms, in which they seek written assurances that these firms will cease from making proxy voting recommendations based on climate commitments and alignments with diversity, equity and inclusion quotas that may be contrary to the financial interests of investment vehicles and citizens and businesses within their states in violation of federal and state laws.

The January 26 complaint alleges that the rule conflicts with the scope of ERISA’s fiduciary duties, is arbitrary and capricious in violation of the Administrative Procedure Act and goes beyond the DOL’s authority to regulate ERISA fiduciaries to consider nonpecuniary factors in administering plan assets. Among other things, the plaintiffs contend that the rule “will not only loosen the statutory and regulatory restraints on fiduciaries to consider ESG factors, it will allow fiduciaries and investment managers to potentially substitute their own ESG policy preferences under the guise [of] making a risk-return determination about an investment or investment course of action.”

If granted, a preliminary injunction and related legal actions will likely check any immediate actions that 401(k) plan sponsors might have taken in response to the DOL’s 2022 rule but these are not likely to affect a long-term shift to include sustainable investment options. This, even as there has only been a modest uptake to-date in sustainable investment fund options in 401(k) plans.

Various surveys have found that a high percentage of defined contribution plan participants want their investments to be aligned with their values. Yet offerings are still limited and while some research points to conflicting results, when sustainable fund options are available, the uptake is limited. Based on data derived from Vanguard’s 1,700 qualified plans and five million participants as of December 2021, offerings of socially responsible funds, limited to equity funds that take on board environmental, social and governance factors, have been increasing at a modest pace with larger plans, or plans with over 1,000 participants, more likely to include these funds in their investment lineup than small plans. According to Vanguard’s How America Saves 2022 report, approximately 13% of plans offer socially responsible funds, up from 9% in 2017. During the same interval, the percentage of participants that use socially responsible funds increased from 3% to 6%. While usage doubled, the absolute level of participation remains low.Modest levels of participation may be due to confusion and misunderstanding regarding sustainable investing, and stepped-up employee education is needed. At the same time, the restrained uptake of investment options by defined contribution plans is likely due to the uncertainties surrounding the DOL’s fiduciary rules, but fiduciary considerations are further handicapped due to: (1) Confusion and misunderstanding that also applies to investors as well as other stakeholders regarding the various types of sustainable investing strategies that have been adopted by mutual funds and ETFs along with their financial and non-financial outcomes, if any, that have arisen due to the absence of clear definitions, lack of investment product clarity and a disclosure gap, (2) Limited availability of sustainable product offerings, in terms of fundamental investment offerings and suitably long investment performance track records, and (3) The challenge of offering sustainable investment options that will satisfy the sustainability preferences of a sufficiently large segment of employees. As used here, sustainable investing refers to an overarching term that encapsulates the different strategies and approaches being employed today by investment managers and reflected in investment products such as mutual funds and ETFs. The overarching sustainable investing strategies/approaches include values-based investing, negative/exclusionary screening, impact investing, thematic investing and ESG integration in its various forms. In addition, proxy voting and issuer engagement may be employed as an overlay by one or more of the aforementioned approaches.

Some but not all of these factors, could potentially be clarified in October of this year when the SEC intends to finalize rules to provide additional information regarding the ESG investment practices of investment managers offering investment products. The proposed rules and form amendments seek to facilitate enhanced disclosure of ESG issues to clients and shareholders and are designed to create a consistent, comparable, and decision-useful regulatory framework for ESG advisory services and investment companies to inform and protect investors while facilitating further innovation in this evolving area of the asset management industry. In addition, the SEC is proposing to amend its fund Names Rule, and, as it relates to the application of the rule to such terms as “ESG” or “Sustainable,” the proposal would extend the Names Rule to encompass fund strategies, including sustainable investing strategies covering 100% of portfolio assets.