The Bottom Line: Green bond funds in the US experienced positive cash flows in September and added $13.1 million to end September at $855.9 million.

September green bond funds: summary

Green bond funds in the US experienced positive cash flows in September and added a net of $13.1 million to end September at $875.9 million. This resulted in a net gain of only 2% relative to August due to the liquidation of the $29.9 million green bond fund managed by AllianzGI. Even with the inclusion of Franklin’s municipal green bond fund and corresponding share classes, green bond fund/share class returns in September produced an average gain of 0.11%. This exceeded the -0.05% total return posted by the Bloomberg Barclays US Aggregate Bond Index but lagged by 64 bps the ICE BofAML Green Bond Index (Hedged) which only two funds outperformed. These developments unfolded against a backdrop of strong green bonds issuances in September. Issuance of green bonds during the last month of Q3, which also experienced robust volumes of social bonds, sustainability bonds and sustainability-linked bonds, reached $32.5 billion, the highest monthly level so far this year and more than twice the $14.4 billion level reached in August. While affecting sustainable bonds more broadly, September also featured a European Central Bank (ECB) announcement that certain sustainable bonds will be accepted as collateral for Eurosystem credit operations and also for the Eurosystem outright purchases for monetary policy purposes, starting in 2021. This policy is likely stimulate sustainable green and social bond issuances.

Green bond funds experience positive cash flows in September and closed Q3 at $855.9 million in assets

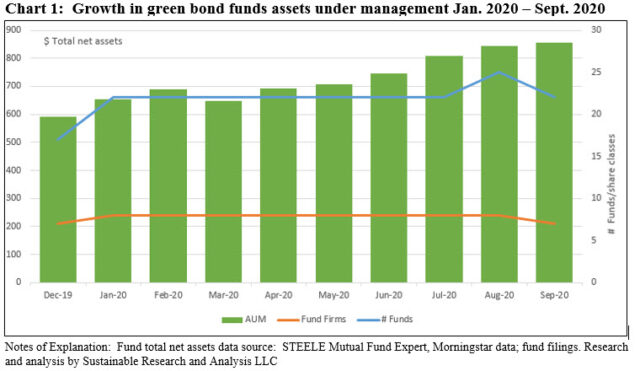

Cash flows into sustainable fixed income funds were positive in September even as most fixed income indices posted declines, excepting treasuries across the board that returned 0.14% while longer-dated Treasuries were higher. Green bond funds, now down to seven funds and 22 funds/share classes, also experienced positive cash flows estimated at $42.9 million. However, net gains were limited to $13.1 million to end September at $855.9 million as a consequence of the liquidation and dissolution of the AllianzGI Green Bond Fund with about $29.9 million in net assets. This resulted in a net gain of only 2% relative to August and below the roughly 4-5% monthly increase in net assets needed to reach $1.0 billion in green bond fund assets by year-end. Refer to Chart 1.

The principal beneficiaries of the net inflows were three of the four largest funds that make up the green bond funds universe. These include the Calvert Bond Fund, iShares Global Green Bond ETF and VanEck Vectors Green Bond ETF, in that order, that expanded by $28.2 million, $6.3 million and $5.8 million, respectively.

In the third quarter, green bond funds added a net of $76.5 million, versus $95.8 and $58.3 million in the second and first quarters, in that order.

