The Bottom Line: Green bond funds, ending January with $1.44 billion, experienced monthly net outflows for the second consecutive month coincident with total return declines.

Summary

Green bond funds, including green bond mutual funds and green bond ETFs, experienced monthly net outflows for the second consecutive month coincident with total return declines. Net declines kicked up to $42.6 million or a month-over-month drop of 2.9% to end January with $1,438.2 million (estimated cash outflows=$14.0 million). Green bond funds fell an average of -2.14% in January and -0.93% for twelve months, but intermediate-term returns hold up. The results reinforce the advisability of investing for the intermediate-to-longer-term. Sustainable debt and green bonds issuances reach record levels, to $1.6 trillion according to Bloomberg.

Green bond funds experienced monthly net outflows for second consecutive month coincident with total return declines

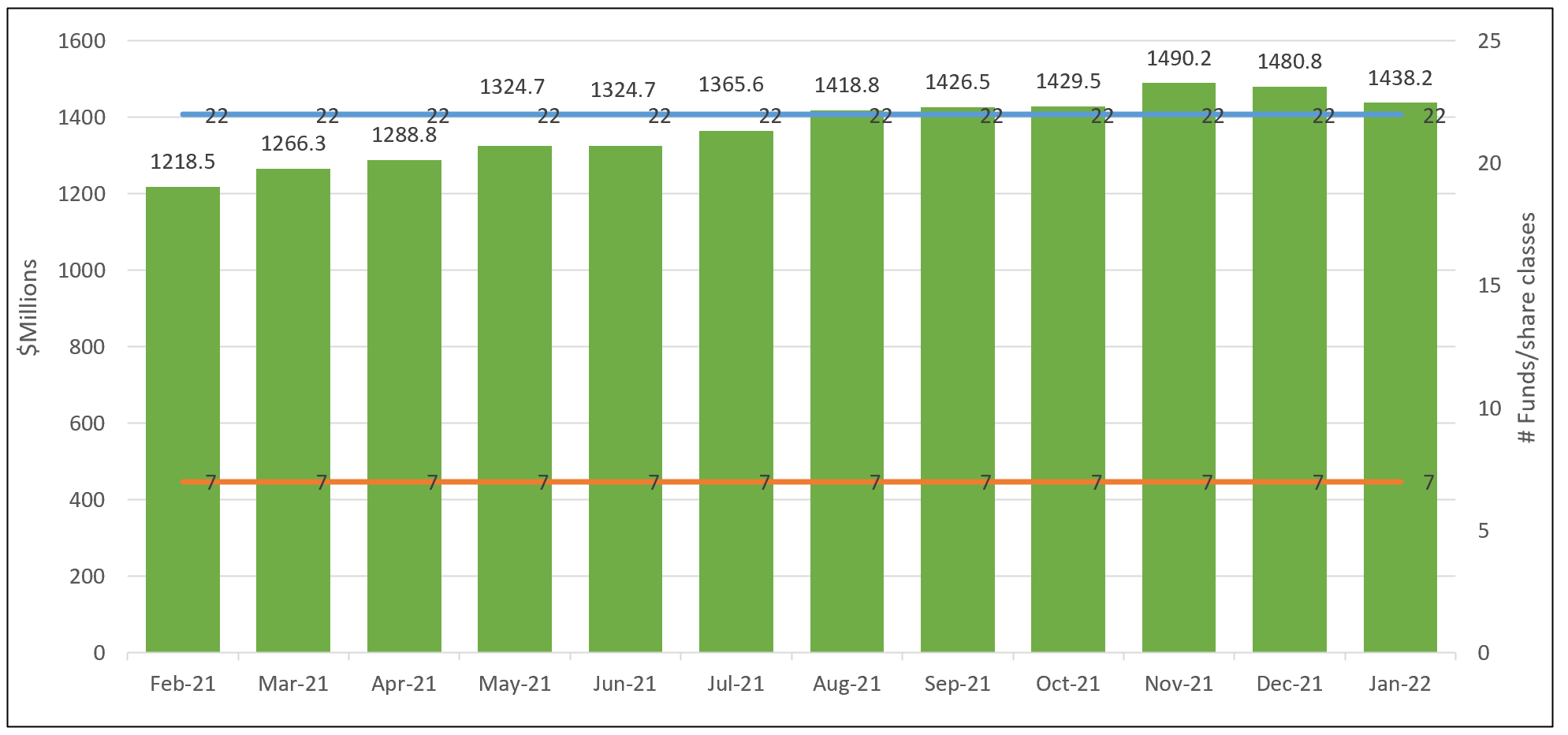

Green bond funds experienced net outflows in January, as net declines kicked up to $42.6 million or a month-over-month decline of 2.9% to end January with $1,438.2 million (estimated cash outflows=$14.0 million). Net declines have now taken place for the second consecutive month, coincident with total return declines in December and January. Refer to Chart 1. Green bond funds net outflows stand in contrast with sustainable fixed income ETFs that managed to register a narrow $24.9 million net gain in January and also sustainable fixed income mutual funds that added $324.8 million in net assets. Sustainable equity mutual funds and ETFs, on the other hand, declined a net of $12.4 billion and $8.3 billion, respectively.

While net withdrawals were recorded by institutional as well as retail investors, institutional investors accounted for at least 80% of the total and may be attributed to a one-off investor decision. All but one fund experienced withdrawals. The one exception was the VanEck Green Bond ETF (GRNB) that gained $1.6 million in net assets and ended the month with $103.1 million—even as the fund recorded the worst decline (-2.28%) in January among taxable funds.

