Sustainable international mutual funds and ETFs and foreign funds in particular expand rapidly

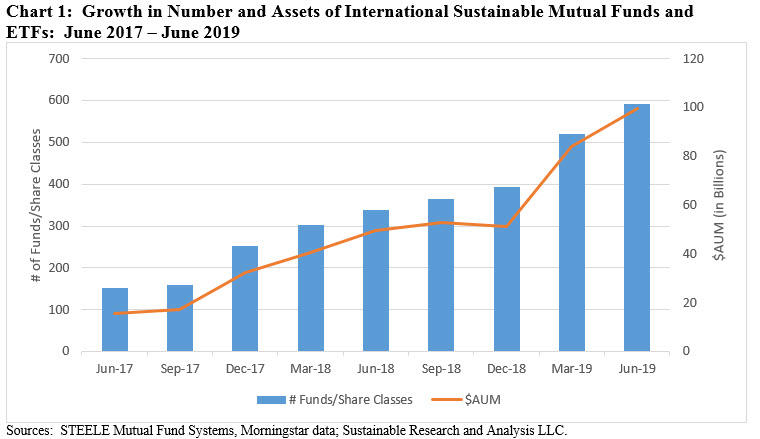

The international equity mutual funds segment, comprised of broad-based mutual funds and exchange-traded funds (ETFs), has experienced significant growth . In the last 24 months, international funds expanded from 151 funds/share classes with $15.4 billion in assets under management to 593 funds/share classes and $99.8 billion in assets under management, or almost a seven-fold increase. Just in June, two fund firms, including Aegon and Virtus, launched 2 new funds (7 share classes) while a third, Vanguard, added two share classes to an existing fund. While market movement and net new flows have been a factor, the most significant driver in the two-year increase is the rebranding of existing funds by conventional investment management firms that have adopted sustainable investing strategies, mainly in the form of ESG integration practices, primarily targeted to institutional investors. In the process, the sustainable profile as well as the lineup of the leading firms in this segment and the rank ordering of funds have also changed; and while this segment is comprised of various investment themes or objectives, the largest segment, with $44.5 billion in assets or 44.6% of the segment’s total net assets as of June 2019, is sourced to large cap growth, value and hybrid funds that invest in foreign securities, excluding the US. Otherwise, funds in this segment range from country specific and regional-oriented funds, such as Japan, Europe and Pacific/Asia-oriented stock funds, to thematic funds focusing, for example, on alternative energy, as well as emerging market funds. The recent growth of the international funds segment and the profile of funds that comprise this universe, including their sustainable investing orientation, are described in this research article along with the recent creation of a sustainable foreign fund index which was launched as of June 30, 2019. See Chart 1. [ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]

ETFS: 21 funds and $3.1 billion in net assets under management

The international funds segment has expanded significantly over the last two years in percentage terms, growing from 14 funds at June 2017 to 21 funds at June 2019, for a net increase of 7 funds, or 50%, however, assets under management have expanded modestly from $1.06 billion to about $3.1 billion, for an increase of about $2.0 billion or 191%. The ETF international segment is dominated by three funds offered by BlackRock/iShares and Vanguard with its recently launched Vanguard ESG International Stock ETF. These three funds account for $1.7 billion and 54% of the segment’s assets. Nine ETFs manage less than $35 million in net assets and, in fact, one of these smaller ETFs, the Hartford Global Impact NextShares which hovered around $5 million, was slated for liquidation on or about June 7, 2019.

The ETFs offered at the end of June fall into four geographic categories, dominated by three that include the largest, comprised of foreign funds that account for $1.4 billion in net assets and make up 44.3% of the total. Diversified emerging markets add $865 million and represents 28% of the segment total while world funds constitute $853 million and 27.6% of net assets.

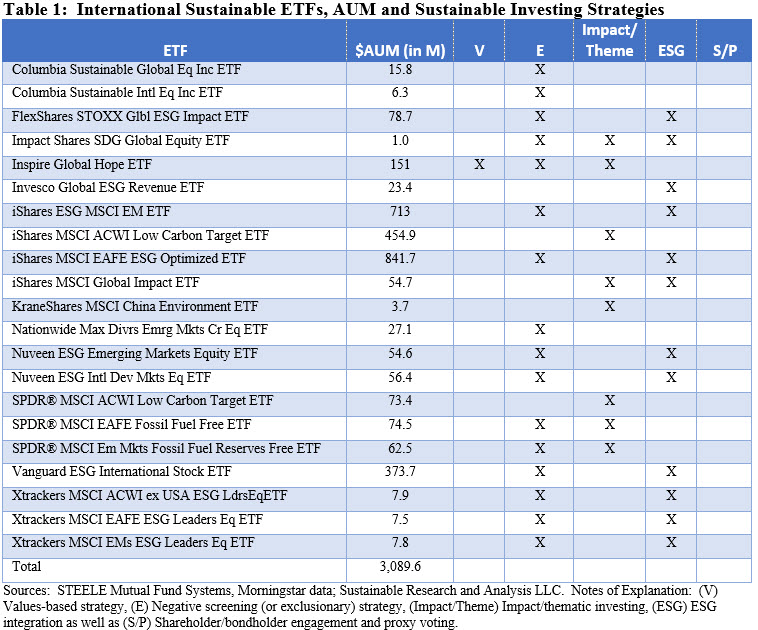

At the same time, the sustainable investing ETF options are also concentrated and most frequently rely on indexes and a ratings methodology provided by MSCI. In the table below, sustainable investing has been classified into five commonly acknowledged approaches, including a values-based strategy, negative screening (or exclusionary) strategy, impact/thematic investing, ESG integration as well as shareholder/bondholder engagement and proxy voting. All but five of the ETFs rely on some form of negative screening or exclusionary approach while 12 funds employ an ESG integration approach either exclusively or in combination with exclusions. Eight ETFs employ an impact and/or thematic approach either exclusively or in combination with one or more sustainable investing practices. Refer to Table 1.