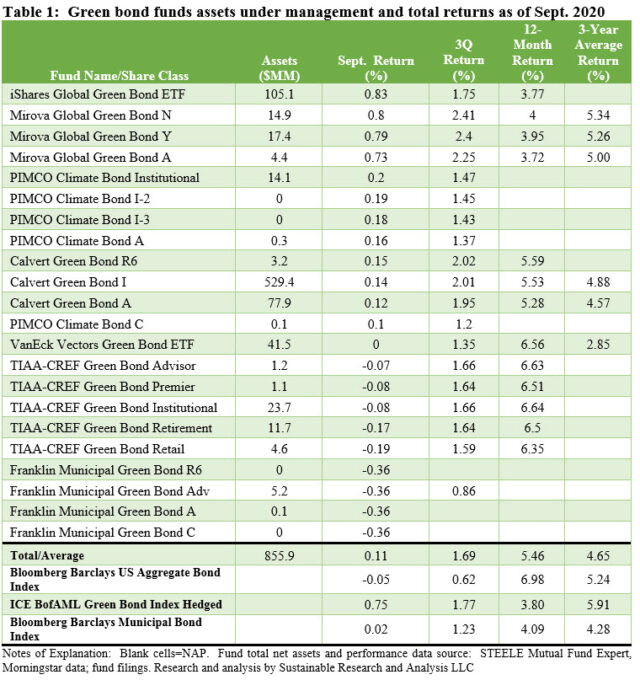

Green bond funds/share classes in September produced an average gain of 0.11%

Even with the inclusion of Franklin’s municipal green bond fund and corresponding share classes, green bond fund/share class returns in September produced an average gain of 0.11%. This exceeded the -0.05% total return posted by the Bloomberg Barclays US Aggregate Bond Index but lagged by 64 bps the ICE BofAML Green Bond Index (Hedged). The same funds scored an average return of 1.69% in the third quarter, beating the conventional investment-grade intermediate benchmark by 107 bps but falling behind the ICE green bond index by 8 bps. A more limited group of funds in operation for the full 12-month period to September 30, five funds and 13 share classes in total, recorded an average gain of 5.46% and outperformed the green bond benchmark but not the conventional Bloomberg Barclays US Aggregate Bond Index. Funds with three year returns are even more limited in number as only three funds were in operation during the entire period and only two without a change in investment policy[1]. The two funds, consisting of five share classes, registered an average return of 5.01%, falling short of both benchmarks. Refer to Table 1.

Individual fund returns in September ranged from a high of 0.83% posted by iShares Global Green Bond ETF to a low of -0.19% recorded by TIAA CREF Green Bond Fund-Retail shares to an even lower -0.36% delivered by the each of the share classes that make up the Franklin Municipal Bond Fund.

Another green bond index beating fund in September was the Mirova Global Green Bond Fund and its three share classes, including the Mirova Global Green Bond Fund N that led in the 3Q with a 2.41% return. A small number of funds combined with their short period of operation (4 of the seven funds were launched within the last two years) limits the ability to reach meaningful conclusions regarding the performance of green bond funds at this time. That said, (1) Even though the seven funds invest in green bonds, strategies vary and this affects performance outcomes. For example, performance results vary in line with whether a fund invests in dollar denominated bonds only or in combination of dollar and non-dollar bonds along with hedging strategies, or across taxable and municipal bonds, to mention two important strategy distinctions, and (2) there should be a negative correlation between higher performing funds and lower expense ratios but that can’t be confirmed based only on the results recorded in September.

Issuance of green bonds in September reached $32.5 billion

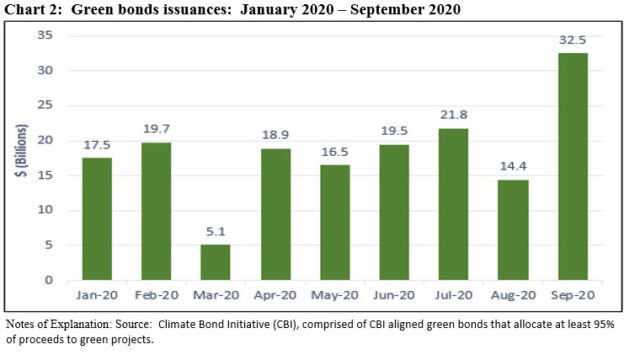

Issuance of green bonds in September, which also experienced robust volumes of social bonds, sustainability bonds and sustainability-linked bonds, reached $32.5 billion, the highest monthly level so far this year and more than twice the $14.4 billion level reached in August. This also capped the best quarterly volume this year, reaching $68.7 billion versus $54.9 billion in Q2 and an even lower $42.3 billion in Q1. Refer to Chart 2. Issuance in September was bolstered by an innovative first-time 10-year 0% coupon Federal green bond issued by Germany in the amount of €6.5 billion ($7.8 billion) with a proviso that the bond can be swapped for an otherwise identical conventional bond that was also issued at the same time. The green bond was reported to have been almost 6X oversubscribed. The German government reported that it intends to issue a second Green Federal security in the fourth quarter of 2020. Other issuers in September included first time issuer Volkswagen that came to market with two bonds at €2.0 billion (about $2.4 billion) with terms of 8 and 12 years to finance modular electric drive matrix (MEB) and the new BEV models as well as US-based Verizon that issued a $1.0 billion green bond.