The largest withdrawals were recorded by Calvert Green Bond Fund I (CGBIX), iShares Global Green Bond ETF (MGGAX) and PIMCO Climate Bond Institutional Shares (TGRNX) in the amounts of $33.7 million, $4.8 million and $2.4 million, respectively.

Chart 1: Green bond mutual funds and ETFs and assets under management – February 2021 – January 31, 2022 Notes of Explanation: Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Notes of Explanation: Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Green bond funds drop -2.14% in January and -0.93% for twelve months but intermediate-term returns hold up

Inflation, concerns about central bank tightening and tensions in eastern Europe roiled markets and led to a sharp increase in volatility during the month of January. Against this backdrop, US Treasury yields rose 27 bps to end January at 1.79%, bond markets fell in the US and overseas and green bond funds registered an average -2.14% decline.

Returns for green bond funds spanned a range from a low of -2.89% posted by the Franklin Municipal Green Bond A (FGBGX) to a high of -1.74% recorded by iShares Global Green Bond ETF (BGRN). The average return for the segment exceeded by 1 bps the results registered by the Bloomberg US Aggregate Bond Index while trailing the Bloomberg Global Aggregate Bond Index and the ICE BofAML Green Bond Hedged US Index. When the Franklin municipal green bond funds are excluded from consideration, the group’s average result in January picks up 14 bps to -2.0%. Municipal bonds based on the Bloomberg Municipal Bond Index, which were down -2.74% in January, experienced a sell-off in anticipation of a Federal Reserve tightening cycle due to worrying inflation numbers. January’s municipal bond funds performance erased the gains achieved for the entire 2021 calendar year. Refer to Table 1.

