Summary

DWS launched an institutional money market fund that integrates environmental, social and governance considerations while at the same time employing exclusionary screens. This $329.3 million fluctuating Net Asset Value (NAV) fund contrasts with the stable value GuideStone Money Market Fund that pursues a values/religious-based approach. Other significant differences extend to eligible security types, minimum investments and expense ratios.

DWS, formerly Deutsche Asset Management, made its sustainable investing debut in the US last month by repurposing the firm’s existing $329.3 million DWS Variable NAV Money Market Fund

DWS, formerly Deutsche Asset Management, made its sustainable investing debut in the US last month by repurposing the firm’s existing $329.3 million DWS Variable NAV Money Market Fund, an institutional money market fund that integrates environmental, social and governance (ESG) considerations while at the same time employing exclusionary screens[1]. Refer to Chart 1 for ESG definitions. The DWS ESG Liquidity Fund, which charges an expense ratio of 98 basis points (bps) but is limiting fees to 10 bps pursuant to an 88 bps fee waiver in effect at least until September 30, 2019, has also recalibrated its minimum investment to $10 million effective as of October 15, 2018. As of September 30, 2018, the fund is generating a 7-day yield of 2.16%[2]. While not the only sustainable money market fund offering available to investors in the US, this fund’s strategy relies on ESG integration rather than emphasizing a values-based approach pursued by the GuideStone Money Market Fund. The fund is strictly geared to institutional investors, it invests in a broader range of money market instruments and is subject to a fluctuating versus a stable net asset value. As such, it is expected to generate a higher net yield. The fund’s launch is timely, as short-term interest rates are rising while sustainable investing strategies among institutional investors continues to gain traction. It therefore would not be surprising to see more offerings in this class over time, especially if the fund is successful in accumulating assets under management (AUM). DWS, like BlackRock, is a highly regarded liquidity manager. The fund’s capacity to attract ESG sourced AUM will, in part, depend on the effective execution of its ESG strategy. On this score, time will tell.

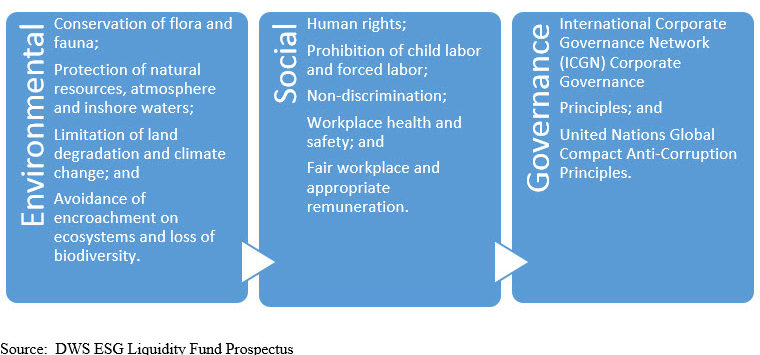

DWS ESG Liquidity Fund ESG Defitinitions

DWS ESG Liquidity Fund invests in a variety of short-term instruments and will maintain strict quality and maturity limits

The DWS ESG Liquidity Fund invests in high quality, short-term, US dollar denominated money market instruments, including obligations of US and foreign banks, corporate obligations, US government securities, municipal securities, repurchase agreements and asset-backed securities, paying a fixed, variable or floating interest rate. At the time of purchase, eligible securities will have remaining maturities of 397 days or less, or have certain maturity shortening features (such as interest rate resets and demand features) that have the effect of reducing their maturities to 397 days or less. The fund will maintain a dollar-weighted average maturity of 60 days or less and 120 days or less determined without regard to interest rate resets.

In addition to considering financial information, the security selection process also evaluates a company based on ESG criteria

According to the fund’s prospectus which became effective September 1, 2018, in addition to considering financial information, the security selection process also evaluates a company based on ESG criteria. With the exception of municipal securities, a company’s performance across certain ESG criteria is summarized in a proprietary ESG rating which is calculated by an affiliate of the DWS on the basis of data obtained from various ESG data providers. Only companies with an ESG rating above a minimum threshold determined by DWS are considered for investment by the fund. The proprietary ESG rating is derived from multiple factors:

- Level of involvement in controversial sectors and weapons;

- Adherence to corporate governance principles;

- ESG performance relative to a peer group of companies; and

- Efforts to meet the United Nations’ Sustainable Development Goals.

ESG ratings for municipal securities are calculated by DWS by applying a combination of positive and negative screens. From the investable universe of municipal securities, positive screens will automatically include green bonds (bonds that intend to finance projects that are expected to produce positive environmental and/or climate benefits) that meet minimum standards and negative screens will exclude municipal securities with exposure to weapons, issues where more than 10% of the business is attributable to nuclear power or more than 25% of the business is derived from coal, and issues related to gambling, lottery, the production or sale of tobacco, and other sectors deemed controversial by DWS.

The remainder of the investable universe of municipal securities are then scored on key performance indicators in each of three pillars: environmental, social and corporate governance. Only municipal securities with a cumulative score across all three pillars above a minimum threshold determined by DWS are considered for investment by the fund.

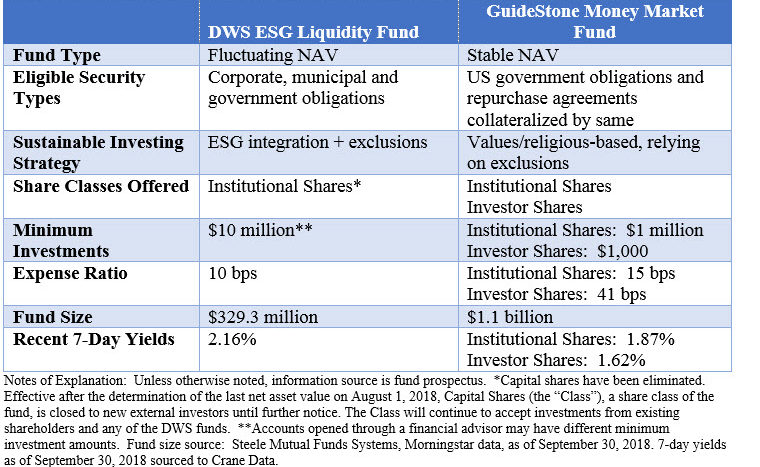

Comparison of key fund considerations

DWS ESG Liquidity Fund is the second only sustainable money market fund offering available today in the US, however, when compared to the GuideStone Money Market Fund, the fund offerings differ in some significant ways. While not the first to be launched, the $1.1 billion GuideStone Money Market Fund, which is sub-advised by BlackRock, has been available since 2009. Unlike DWS ESG Liquidity Fund, GuideStone pursues a values/religious-based approach that is intended to align investments with Christian values. GuideStone funds may not invest in any company that is publicly recognized, as determined by GuideStone Financial Resources of the Southern Baptist Convention (GuideStone Financial Resources), as being in the alcohol, tobacco, gambling, pornography or abortion industries, or any company whose products, services or activities are publicly recognized as being incompatible with the moral and ethical posture of GuideStone Financial Resources. There are other differences between the two funds, and these are summarized in Table 1.

Comparison of DWS and GuideStone Money Market Fund Characteristics

[1] DWS also launched the Xtrackers MSCI EAFE ESG Leaders Equity ETF.

[2] Source: Crane Data.