Introduction and Summary

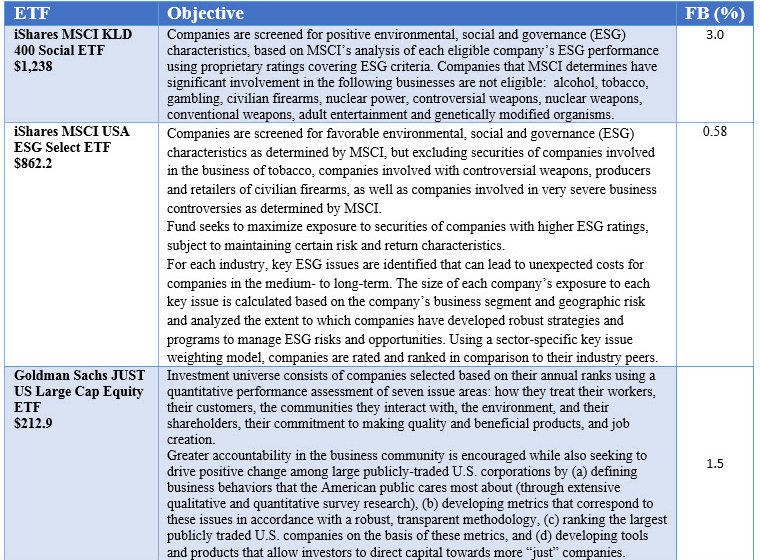

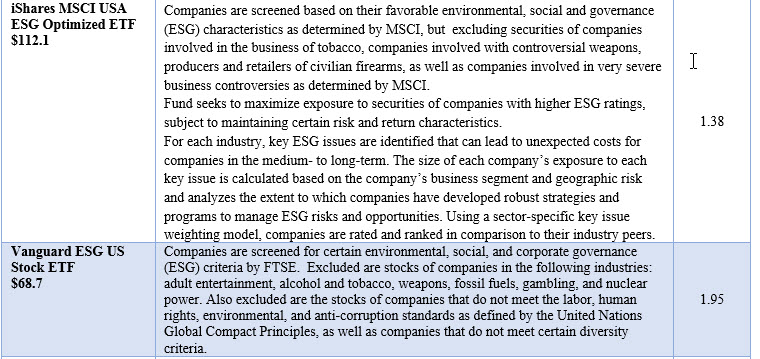

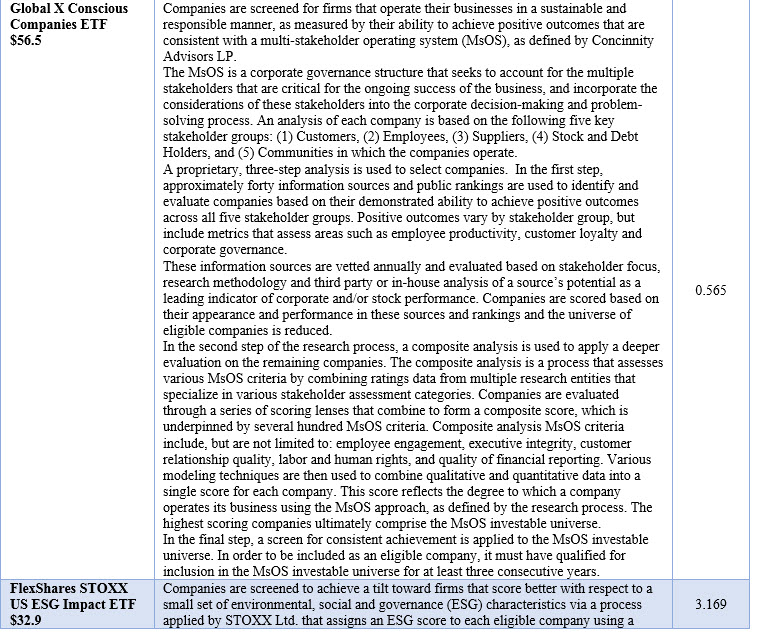

Core US equity-oriented sustainable exchange traded funds (ETFs), defined as broad-based US stock funds that provide exposure to socially responsible companies by screening eligible companies for positive environmental social and governance (ESG) characteristics, exhibit material variations in their approach to investments. These involve definitions of socially responsible companies, ESG considerations and resultant decisions regarding eligible companies. This is not unexpected, but it leads to confusion among investors and other parties regarding the meaning of sustainable investing. Also, it reinforces the necessity for investors to be aware of the potential for such variations across sustainable funds, to understand the basis for stock or bond selection within their investment portfolios and the varying impacts or outcomes associated with a particular fund’s approach to sustainable investing. One example of this involves Facebook, Inc. (FB), a firm that’s been exposed to unfavorable developments regarding the adequacy of its controls, data privacy, and data security (social factors) as well as concerns regarding its corporate governance (governance) structure. Some of these have been long-standing and have led some sustainable funds to exit the Facebook position. Other considerations aside, a review of investments held by a universe of eight core US-oriented sustainable ETFs shows that funds that incorporate ESG factors continue to hold positions in Facebook, Inc. Class A Common Stock as of December 20, 2018 or so. These positions, from which none of the funds have exited, average 1.8% and vary from a low of 0.565% of one fund’s net assets to a maximum position of 3.17%, as compared to a 1.48% Facebook exposure in the S&P 500 Index and 0.0% held by core large cap actively managed sustainable equity funds. Unlike actively managed funds, sustainable ETFs largely consist of index tracking investment vehicles that rely on varying scoring methodologies to establish levels of exposure to a particular company. The scoring methodology adopted by each index will have a material impact on outcomes while at the same time there is limited disclosure and transparency as to holdings decisions and portfolio impacts.

Facebook, Inc. exposed to various social and governance challenges

Facebook, Inc. (FB) is a $362.9 billion Nasdaq Stock Market listed social media company with 2.23 billion active monthly users that was again last week featured in a New York Times (NYT) article that cast a negative light on its data privacy and data security practices. According to the NYT, Facebook had allowed over 150 companies, including firms such as Amazon, Microsoft, Yahoo and other companies, to see names of virtually all Facebook users’ friends without consent, and allowed other companies to read Facebook users’ private messages. A Facebook spokesperson, however, stated that none of the partnerships violated users’ privacy, or a 2011 agreement with the U.S. Federal Trade Commission (FTC) to require explicit permission from members before sharing their data.

This followed the publication of an investigative report published by the same newspaper in November of this year entitled “Delay, Deny and Deflect: How Facebook’s Leaders Fought Through Crisis,” that provided insight into how Facebook has operated through numerous crises over the past few years. The article detailed how Facebook’s top management, Mark Zuckerberg and Sheryl Sandburg, made the company’s growth a priority while ignoring and hiding warning signs over how its data was being exploited to disrupt elections and spread toxic content. According to the same New York Times report, Facebook also engaged in a lobbying campaign to deflect attention from the company and shift public attention to Facebook’s critics and rival technology firms.

