The Bottom Line: Six qualifying funds available for investors seeking a sustainable large-cap blended index mutual fund or ETF investment option to serve as an anchor position in a sustainable investment portfolio.

Large-cap blended index fund: An anchor position in a sustainable investment portfolio

Investors seeking a sustainable large-cap blended index mutual fund or ETF investment option that could potentially serve as an anchor position in a sustainable investment portfolio can start with a review and analysis of the 32 mutual funds and ETFs, for a total of 42 funds/share classes, classified by Morningstar as based on data compiled as of year-end 2023. After qualifying this category of sustainable funds based on screening criteria that considers five factors, the eligible universe is reduced to six retail and institutional funds that pursue one of two approaches to sustainable investing. While actively managed funds remains an option for interested investors, the preference for passively managed large cap funds over actively managed investment vehicles is rooted in research into the performance of passive versus actively managed funds revealing that actively managed large-cap funds rarely beat securities market indices. Or that when they do, their outperformance is not persistent.

Applying screening criteria consisting of five factors reduces to six the number of qualifying funds

The number of qualifying funds is reduced from 32 funds to six funds, including both retail and institutional funds, after the following screens are applied: (1) Management company-The fund should be offered and managed by an established firm with a reputation for quality—to ensure effective fund operations and instill trust and confidence in the organization. (2) Years in operation-The fund should be in operation for at least five years and managed pursuant to the same investment strategy—to provide a sufficiently long but not too long view against which to evaluate the fund’s operation, strategy, and performance. (3) Total return performance-the fund should have generated a total return equal to or greater than the S&P 500 Index for the five-year interval—to evaluate tracking relative to market based financial outcomes over an interval based on a relatively consistent approach and methodology. (4) Expense ratio. The fund should be offered at an expense ratio below the average for the category—since a fund’s expense ratio directly affects the fund’s total return performance over time, and even a small difference in expense ratios can have a significant effect on net investment outcomes, and (5) Fund size-the fund’s total net assets should range above $30 million—so that it may be managed more efficiently and to provide some protection against the fund’s closure.

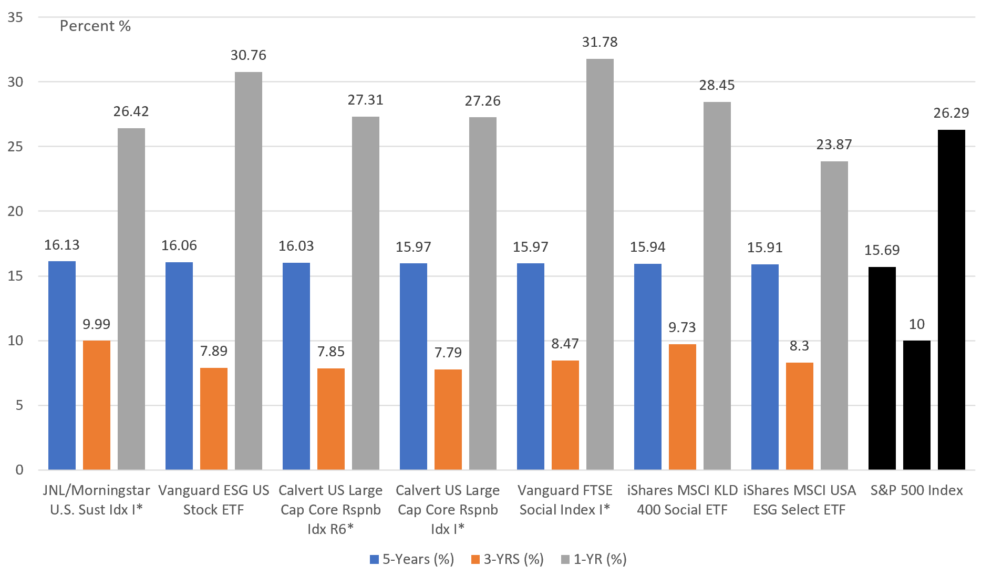

Screened Sustainable Large-Cap Blended Index Mutual Fund or ETFs: Total Returns to 12/31/2023

