The Bottom Line: Investors in Putnam’s 17 sustainable funds are guided to stay the course but monitor post transaction developments before making any investment changes.

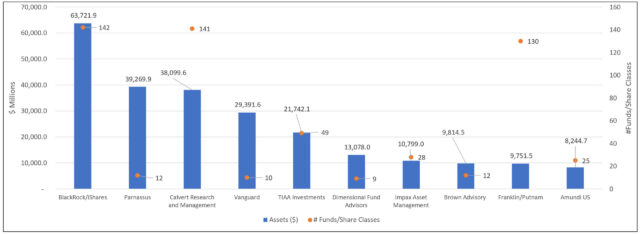

Top ten managers of sustainable funds and their assets under management at the start 2024

Notes of Explanation: # of funds refers to funds and share classes. Data as of year-end 2023. Assets of Franklin Resources combine Putnam’s assets under management as of year-end 2023. Calvert Research and Management includes sustainable fund assets managed by Morgan Stanley and TIAA Investments include Nuveen’s sustainable assets under management. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Franklin Resources announces the completion of its Putnam Investments acquisition

Last week, Franklin Resources announced the successful completion on January 1st of its Putnam Investments acquisition from Great-West Lifeco, Inc, a Canadian insurance centered financial holding company that became a long-term shareholder in Franklin Resources, Inc. The January 2, 2024 press release notes that Putnam is a global asset management firm with $142 billion in AUM as of November 30, 2023 (excluding PanAgora which was not a party to the transaction and will remain an indirect, wholly-owned subsidiary of Great-West Lifeco). The transaction, which was announced last year, adds a target date fund range and complementary investment capabilities with scale, including in the areas of stable value, ultra short duration and large cap value. Consistent with Franklin Templeton’s previous acquisitions, the execution plan is designed to minimize disruption to Putnam’s investment teams and client relationships. The addition of Putnam brings Franklin Templeton’s AUM to $1.55 trillion as of November 30, 2023.

Putnam’s acquisition catapults Franklin into the 9th ranked sustainable fund management firm

Putnam’s acquisition also catapults Franklin, with $629.7 million in sustainable fund assets under management at year-end 2023 into the 9th ranked spot in terms of firms with sustainable assets under management. On a pro-forma basis, the combined firms start the new year managing $9,751.5 million, based on year-end 2023 data, pushing the firm up ahead of Amundi Asset Management US, Inc. and just behind Brown Advisory LLC.

On its own, Putnam, which manages $9,121.8 million in assets, ranked 10th out of 161 fund firms with registered sustainable mutual funds and ETFs—a total of $339,999.8 million as of December 31, 2023. In total, the top 10 firms manage $253,664.3 million in assets and account for a sustainable funds market share of 74.6%. Adding Franklin’s $629.7 million lifts the combined firm’s assets and places it above the 10th ranked firm, Amundi Asset Management US with $7,976 million, and just behind Brown Advisory’s $9,814.5 million.

Franklin’s combined sustainable fund assets are entirely actively managed, including the 14 ETFs with $1,999.3 million in assets, or 20.5% of the firm’s total that will now include Putnam and Franklin branded investment product offerings in addition to offerings managed by Franklin’s ClearBridge and Martin Currie. The combination extends an emphasis on active management with a focus on “delivering strong investment results.”

Changes in the management of the funds are not likely but investors in Putnam funds should continue to monitor the transition over the ensuing months before making any investment shifts

As further noted in the company’s announcement, Franklin’s execution plan “is designed to minimize disruption to Putnam’s investment teams and client relationships.” In light of this commitment, investors in any of Putnam’s funds, including the two funds sub-advised by PanAgora Asset Management, Putnam PanAgora ESG Emerging Markets Equity ETF and the Putnam PanAgora ESG International Equity ETF are guided to monitor the transition and evaluate any changes that might occur over the ensuing months before making any decisions to liquidate or affect a change in their positions.