Concerns about Facebook are not new, as social factors regarding the adequacy of controls, protecting privacy and data security have been known for some time. In November 2011, Facebook agreed to settle FTC charges that it had deceived consumers by “telling them they could keep their information on Facebook’s private and then repeatedly allowing it to be shared and made public.” A new and even higher level of concern was reached in March 2018 when it was revealed that Cambridge Analytica, a voter-profiling firm, had harvested the personal data of millions of Facebook users without their knowledge or permission.

Another key issues is the company’s governance structure, since Mark Zuckerberg, the firm’s founder, also acts as Chairman and CEO. Further, through his control of the company’s Class B common stock, Zuckerberg is able to exercise voting rights with respect to a majority of the voting power of the firm’s outstanding stock and therefore he has the ability to control the outcome of matters submitted to stockholders for approval, including the election of directors and any merger, consolidation, or sale of all or substantially all of the firm’s assets.

Sustainable funds and ESG integration

Sustainable investing is the idea that investing in sustainable companies permits investors to achieve long-term competitive financial returns while at the same time attaining a positive societal impact. The sustainable investing idea encapsulates various strategies that can be achieved individually or by combining more than one approach. These strategies extend from a values-based approach, also referred to as socially responsible investing, that largely relies on excluding certain objectionable industries and/or companies from portfolios, to impact and thematic investing, including green bond investing, to environmental, social and governance integration (referred to as ESG integration) to shareholder/bond holder engagement and proxy voting. The desired strategies can be executed via mutual funds, exchange-traded funds (ETFs), managed funds and individual securities, or some combination of these. For further information, refer to the Investment Research/The Basics tab.

Sustainable funds that employ an ESG integration approach do so by consistently and systematically accounting for relevant and material environmental, social and governance factors in investment decision making. Frequently enough, ESG integration is applied to portfolios in concert with exclusionary approaches. That is, the screening out or the exclusion of investments in companies, based on varying definitions, revenue thresholds as well as other considerations, that are engaged, for example, in the production or manufacturing of alcohol, gambling, tobacco, military weapons, civilian firearms, nuclear power, genetically modified foods or adult entertainment. In addition, companies involved in certain controversies may also be excluded. Beyond fundamental investment research and analysis or consideration of the investment merits of a particular security, stocks or bonds are selected on the basis of a scoring methodology that evaluates and various ESG factors. These are subject to wide variations, as can be observed in Table 1. Also, a company’s weighting within a portfolio will be determined using an optimization technique intended to achieve performance results that correspond to the underlying index.

