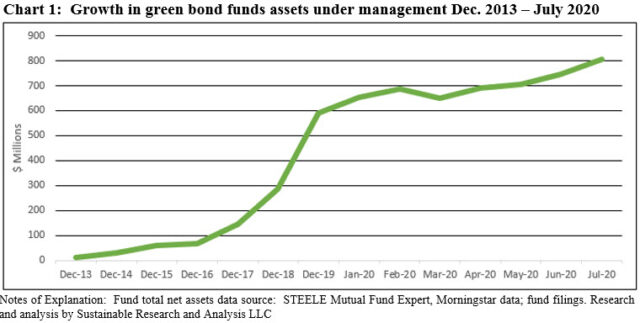

The Bottom Line: Green bond funds and ETFs reached $807.2 million as of July 31, likely to reach $1 billion in assets by year-end 2020.

Green bond funds reach $807.2 million at the end of July, likely to reach $1 billion by year-end

Green bond mutual funds and ETFs surpassed $800 million in assets for the first time at the end of July, reaching $807.2 million with the benefit of a month-over-month 8% July gain of $65.2 million attributable to new money along with market movement. Refer to Chart 1. July’s green bond funds increase represents the second best monthly gain since the first green bond fund was launched by Calvert Investment Management in October 2013. It comes on the heels of recent green bond issuances that synchronize with the uptick observed in July when $20 billion in labelled green bonds were issued following increasing volumes over the previous three months. Barring a market reversal, both green bond fund assets and green bond issuances are expected to achieve further gains this year, with green bond funds likely to reach $1 billion on or before year-end while green bond issuance dynamics could take 2020 volumes beyond last year’s $257.5 billion level.

Eight green bond funds dominated by Calvert and, to a lesser extent, BlackRock iShares

Green bond funds, including six mutual funds and two ETFs currently in operation in the US invest in green bonds that are issued to raise capital for investment in new and existing projects with environmental benefits. In a vast majority of cases, green bonds are backed by the issuer’s full balance sheet (rather than the projects financed). As of July 31, 2020, eight firms in the US offer the eight funds, some with multiple share classes subject to varying expense ratios, that range in size from the most recently launched $5.1 million Franklin Municipal Green Bond Fund to the $556.6 million Calvert Green Bond Fund. Two firms, however, including Calvert Research and Management, a unit of Eaton Vance, and BlackRock, account for 80.1% of the segment’s assets. Also, a minimum of 72% of assets is sourced to institutional investors.

The small green bond funds universe is comprise of passive and actively managed funds that pursue varying fundamental investment approaches and strategies. Beyond investing in corporate, government and related bonds versus municipal bonds in the case of Franklin’s municipal fund, additional areas of differentiation include green bonds qualification criteria (for example, labelled green bonds or not), investments in non-US dollar denominated bonds which applies to six of eight funds and, in turn, the deployment of currency hedging strategies. Additional factors also impacting investment outcomes include engagement in securities lending activities and liquidity management.

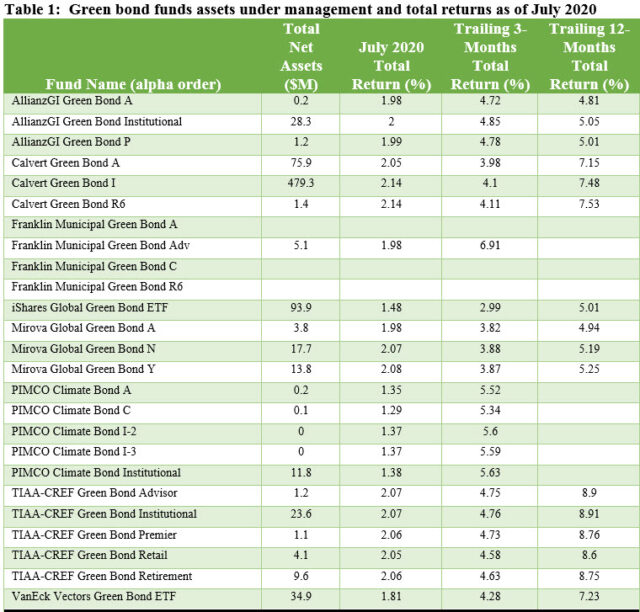

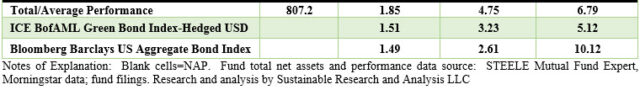

71% of corporate, government and related green bond funds/share classes posted above benchmark results in July