Notes of explanation: Screened from a universe of 32 sustainable large-cap blended index funds, as defined by Morningstar. * Refers to institutional funds with high minimum initial investments. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of explanation: Screened from a universe of 32 sustainable large-cap blended index funds, as defined by Morningstar. * Refers to institutional funds with high minimum initial investments. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

The six retail and institutional funds pursue two approaches to sustainable investing

The remaining six funds either pursue a passively managed values-based approach that incorporates exclusions, ESG integration, including positive and negative screening, engagement and proxy voting as is the case with the Calvert US Large Cap Core Responsible Index Fund or a more narrow ESG screening and exclusionary approach applicable to the five other funds. As these five funds track different indices that are compiled based on varying methodologies, variations apply, and the specific factors used in the process of screening and excluding companies will vary. Further details regarding such factors may be found in the Funds Glossary.

Screened Sustainable Large-Cap Blended Index Mutual Fund or ETFs and Their Sustainable Investing Approach/Strategy

Fund Name | R | I | Sustainable Investing Approach/Strategy |

Calvert US Large Cap Core Responsible Index I | √ | Values-based, Exclusions, ESG integration, including positive and negative screening, engagement and proxy voting. | |

Calvert US Large Cap Core Responsible Index R6 | √ | Values-based, Exclusions, ESG integration, including positive and negative screening, engagement and proxy voting. | |

iShares MSCI USA ESG Select ETF | √ | ESG screening and exclusions. | |

iShares MSCI KLD 400 Social ETF | √ | ESG screening and exclusions. | |

JNL/Morningstar US Sustainable Index I | √ | ESG screening and exclusions. | |

√ | ESG screening and exclusions. | ||

Vanguard FTSE Social Index I | √ | ESG screening and exclusions. |

Notes of Explanation: R-Retail fund; I=Institutional fund, with minimum investments > $100,000. For further sustainable investing approach/strategy, refer to the Funds Glossary. Source: Fund prospectuses, Sustainable Research and Analysis LLC

Passive versus active funds: Research shows that actively managed large-cap funds rarely beat securities market indices while outperformance is not persistent

For sustainable investors as well as conventional investors, a reason to consider a passive fund versus an active fund is rooted in research showing that actively managed large-cap funds rarely beat securities market indices, a compelling argument can be made for choosing to invest in a low-cost large cap sustainable passively managed mutual fund or ETF. According to S&P/Dow Jones Indices, only 39% of large-cap funds outperformed the S&P 500 Index over the one-year period ended June 30, 2023, and the percentage of large-cap funds outperforming over the three, five and 10-year intervals declined to 14%. Moreover, outperformance is not persistent.

Universe of Large-Cap Blended Sustainable Passively Managed Mutual Funds and ETFs: TR Performance to YE 2023

Fund Name | AUM ($ Millions) | ER (%) | 1-YR Return (%) | 3-YR Return (%) | 5-YR Return (%) |

AXS Change Finance ESG ETF | 132.1 | 0.49 | 23.69 | 5.91 | 14.34 |

Calvert US Large Cap Core Responsible Index A | 725.9 | 0.49 | 26.93 | 7.52 | 15.67 |

Calvert US Large Cap Core Responsible Index C | 70.7 | 1.24 | 26 | 6.72 | 14.81 |

Calvert US Large Cap Core Responsible Index I | 2529.8 | 0.24 | 27.26 | 7.79 | 15.97 |

Calvert US Large Cap Core Responsible Index R6 | 1496.2 | 0.19 | 27.31 | 7.85 | 16.03 |