US issuers accounted for $4.7 billion, or 6.8% of September’s total world-wide volume. Comprised of both corporate and municipal issuers, Verizon Communications was the largest green bond issuer in the US, coming to market with its second green bond offering intended to primarily finance long-term renewable energy purchase agreements which support the construction of solar and wind facilities to bring new renewable energy to the grids powering Verizon’s networks. Augmented by Verizon, corporate issuers led with $2.9 billion in green bonds or 62% of US issuers while municipal entities, ten in total, came to market with $1.7 billion or 35.7% of the US total.

Municipal debt issuances were led by the Metropolitan Transportation Authority, NY, which came to market with $900 million Transportation Revenue Green Bonds rated by Moody’s Investors Service a notch lower at A3 after the MTA’s downgrade from A2. That said, the headlines were captured by the San Francisco Public Utilities Commission (SFPUC), an issuer of multiple green bonds going back to 2016 that launched a $150.9 million offering to be marketed internationally as taxable bonds and listed on the London Stock Exchange’s International Securities Market (ISM).

New Developments

ECB accepts certain sustainability bonds as collateral for Eurosystem credit operations

On September 22 the European Central Bank (ECB) announced its decision to accept as collateral for Eurosystem credit operations and also for the Eurosystem outright purchases for monetary policy purposes bonds with coupon structures linked to certain sustainability performance targets. To be eligible, sustainable bonds must comply with all other eligibility criteria.

According to the ECB, the coupons must be linked to a performance target referring to one or more of the environmental objectives set out in the EU Taxonomy Regulation and/or to one or more of the United Nations Sustainable Development Goals relating to climate change or environmental degradation. This further broadens the universe of Eurosystem-eligible marketable assets and signals the Eurosystem’s support for innovation in the area of sustainable finance.

EU rules define an economic activity as environmentally sustainable if it makes a “substantial contribution” to one of its six objective, which relate to climate change mitigation, protection of water, transition to a circular economy, pollution prevention and protection of biodiversity. Non-marketable assets with comparable coupon structures are already eligible. The decision aligns the treatment of marketable and non-marketable collateral assets with such coupon structures.

BIS Quarterly Review September 2020 research article advocates for company green ratings

A research paper published in the BIS Quarterly Review, September 2020, makes that case that current labels for green bonds do not necessarily signal that issuers have a lower or decreasing carbon intensity, measured as emissions relative to revenue. Instead, rating firms on the basis of their carbon emissions, rather than any individual green or other bonds, could provide a useful signal to investors and encourage companies to increase their carbon efficiency. The paper goes on to propose that such ratings could complement existing labelling systems and can be designed to provide extra incentives for large carbon emitters to help combat climate change.

This argument has merit. It should be noted, however, that green bond proceeds according to the ICMA best practices guidelines can be used for purposes that extend beyond GHG reduction. It’s true that the impact on GHG emissions have likely been limited, but even more importantly has been the impact of green bonds on sustainable finance and their role in focusing attention on and driving home the importance of taking action to address climate risk.

Credit Roundtable ESG Survey results

The Credit Roundtable, an education, outreach and advocacy group focused on preserving bondholder protections, published the results of a survey conducted between August and September of this year on environmental, social and governance with a view toward better understanding how member firms view ESG factors in the investment process. Responses from institutional fixed income managers overseeing more than $4 trillion of assets with regard to green bonds, in particular, indicate that (1) the lack of standard definitions deters investments in green bonds (67.39%) and (2) 34% expect to see green/sustainable bonds pricing through the secondary curve on a consistent basis within 12 months (12.8%) to within several years (21.3%), 38.3% were unsure while 27.7% responded that they don’t expect this outcome. 64% of respondents to the survey reported that they do not specifically target green or sustainable bonds.

[1] Since September 1, 2019 VanEck Green Bond ETF green bonds limited to US dollar denominated.