The Bottom Line: References to greenwashing appear to be on the rise, but various considerations other than greenwashing may be contributing to the recent uptick.

References to greenwashing are on the rise but likely overstated

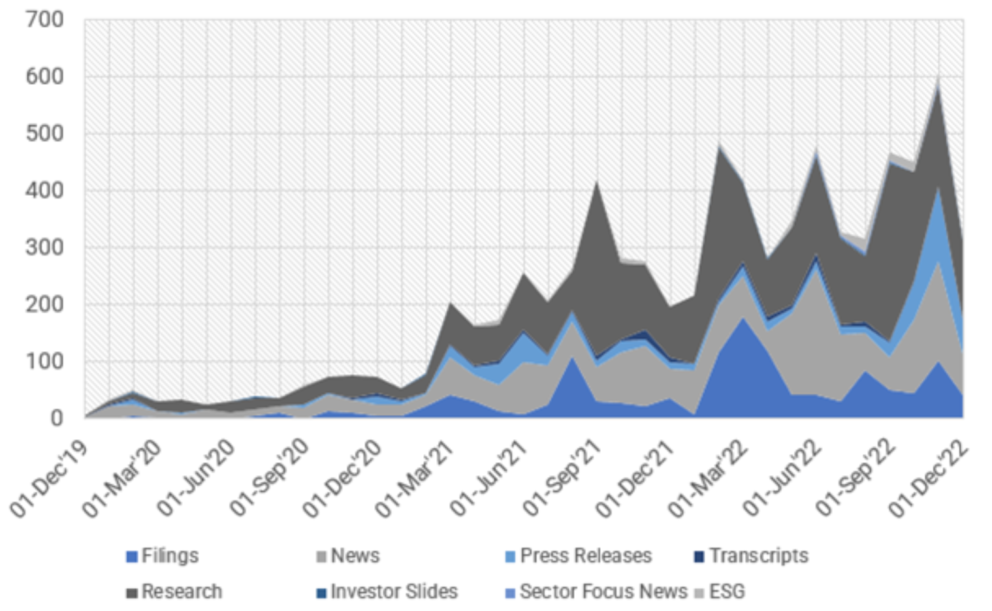

References to greenwashing appear to be on the rise, as illustrated by data along the lines captured by FactSet in a recent posting. While the number of original or first-time mentions may be overstated, the fact remains that concerns about greenwashing have been climbing, perhaps more so in Europe than in the US. As regards to investment products, such as sustainable mutual funds, ETFs and other investment vehicles with a focus on the US, key reasons for the increase in greenwashing mentions are most likely due to factors ranging from the dramatic growth in sustainable investing, absence of widely accepted definitions of terms, including a universally accepted definition of greenwashing, an uptick in SEC enforcement actions in the US, growth in responsible investing policies and regulations around the world as well as methodological factors associated with the collection of greenwashing data. In the end, this still means that investment management firms should ensure that they are documenting their sustainable investing approaches as well as methods implementing practices and procedures that are consistent with these. At the same time, investors should take on a more active due diligence role to understand the sustainable strategies pursued by their portfolio of funds, how these strategies are being implemented, their outcomes, if applicable, and importantly to ensure continued alignment with their sustainable investment preferences. Refer to “Investors should conduct due diligence even as the SEC increases scrutiny of ESG funds.”

Greenwashing mentions across source types

Sustainable investing has grown dramatically and is now reaching mainstream proportions

Sustainable investing has grown dramatically in recent years and is now reaching mainstream proportions based on some direct and proxy data. Sustainable investing didn’t really begin to take off in the US until the start of 2018 driven, in part, by fund re-brandings. Sustainable fund assets under management now stands at a conservative $278.9 billion as of December 31, 2022 sourced to 2,049 mutual funds/share classes and ETFs, according to Morningstar. The dramatic growth has also resulted in increased scrutiny and attention focused on sustainable investing practices that have also factored into the recently experienced pushback and politicization of ESG.

