The Bottom Line: Green bond fund assets continued to expand in January, reaching almost $1.2 billion while interest in green and sustainable bonds remains high.

Green bond fund assets continue to expand in January while investor interest in green bonds remains high

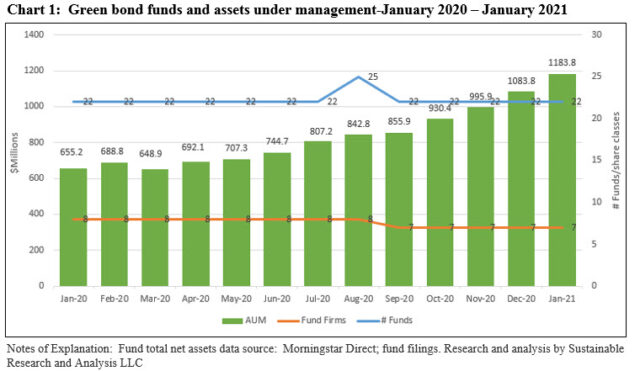

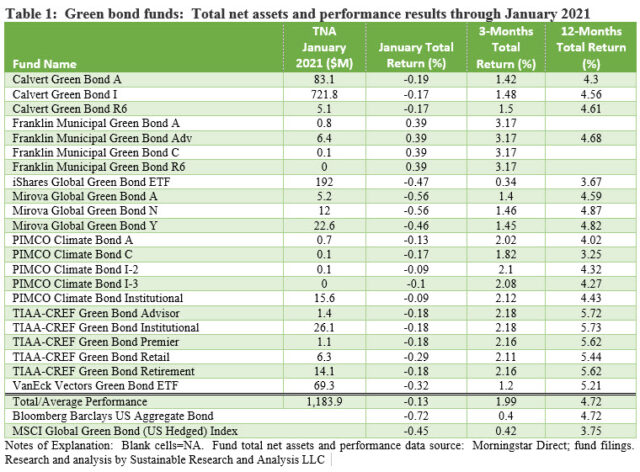

Green bond funds, including mutual funds and ETFs that for the first time in December surpassed the $100 billion total net assets mark, added another $100.1 million in January to end the first month of the year at $1,183.8 million. None of the taxable green bond funds posted positive results in January, but the -0.13% average performance of the seven green bond funds and 22 funds/share classes beat the -0.72% recorded by the broad-based Bloomberg Barclays US Aggregate Bond Index and the -0.45% decline generated by the MSCI Global Green Bond Select (US Hedged) Index. The Franklin’s Municipal Green Bond Fund, a fund investing in municipal green bonds that promote environmental sustainability, was the exception, adding 0.39% in January. Also in January, a total of $31.5 billion in green bonds were issued worldwide. This was below December’s level of $50.3 billion but significantly ahead of last January’s $17.5 billion level. At the same time, sustainable debt, other than green bonds, reached about $52.8 billion and may be contributing to a green bonds squeezing out effect.

Green bond funds added $100.1 million in assets in January

In January, green bond funds added $100.1 million in assets and registered a month-over-month 9% increase. Refer to Chart 1. January was the strongest month for new money coming into green bond funds since the launch of the first green bond fund by Calvert Research and Management (a unit of Eaton Vance) at the end of 2013. This followed the second strongest month in December when green bond funds added a net of $87.9 million. Once again, three of the seven funds dominated the field, led by the Calvert Green Bond Fund that recorded a net gain of $49.3 million. The other two, both ETFs, include the iShares Global Green Bond ETF and VanEck Vectors Green Bond ETF that added $35.5 million and $12.3 million respectively. The iShares Global Green Bond, launched in November 2018, is acquiring momentum with its strong 23% monthly increase.