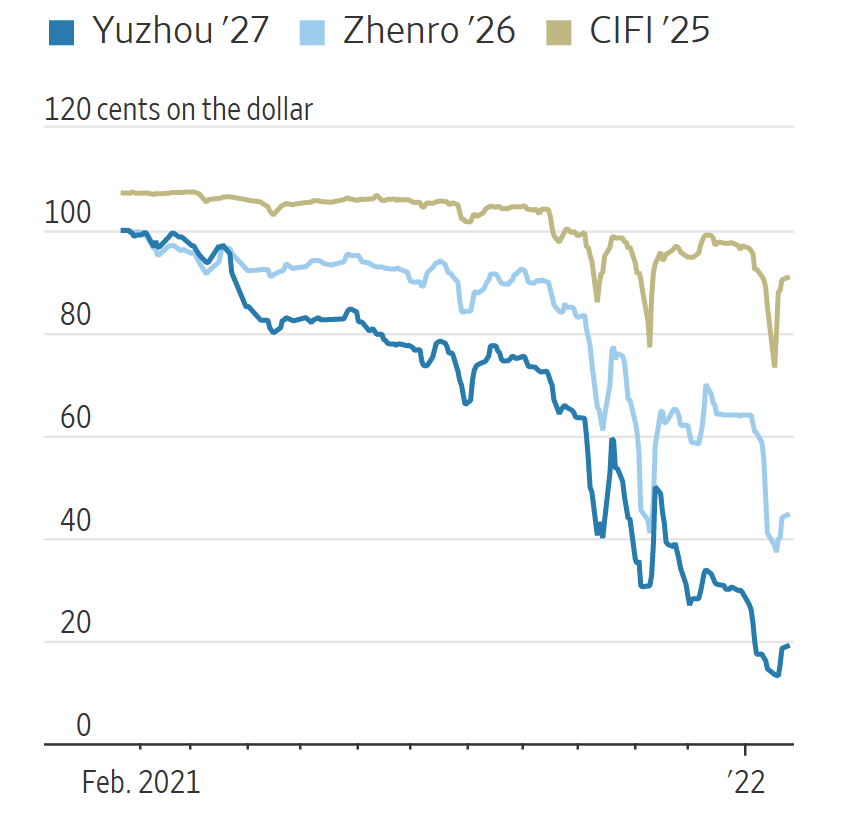

Excluding the Franklin municipal funds, the laggard in January was the VanEck Green Bond Fund ETF (GRNB) that recorded a -2.28% decline. In addition to the factors noted above, the fund’s results were pressed by a number of non-investment-grade dollar denominated China-based real estate development company green bonds holdings, for example, CIFI Holdings, Yuzhou Group Holdings and Zhenro Properties, that have been facing financial pressures and have suffered significant price declines. Refer to Chart 2. The fund maintains an 11.9% position in US dollar denominated China green bonds.

Municipals, including the Franklin Municipal Green Bond Fund, calendar year 2021 was a challenging year for bond funds generally as well as green bond bonds that did not avoid the downdraft that led bond indices lower. Still, their three-year trailing performance record to January 2022 has held up. Posting an average annual gain of 3.7%, green bond funds beat the Bloomberg US Aggregate Bond Index and the ICE BofAML Green Bond Hedged US Index by 5 bps and the Bloomberg Global Aggregate Bond Index by 137 bps. The TIAA-CREF Green Bond Fund Institutional Shares (TGRNX) along with its four other share classes delivered strong results. The results over all reinforce the advisability of investing in green bond funds for the intermediate-to-long-term

Chart 2: Prices of selected green bonds issued Source: Tradeweb, as reported in the WSJ 1/28/2022

Source: Tradeweb, as reported in the WSJ 1/28/2022

Sustainable debt and green bonds issuances reach record levels, to $1.6 trillion according to Bloomberg

With issuance numbers covering 2021 now finalized or nearly finalized, it has been reported that green bonds volume increased on a year-over-year basis by anywhere from 74% to over 100%, depending on data source. The Climate Bond Initiative, using updated numbers, reported that green bond issuance increased 74% to end the year at $517.4 billion, up from $297 billion. At the same time, Bloomberg reported that green bonds “doubled issuance between 2020 and 2021, with volumes reaching more than $620 billion.” Regardless of the actual number, green bonds issuance increased dramatically as governments, corporations, financial institutions and local government entities across the globe but led by the US, Germany and China, have been stepping up their commitments to finance the energy transition spurred on by the COP 26 UN climate conference.

A new record was also set by sustainable debt instruments more broadly, according to Bloomberg. On a combined basis, issuance of sustainable debt instruments, including green bonds, green loans, social bonds, sustainability bonds as well as sustainability linked loans and bonds, reached about $1.6 trillion in 2021. Stimulated by the COVID pandemic and rising social and racial justice considerations, it remains to be seen whether sustainable and social bond issuances will track or exceed 2021 levels in 2022.

