The Bottom Line: Twenty events of note were identified for the month of March 2020, including 12, or 60%, involving newly introduced sustainable fund products.

Events Summary

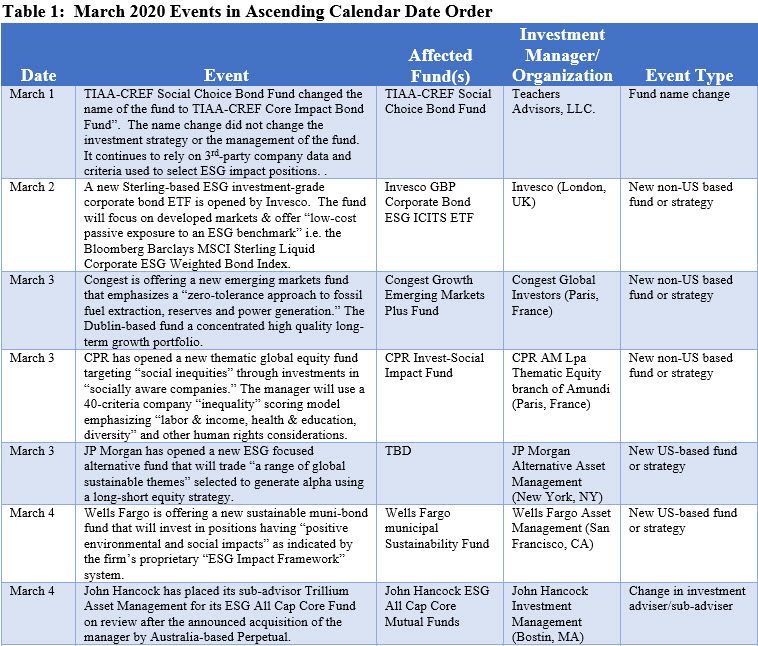

Twenty events of note were identified for the month of March 2020*. These are as follows:

-

- The majority of these events, 12 in total, involved newly introduced sustainable fund products. It doesn’t appear, based on activity since the start of the year, that the extreme turbulence in financial markets due to the coronavirus has had much impact through the first quarter on fund formation announcements.

- 10 of these were for new non-US based funds.

- Two events applied to US-base funds.

- The remaining events are classified, as follows:

- 2 events are linked to changes in sustainable management/portfolio management personnel.

- 1 fund closing.

- 1 change in portfolio management policies.

- 1 change in fund name.

- 1 change in investment manager/sub-adviser.

- 1 merger, acquisition, divestiture or JV.

- 1 event due to a change in fund operational support platform.

- *One event, actually carried forward from February, involves a change to a 3rd-party’s operational platform to capture sustainable process data.

- The majority of these events, 12 in total, involved newly introduced sustainable fund products. It doesn’t appear, based on activity since the start of the year, that the extreme turbulence in financial markets due to the coronavirus has had much impact through the first quarter on fund formation announcements.

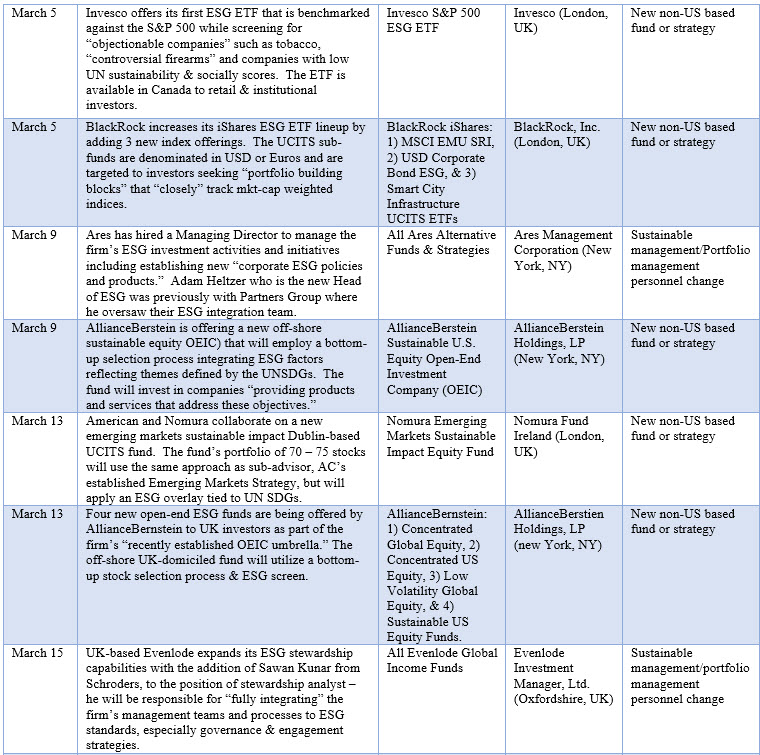

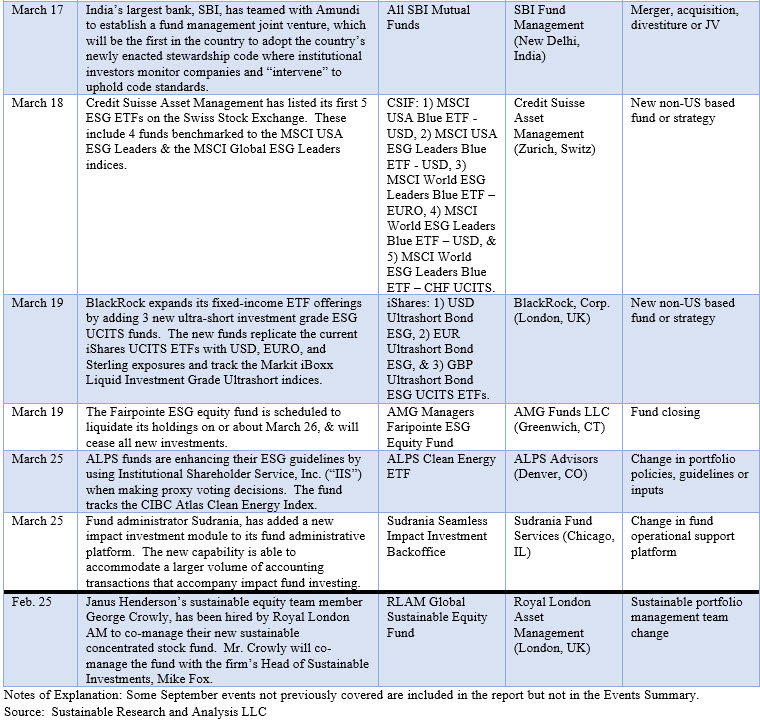

Refer to Table 1 for details.