The growth in sustainable investing has also been occurring in the absence of widely accepted definitions, standard classifications, and reporting practices

The growth in sustainable investing has also been occurring in the absence of widely accepted definitions of terms such as ESG or sustainable investing, standard classifications of investment products as well as generally accepted reporting and disclosure practices regarding sustainable investing, sustainable investment products as well as non-financial outcomes if applicable. This has led to confusion and misunderstanding on the part of investors, financial intermediaries, asset owners, regulators, government officials, financial and non-financial reporters as well as various other stakeholders. This, in turn, makes it rather difficult to determine whether greenwashing has taken place—a question compounded by the absence of a commonly accepted definition of greenwashing.

The absence of commonly accepted definitions and standards also applies to greenwashing

For example, the SEC defines greenwashing as “the act of exaggerating the extent to which products or services take into account environmental and sustainability factors. Funds and advisers that engage in greenwashing may exaggerate or overstate the environmental and sustainability practices or factors considered in their investment products or services, while labeling and marketing themselves in a manner that makes it difficult for investors to distinguish them from funds and advisers that are truly using environmental and sustainability strategies.” In its definition, the CFA Institute refers to either the “intentional or unintentional false or misleading statements about the ESG characteristics of a product, or the way factors are incorporated into the investment product or its ultimate impact on ESG issues.” Still another definition, offered by the Merriam Webster dictionary, takes a narrower approach by defining greenwashing as “the act or practice of making a product, policy, activity, etc. appear to be more environmentally friendly or less environmentally damaging than it really is.” These are not the only definitions, but in the absence of a consensus around the definition of greenwashing, the characterization can be easily misapplied.

An uptick in the number of Securities and Exchange Commission (SEC) enforcement actions involving ESG funds

Following the formation of the SEC Division of Enforcement Climate and ESG Task Force in March 2021, there have been three reported ESG-related investigations, two of which were settled by the SEC. The first action, settled in May 2022 for a $1.5 million penalty, involved six Overlay Funds advised by BNY Mellon Investment Adviser, Inc. The SEC found the adviser was responsible for misstatements and omissions about the performance of ESG quality reviews that were not performed for all investments held in the funds between 2018 and 2021. The second action, involving Goldman Sachs Asset Management, L.P., was related to the firm’s failure between 2017 and 2020 to follow policies and procedures involving ESG research used to select and monitor securities in two mutual funds and one separately managed account strategy. GSAM settled the matter by agreeing to a cease-and-desist order and a $4 million penalty. The third action, involving Deutsche Bank’s claims about the sustainable investing practices of its DWS investment management arm, is still ongoing. Just to put these resolved SEC actions into some rough perspective, these involved a total of eight funds managed by two firms of 170 firms in the US advising sustainable mutual funds and ETFs at the start of 2020, or a “greenwashing” rate of 1.1%. Still, investment management firms should ensure that they are documenting and doing what they say in term of their sustainable investing approaches.

Expansion in responsible investment policies and regulations around the world continues to accelerate

According to the Principles for Responsible Investing (PRI), the increase in the introduction of responsible investment policies and regulations around the world continues to accelerate. The PRI’s database, last updated in the first quarter of 2022, reports policies promulgated by 116 countries. In the US, the SEC is expected to issue final rules as early as April of this year relating to climate change disclosures and around October of this year final rules involving investment company names and enhanced disclosures by certain investment companies about ESG investment practices.

In the long-term, standards setting policies and regulations establish guideposts for investment management companies so that they may properly convey to investors their ESG practices and potential outcomes. In the near-term, however, new regulations such as the newly implemented regulations in Europe, has forced the reconfiguration of product offerings and in the process has exposed managers to accusations of greenwashing.

Considerations connected to some methodologies used to compile greenwashing data points

In the case of the FactSet chart displayed above, methodological explanations were not provided. But in general, methodologies used to compile greenwashing information may rely on algorithms that search for defined terms like greenwashing that appear in newspapers, magazines, newsletters, aggregator platforms, social media posts, regulatory filings, and disclosure statements, to name just a few. Unless adjusted, a singular greenwashing reference may be subject to a multiplier effect that overstates the number of original references or occurrences. Further, the results do not appear to have been normalized for the large number of sustainable fund introductions since the start of 2018 or the significant entry of investment management firms offering sustainable investment products.