Green bond funds gave up -0.13% in January and beat the broad-based Bloomberg benchmark by 59 bps and the MSCI Green Bond Index by 32 bps

The early January Democratic victory in the two Georgia Senate races made it more likely that the new Biden Administration’s proposed $1.9 trillion “American Rescue Plan,” even if it’s rolled back somewhat, is expected to have a dramatic impact on economic growth when combined with a successful vaccination campaign. Against this backdrop, long interest rates, as measured by the 10-year US Treasury Bond, moved up 17 basis points in January, ending at 1.11% from 0.93% at the end of December. At the same time, the Bloomberg Barclays US Aggregate Bond Index dropped -0.72% in January while the MSCI Global Green Bond Select (US Hedged) Index sustained a -0.45% decline. Green bond funds, on average, gave up -0.13%, but beat the broad-based investment-grade intermediate Bloomberg benchmark by 59 bps and the MSCI Global Green Bond Index by 32 bps. Even with the exclusion of the only green bond fund to stay in the black in January, the Franklin Municipal Bond Fund that posted a positive 39 bps versus 64 bps delivered by the Bloomberg Barclays Municipal Bond Index, the average performance of the 18 remaining funds/share classes still bested the broad-based investment-grade benchmark and green bonds yardstick. See Table 1.

The smallish PIMCO Climate Bond Fund Institutional shares and I-2, both led the taxable fund segment of funds with a narrow negative -0.09%. At the other end of the range, Mirova Global Green Bond Fund A and N Shares each lagged with -56 bps and is the only fund to fall short of matching the MSCI Global Green Bond (US Hedged) Index.

The average performance of the funds over the trailing three-months and twelve months exceeded the two benchmarks by wide margins.

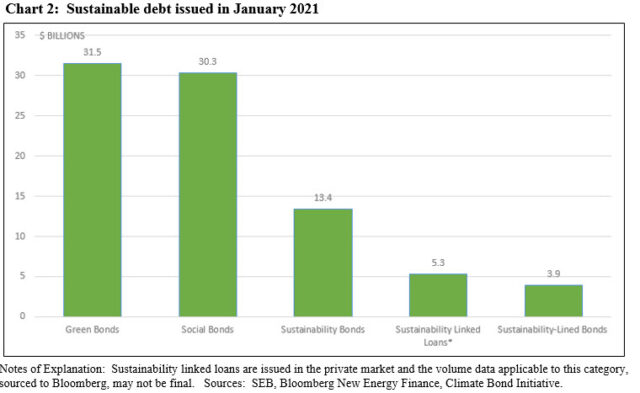

A total of $31.5 billion in green bonds were issued worldwide in January

A total of $31.5 billion in green bonds were issued worldwide in January. This was below December’s level of $50.3 billion but significantly ahead of last January’s $17.5 billion. In the U.S. there were two corporate green bond issuers, both from the energy sector. These included a $1.0 billion green bond issued by SK Battery America, Inc., the US subsidiary of South Korea’s SK Innovation Co, a refinery-to-battery company, that will use the proceeds to expand its electric vehicle battery manufacturing capacity in the US, and $400 million issued by Southern Power Company. Duke Realty Corp issued a $450 million, 1.75% 10-year green bond and there were several smaller municipal issuers that also came to market in the US.

Sustainable debt issued in January reached $84.4 billion

While investor interest in green bonds remained high and issuance in 2020, which reached $269.5 billion[1], exceeded by 4.6% the level achieved in 2019, green bonds were overtaken in January by other sustainable debt categories. These included social bonds, sustainability bonds, sustainability linked bonds and sustainability-linked loans that together issued $52.8 billion[2]. Refer to Chart 2. The rapid growth of these sustainable debt categories could be suppressing green bond issuances, but it remains to be seen what the ultimate impact of this may be, especially in light of continued strong European Union backing for green bonds and a renewed focus on the environment in the US.

[1] Based on latest update. There is some variation in 2020 green bond issuance by source, with volume for the year ranging from about $269.5 billion to $305.3 billion.

[2][2] Sustainability linked loans are issued in the private market and the volume data applicable to this category, sourced to Bloomberg, may not be final.