The Bottom Line: Green bond funds, which continue to offer sustainable investors exposure to investments that promote climate change mitigation or adaptation, rebounded in 2023.

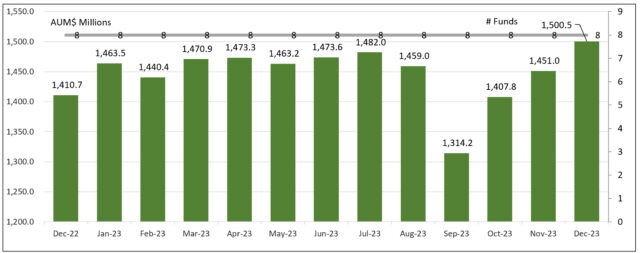

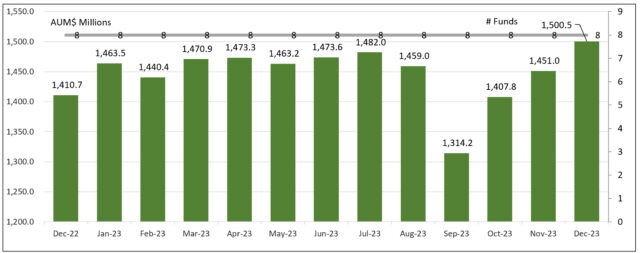

Green bond funds end the year with $1.5 billion in assets, experiencing limited outflows

Green bond funds, the segment of thematic bond funds consisting of eight funds, five mutual funds/28 share classes and three ETFs, that offer investors exposure to a broad range of environmental projects, activities and investments intended to promote climate change mitigation and adaptation while seeking market-based returns, principally by investing in green bonds, ended the year 2023 with $1.5 billion in net assets. The small fund category gained assets for the third consecutive month, adding $49.5 million in December and $89.8 million, or some 6% over the course of the entire year. At $1.5 billion in assets, the category reached its highest month-end level for the year, but just short by $16.1 million of the month-end high reached in August 2022. Based on a simple calculation, the green bonds category likely sustained about $19 million, or 1%, in cash outflows during the challenging 2023 calendar year.

The increase in net assets was largely attributable to two of the three largest funds in the category. These include iShares USD Green Bond ETF that added a net of $43 million during the year and an additional $14.4 million (net) attracted by the TIAA-CREF Green Bond Fund. The third and oldest fund in the category, the Calvert Green Bond Fund, broke just about even on a net basis over the calendar year.

The investors in the green bond funds category remain dominated by institutional shareholders.

Green bond issuance up for the year as are investments in clean and renewable energy

The narrow level of outflows in 2023 occurred in a challenging period for credit markets and this experience is juxtaposed against the increase in green bonds issuance reported for 2023. According to BofA Securities Global Research, $489 billion in green bonds were issued in 2023, for a 12% year-over-year gain. This comes while global spending on clean-energy transition hit record highs, according to BloombergNEF. Total spending in 2023, including investments to install renewable energy, buy electric vehicles, build hydrogen production systems and deploy other technologies, surged to $1.8 trillion, or an increase of 17%. Adding on top of that investments in building out clean-energy supply chains and $900 billion in financing brings the total funding in 2023 to about $2.8 trillion. Still, according to BloombergNEF, the world needs to be investing more than twice as much on clean technology to reach net zero emissions by mid-century. These activities support significant investing opportunities.