Table 1: Green bond funds: Assets, expense ratios and performance through January 31, 2022

Fund Name | Symbol | AUM ($) | Expense Ratio (%) | Jan. 2022 TR (%) | 2021 TR(%) | 3-Year TR (%) |

Calvert Green Bond A* | CGAFX | 86,580,331 | 0.73 | -1.90 | -1.92 | 3.32 |

Calvert Green Bond I* | CGBIX | 838,967,908 | 0.48 | -1.88 | -1.67 | 3.55 |

Calvert Green Bond R6* | CBGRX | 8,601,872 | 0.43 | -1.88 | -1.61 | 3.63 |

Franklin Municipal Green Bond A** | FGBGX | 1,515,829 | 0.46 | -2.89 | 0.99 | |

Franklin Municipal Green Bond Adv** | FGBKX | 8,795,307 | 0.46 | -2.77 | 1.12 | |

Franklin Municipal Green Bond C** | FGBHX | 230,314 | 0.46 | -2.82 | 0.78 | |

Franklin Municipal Green Bond R6** | FGBJX | 4,887 | 0.46 | -2.67 | 1.07 | |

Mirova Global Green Bond A* | MGGAX | 6,645,331 | 0.97 | -1.87 | -3.02 | 3.32 |

Mirova Global Green Bond N* | MGGNX | 7,845,261 | 0.67 | -1.87 | -2.73 | 3.63 |

Mirova Global Green Bond Y* | MGGYX | 31,814,254 | 0.72 | -1.87 | -2.69 | 3.55 |

PIMCO Climate Bond A* | PCEBX | 817,340 | 0.94 | -2.05 | -0.56 | |

PIMCO Climate Bond C* | PCECX | 22,129 | 1.69 | -2.11 | -1.30 | |

PIMCO Climate Bond I-2* | PCEPX | 583,427 | 0.64 | -2.03 | -0.24 | |

PIMCO Climate Bond I-3* | PCEWX | 81,105 | 0.69 | -2.03 | -0.30 | |

PIMCO Climate Bond Institutional* | PCEIX | 17,630,681 | 0.54 | -2.02 | -0.15 | |

TIAA-CREF Green Bond Advisor* | TGRKX | 3,198,899 | 0.46 | -2.07 | -0.62 | 4.45 |

TIAA-CREF Green Bond Institutional* | TGRNX | 29,119,015 | 0.45 | -2.07 | -0.60 | 4.47 |

TIAA-CREF Green Bond Premier* | TGRLX | 1,037,652 | 0.55 | -2.08 | -0.73 | 4.34 |

TIAA-CREF Green Bond Retail* | TGROX | 7,367,849 | 0.73 | -2.09 | -0.97 | 4.2 |

TIAA-CREF Green Bond Retirement* | TGRMX | 15,984,461 | 0.54 | -2.08 | -0.72 | 4.33 |

iShares Global Green Bond ETF*^ | BGRN | 268,289,464 | 0.20 | -1.74 | -2.54 | 3.3 |

GRNB | 103,111,220 | 0.20 | -2.28 | -2.00 | 2.37 | |

Average/Total | 1,438,244,536 | -2.14 | -0.93 | 3.73 | ||

Bloomberg US Aggregate Bond IX | -2.15 | -2.97 | 3.67 | |||

Bloomberg Global Aggregate Bond IX | -2.05 | -4.71 | 2.36 | |||

Bloomberg Municipal Total Return IX | -2.74 | 1.52 | 3.5 | |||

S&P Green Bond US Dollar Select IX | -2.3 | -1.41 | 3.72 | |||

ICE BofAML Green Bond Index Hedged US | -1.78 | -2.19 | 3.67 |

Notes of Explanation: Blank cells=NA. 3-year annualized average performance results to January 2022. *Fund invests in foreign currency bonds and performance should also be compared to a more narrowly based relevant index such as the ICE BofAML Green Blond Index Hedged US or equivalent. ** Fund invests in US dollar denominated green bonds only and performance should also be compared to a more narrowly based relevant index such as the S&P Green Bond US Dollar Select Index or equivalent. ^Effective March 1, 2022 fund will shift to US dollar green bonds. Fund total net assets and performance data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and Analysis LLC