The Bottom Line: ISSB reporting standards covering sustainability-related risks and opportunities companies face over varying time intervals have the potential to achieve widespread adoption worldwide.

International Sustainability Standards Board (ISSB), a unit of the International Financial Reporting Standards (IFRS), this week issued its inaugural reporting standards

Following an intensive eighteen-month effort, the International Sustainability Standards Board (ISSB), a unit of the International Financial Reporting Standards (IFRS), this week issued its inaugural reporting standards (https://www.ifrs.org/content/ifrs/home/issued-standards/ifrs-sustainability-standards-navigator.html) intended to realize high-quality, comprehensive global baseline of sustainability disclosures focused on the needs of investors and the financial markets. According to the ISSB, the Standards, in the form of IFRS S1 and IFRS S2, will help to improve trust and confidence in company disclosures about sustainability to inform investment decisions. And for the first time, the Standards create a common language for disclosing the effect of climate-related risks and opportunities on a company’s prospects. The strong desire for a common and widely accepted disclosure framework, the role of the IFRS as a standards setter for accounting standards, the support for its initiative by investors, companies, policy makers, market regulators and others from around the world, the methodical approach to standards setting and the integration and consolidation of several highly regarded sustainability disclosure frameworks are some of the contributing factors that are likely to motivate the widespread adoption of the ISSB’s reporting standards around the world.

IFRS S1 and IFRS S2 form a set of disclosure requirements designed to enable companies to communicate to investors about the sustainability-related risks and opportunities they face over the short, medium and long term

IFRS S1, General Requirements for Disclosure of Sustainability-related Financial Information, provides a set of disclosure requirements designed to enable companies to communicate to investors about the sustainability-related risks and opportunities they face over the short, medium and long term. IFRS S2, Climate-related Disclosures, sets out specific climate-related disclosures and is designed to be used with IFRS S1. Both fully incorporate the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). It should be noted that in its published rule-making proposal last year covering climate-related risk disclosures, the U.S. Securities and Exchange Commission (SEC) incorporated key aspects of the TCFD framework.

ISSB Standards are designed to ensure that companies provide sustainability-related information alongside financial statements

The ISSB developed IFRS S1 and IFRS S2 with the benefit of extensive market feedback and in response to calls from the G20, the Financial Stability Board and the International Organization of Securities Commissions (IOSCO), as well as leaders in the business and investor community.

The ISSB Standards are designed to ensure that companies provide sustainability-related information alongside financial statements—in the same reporting package. The Standards have been developed to be used in conjunction with any accounting requirements. They are also built on the concepts that underpin the IFRS Accounting Standards, which are required by more than 140 jurisdictions. The ISSB Standards are suitable for application around the world, creating a truly global baseline.

These standards will be of importance because they will help set the bar globally for consistent and comparable disclosures, including information on metrics, targets, climate related risks/opportunities, and more. Ultimately, these standards should help investors and other stakeholders compare sustainability performance across companies and inform investment decisions.

The International Sustainability Standards Board (ISSB) is a unit of the IFRS Foundation, a not-for profit public interest organization that oversees financial reporting standard-setting. Its main objectives include:

-Developing and promoting the International Financial Reporting Standards (IFRS) through the International Accounting Standards Board (IASB) for accounting standards. These standards govern financial reporting in more than 140 countries.

-More recently, the IFRS Foundation expanded into the area of sustainability disclosures focused on the needs of investors and the financial markets.

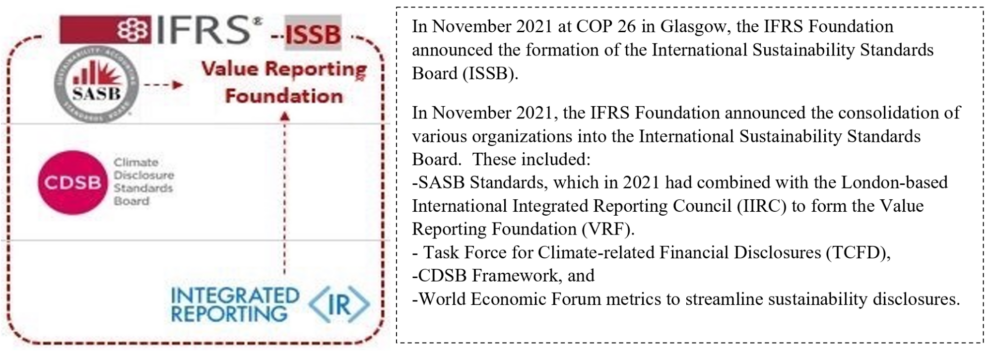

Formed in 2021, the ISSB integrated and consolidated several highly regarded sustainability disclosure frameworks

High level summaries-IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2: Climate-related Disclosures

IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information | IFRS S2: Climate-related Disclosures |

FRS S1 is effective for annual reporting periods beginning on or after 1 January 2024 with earlier application permitted as long as IFRS S2 Climate-related Disclosures is also applied. The objective of IFRS S1 is to require an entity to disclose information about its sustainability-related risks and opportunities that is useful to users of general purpose financial reports in making decisions relating to providing resources to the entity. IFRS S1 requires an entity to disclose information about all sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium, or long term (collectively referred to as ‘sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s prospects’). IFRS S1 prescribes how an entity prepares and reports its sustainability-related financial disclosures. It sets out general requirements for the content and presentation of those disclosures so that the information disclosed is useful to users in making decisions relating to providing resources to the entity. IFRS S1 sets out the requirements for disclosing information about an entity’s sustainability-related risks and opportunities. In particular, an entity is required to provide disclosures about:

| IFRS S2 is effective for annual reporting periods beginning on or after 1 January 2024 with earlier application permitted as long as IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information is also applied. The objective of IFRS S2 is to require an entity to disclose information about its climate-related risks and opportunities that is useful to users of general purpose financial reports in making decisions relating to providing resources to the entity. IFRS S2 requires an entity to disclose information about climate-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long term (collectively referred to as ‘climate-related risks and opportunities that could reasonably be expected to affect the entity’s prospects’). IFRS S2 applies to:

i. climate-related physical risks; and ii. climate-related transition risks; and

IFRS S2 sets out the requirements for disclosing information about an entity’s climate-related risks and opportunities. In particular, IFRS S2 requires an entity to disclose information that enables users of general purpose financial reports to understand:

|

Source: IFRS