71% of corporate, government and related green bond funds/share classes posted above benchmark results in July, generating an average total return of 1.85% versus the ICE BofAML Green Bond Index-Hedged USD[1], up 1.51%. Fund returns ranged from a low of 1.29% achieved by the PIMCO Climate Bond Fund C to a high of 2.14% recorded by Calvert Green Bond I. Only two funds with corresponding share classes underperformed. By way of a comparison to a non-green broad-based bond index (intermediate investment-grade), the same funds outperformed and underperformed the conventional Bloomberg Barclays US Aggregate Bond Index that posted a 1.49% total return.

The results over the trailing 12-months are similar for the 16 funds/share classes in existence for the entire time period. These funds registered an average return of 6.79%. 11 funds/share classes of 16, or 69%, eclipsed the performance of the ICE BofAML Green Bond Index-Hedged USD, up 5.12%. Returns ranged from a low of 4.81% posted by the Allianz Green Bond Fund A to a high of 8.91% achieved by the TIAA-CREF Green Bond Fund Institutional Shares. When compared to the conventional Bloomberg Barclays US Aggregate Bond Index that was up a strong 10.2%, however, none of the funds managed to outperform. Refer to Table 1.

Reasons to believe green bonds issuance in 2020 could equal or exceed 2019 level

After a downturn in March that dropped new issuance to $5.0 billion when labelled green bonds were suppressed by social bond offerings, volumes picked up momentum again in April, May and June. Just last month, volume reached a year-to-date monthly high of $20 billion and so far in August a number of issuers have launched labelled green bonds, including China Development Bank, the City of Seattle and Reykjavik Energy, to mention some. The week before last, Visa Inc. came to market with an inaugural seven-year green bond offering totaling $500 million. The green bond, believed to be the first issued by a digital payments network, is intended to raise proceeds to finance projects that meet eligible categories, including green buildings, renewable energy, sustainable water and wastewater management and projects that support sustainable living behaviors.

While estimates for 2020 green bond volumes had been scaled back (for example, Moody’s Investors in May revised its original 2020 forecast of $300 billion to $175 billion to $225 billion of green bond volume in 2020) there are at least two emerging reasons to believe green bond volumes could equal and even exceed the 2019 level. First, as postulated by S&P Global, the EU recovery plan could act as lightning rod for the green bond market. EU leaders on July 21 agreed to a groundbreaking US$858 billion (€750) fiscal stimulus package to address the impact of the coronavirus. Programs to fight climate change are a centerpiece of the plan, amounting to roughly US$500 billion and signaling a strong commitment overall to EU green stimulus as part of the post pandemic recovery roadmap. This is sparking hope among green bond specialists that the plan will stimulate the green bond market. Second, it has been reported that Christine Lagarde, president of the European Central Bank (ECB), has promised that green objectives will be at the heart of the ECB’s €2.8 trillion asset purchasing program. In an interview with the Financial Times, president Lagarde pledged to “explore every avenue available to combat climate change,” saying she will look at “greener” changes to all of the Bank’s operations to reach this objective. Such an action on the part of the ECB will also bolster demand for green bonds and could, in turn, stimulate further issuances.

[1] ICE BoAML Green Bond Index-Hedged USD used for relative performance evaluation purposes even as this benchmark may not actually be the benchmark of record for each one of the green bond funds. Franklin Municipal Green Bond Adv excluded from comparisons.