Calvert US Large-Cap Core Responsible ETF | 250.9 | 0.15 | |||

Calvert US Large-Cap Diversity, Equity and Inclusion ETF | 30.6 | 0.14 | |||

Fidelity U.S. Sustainability Index | 2966 | 0.11 | 29.04 | 10.62 | 16.14 |

FlexShares ESG & Climate US Large Cap Credit Index | 41.9 | 0.09 | 25.51 | ||

FlexShares STOXX US ESG Select ETF | 188.6 | 0.32 | 27.83 | 9.62 | 15.85 |

Global X Conscious Companies ETF | 604.6 | 0.43 | 21.98 | 8.09 | 13.97 |

Goldman Sachs ActBt® P-A US Lg Cp Eq ETF | 7.9 | 0.2 | 24.5 | ||

Impact Shares NAACP Minority Empowerment ETF | 41.6 | 0.75 | 27.97 | 9.37 | 19.23 |

Impact Shares YWCA Women’s Empowerment ETF | 49.1 | 0.75 | 27.97 | 9.37 | 19.23 |

IQ Candriam U.S. Large Cap Equity ETF | 379.6 | 0.09 | 32.39 | 10.44 | |

iShares Climate Conscious & Transition MSCI USA ETF | 1808.9 | 0.08 | |||

13377.3 | 0.15 | 25.72 | 8.34 | 15.54 | |

iShares ESG MSCI USA Leaders ETF | 1120.8 | 0.1 | 29.07 | 10.63 | |

iShares ESG MSCI USA Min Vol Factor ETF | 8.8 | 0.18 | 12.1 | ||

iShares MSCI KLD 400 Social ETF | 4086.2 | 0.25 | 28.45 | 9.73 | 15.94 |

iShares MSCI USA ESG Select ETF | 5342.8 | 0.25 | 23.87 | 8.3 | 15.91 |

iShares® ESG Screened S&P 500 ETF | 182 | 0.08 | 29.8 | 9.64 | |

JNL/Morningstar U.S. Sust Idx A | 300.9 | 0.71 | 25.91 | 9.58 | 15.7 |

JNL/Morningstar U.S. Sust Idx I | 14.4 | 0.36 | 26.42 | 9.99 | 16.13 |

JPMorgan Carbon Transition US Eq ETF | 4.8 | 0.15 | 27.47 | 10.35 | |

Nuveen ESG Large-Cap ETF | 25.3 | 0.21 | 22.29 | 7.15 | |

SPDR® MSCI USA Gender Diversity ETF | 218.6 | 0.2 | 22.34 | 3.34 | 10 |

SPDR® S&P 500® ESG ETF | 1110.1 | 0.1 | 27.84 | 11.44 | |

TCW Transform 500 ETF | 646.7 | 0.05 | 27.42 | ||

VanEck Morningstar ESG Moat ETF | 5.7 | 0.49 | 18.28 | ||

7446.4 | 0.09 | 30.76 | 7.89 | 16.06 | |

Vanguard FTSE Social Index Admiral | 8531.2 | 0.14 | 31.79 | 8.45 | |

Vanguard FTSE Social Index I | 8005.2 | 0.12 | 31.78 | 8.47 | 15.97 |

V-Shares US Leadership Diversity ETF | 1.3 | 0.29 | 27.93 | ||

Xtrackers MSCI USA Clmt Actn Eq ETF | 1866.7 | 0.07 | |||

Xtrackers MSCI USA ESG Leaders Eq ETF | 983.2 | 0.1 | 29 | 10.63 | |

Xtrackers Net Zero Pwy Par Alg US Eq ETF | 166.6 | 0.1 | 27.86 | ||

Xtrackers S&P 500 ESG ETF | 975.2 | 0.1 | 27.84 | 11.46 | |

Total/Average | 65,744.6 | 0.26 | 26.59 | 8.81 | 15.52 |

Notes of Explanation: Universe of large-cap index funds are defined by Morningstar. Data as of December 31, 2023. ER=Expense Ratio. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.