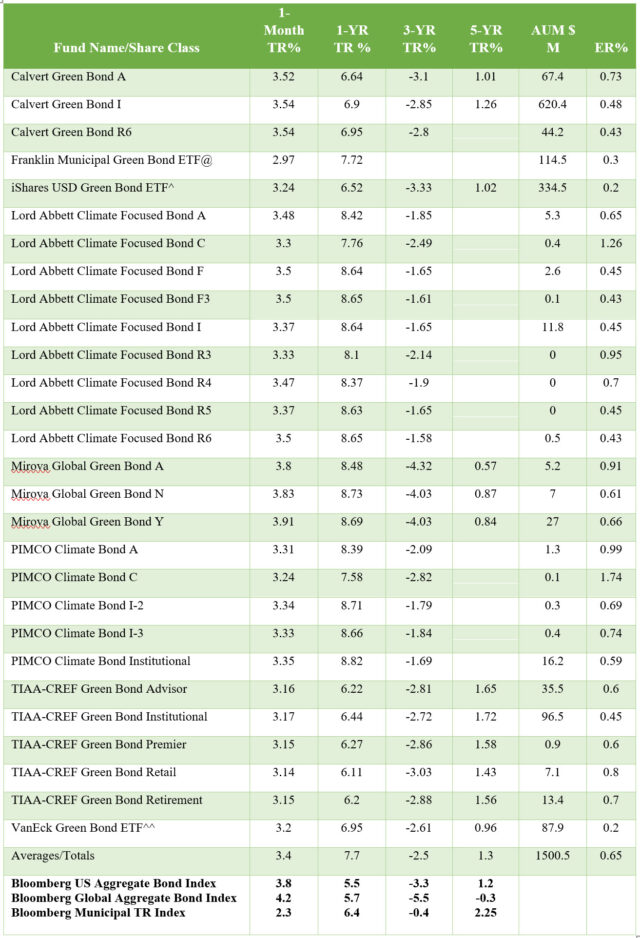

Green bond funds gained 7.7% in a challenging 2023, beating indices

Low interest rates followed by the Federal Reserve’s aggressive policy normalization created a challenging environment for bond investors in 2022 and 2021. A combination of a strong economy and reduced concerns of a looming recession, better-than-expected corporate earnings, lower inflation and an apparent end to the Federal Reserve’s interest rate hikes that were expected to lead to multiple Fed rate cuts in 2024 fueled a rally in the last quarter of 2023. Credit markets rebounded as well gaining 3.8% in December and 5.53% for the full calendar year, according to the Bloomberg US Aggregate Bond Index. Still, 2023’s ear’s gain was not yet sufficient to overcome 2022’s 13% decline.

Against this backdrop, taxable and municipal green bond funds finished the year up 7.7%, with much of the gain realized in November and December of the year when the category added 3.6% and 3.4%, respectively. Returns for the year ranged from a low of 6.1% recorded by the TIAA-CREF Green Bond Fund-Retail class to a high of 8.82% delivered by the PIMCO Climate Bond Fund-Institutional class.

Green bond funds offer investors an opportunity to gain exposure to investments that promote climate change mitigation or adaptation

Regardless of orientation, all 28 green bond funds and share classes outperformed the Bloomberg US Aggregate Bond Index as well as the Bloomberg Global Aggregate Bond Index for the year, including the municipal Franklin Municipal Green Bond ETF that outperformed the Bloomberg Municipal Total Return Index by 1.3%. Largely similar results can be observed over the trailing three-year interval, however, some of the intermediate term results are more nuanced based on the fund’s mandate to invest in non-US dollar denominated securities. This is the case, for example, with the Mirova Global Green Bond Fund. That said, these funds, on the whole, offer investors an opportunity to expand their sustainable credit exposure allocation via investments that are intended to promote climate change mitigation or adaptation projects or activities.

Green bond fund mutual funds & ETFs assets under management: 12/22 – 12/23 Notes of Explanation: Sources: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Notes of Explanation: Sources: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Notes of Explanation: Sources: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Notes of Explanation: Sources: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC Green bond funds: Performance results, expense ratios and AUM – December 31, 2023

Notes of Explanation: Notes of Explanation: Blank cells=NA. 3 & 5-year returns are average annual total returns. @Fund rebranded as of May 3, 2022. ^Effective March 1, 2022, fund shifted to US dollar green bonds. ^^As of September 3, 2019, the fund shifted to US dollar green bonds and tracks the S&P Green Bond U.S. Dollar Select Index. Fund total net assets, performance and expense data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and Analysis LLC.