At issue for investors is that scoring methodologies and exclusions both vary and different funds with similar objectives are likely to arrive at different conclusions with regard to a particular stock or bond. Especially in the absence of effective disclosures, this leads to confusion and leaves investors and others to question what sustainable investing generally and ESG integration in particular really means and what it encompasses.

Investments in Facebook, Inc. range from 0.565% to 3.2%

The potential for confusion can be illustrated, in part, using the case of Facebook, Inc. Starting with the entire universe of 87 ETFs valued at $9.6 billion in net assets in operation as of November 30, 2018, the funds were screened to limit the resulting segment of funds to eight ETFs with $2.6 billion in net assets, or27% of all sustainable ETFs representing core US equity-oriented sustainable ETFs. That is, the eight remaining ETFs include funds that employ an ESG integration strategy along with an exclusionary approach. Excluded from this segment are ETFs that rely entirely on exclusions, thematic ETFs, values-based ETFs, factor oriented ETFs, such as growth and value, revenue, dividends, small cap and mid-cap products that are likely to exclude Facebook for reasons other than ESG considerations. Based on an analysis of the investments held by the eight remaining funds and their index tracking strategies, none of the funds excluded Facebook. In fact, investments in the social networking company on or about December 20, 2018 varies from 0.565% to 3.2%. This stands in contrast to a complete absence of Facebook investments among the largest actively managed core US equity oriented sustainable mutual funds.

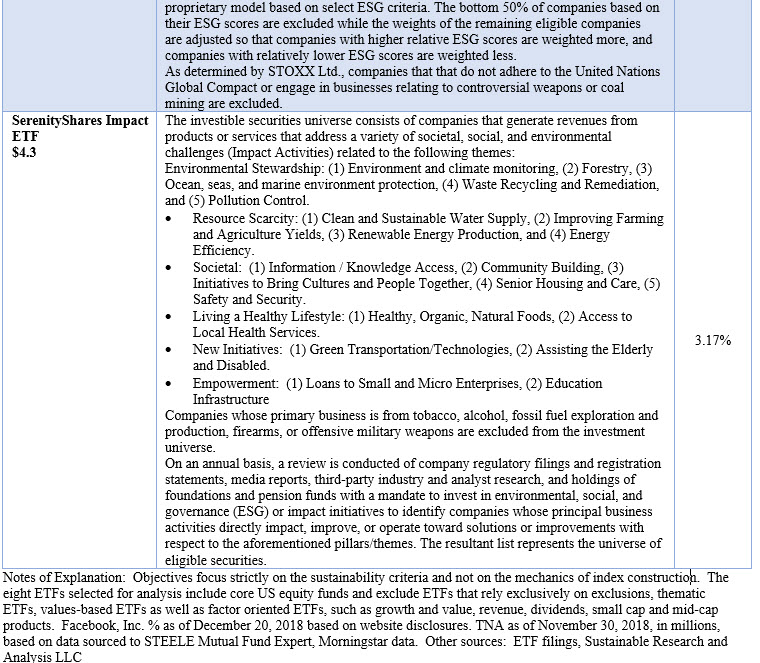

A listing of the eight funds in order of their size (total net assets or TNA), their sustainable investing and ESG integration strategies as defined in their offering documents and levels of investment in Facebook, Inc., is provided in Table 1.

What does this mean for investment managers and investors?

This article is not intended to advocate for or against investments in Facebook, Inc. in index tracking funds. In fact, the stock, which is down some 40% since its peak in July of this year may be considered attractive by some investment managers on a valuation basis after accounting for Facebook’s social as well as governance risks. That’s a fundamental consideration for active managers that’s not applicable to index funds that rely on decisions made by the underlying index providers. Rather, the article is intended to illustrate just one source of the material variations that can result from the application of ESG integration-oriented sustainable investing strategies that, in turn, can lead to confusion among investors and other parties regarding the meaning of sustainable investing.

Investment managers, whether active or passive, should be encouraged to provide additional information regarding the rationale for holding or liquidating various securities in their portfolio, especially when companies are embroiled in governance, social and environmental controversies. Also, investment advisors should step up their disclosures regarding societal impacts. At the same time, investors seeking to achieve positive societal outcomes with their investment portfolios should become acquainted with the nature of the sustainable strategies employed by their fund and register with their investment adviser a desire for stepped disclosures and impact reporting. In the absence of same, investors should seek alternative investment options.