Mutual Funds: 154 funds, 573 share classes and $96.7 billion in net assets under management

It is via mutual funds that the international investment company segment expanded most dramatically, largely due to fund re-brandings that gained momentum in the last two years. This came in two waves starting in the fourth quarter of 2017 when sustainable international mutual fund assets ticked up by 90.2% as three firms in particular, JPMorgan, Morgan Stanley and Hartford Funds, repurposed existing funds by adopting ESG strategies that combine with fundamental investment decisions to inform their conclusions. In the process of doing so, they made their way into the top 10 segment. Assets jumped again, this time by 66.1% in the first quarter of 2019, when a significant number of existing funds were again rebranded. Additional funds were added by the three mentioned previously, but also funds managed by firms like Franklin Templeton, Legg Mason, and Neuberger Berman were added to the mix.

As of June 2019, there were a total of 154 mutual funds offering 573 share classes with $96.7 billion in net assets, or 96.7% of the segment’s total. The segment added a whopping $82.2 billion in assets since June 2017, and experienced an increase of 567.2% as the number of funds/share classes ticked up from 151 to 573. Fund re-brandings based almost entirely on the adoption of prospectus language changes that reflect the adoption of ESG strategies is largely responsible for the gains. Along the way, the category of funds shifted, as did the profile of the funds and fund management firms.

Funds Categories: Foreign funds is the largest category of international mutual funds, representing $43.1 billion and 44.6% of net assets

Foreign funds is the largest category of international mutual funds, representing $43.1 billion and 44.6% of net assets, up by about 525% from $6.9 billion in assets, or 47.25%, two years earlier. Diversified emerging market funds now represent the second largest category with $30.1 billion or 31.1% of net assets. This compares to around $2.5 billion as of mid-year 2017 when this category accounted for only about 17% of the international funds segment. While world funds gained 410.2% in net assets, this category now ranks third with $19.8 billion in net assets at the end of June 2019.

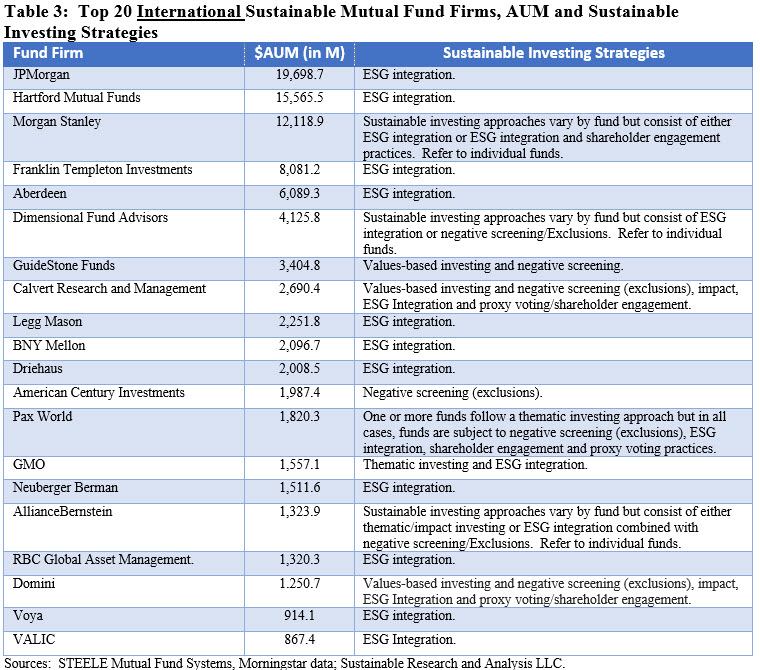

As the number of firms offering international mutual funds increased from 35 to 55 firms at the end of June, the profile of the leading firms and their rank ordering shifted. The top 20 firms offering international mutual funds manage a combined total of $90.7 billion in net assets that represent about 94% of the total segment. Within this cohort of fund firms, 12 new firms have been introduced into the top 20 rankings in the last two years. Put another way, only eight firms that ranked in the top 20 two years ago remain in the top ranking and also their ranking order shifted. Of the top 10 ranked firms two years ago, only three retain their position even as their rankings have shifted. More dramatically even, the top five firms which didn’t offer sustainable international funds two years ago now dominate with their assets under management, accounting for 63.6% of the assets that have largely been repurposed or re-branded. All five fund firms have adopted ESG integration strategies.

Across all international fund categories, institutional investors now account for a minimum of 71.7% of assets under management, up from 61% two years ago.

ESG profile of largest international mutual funds firms and funds: ESG integration dominates

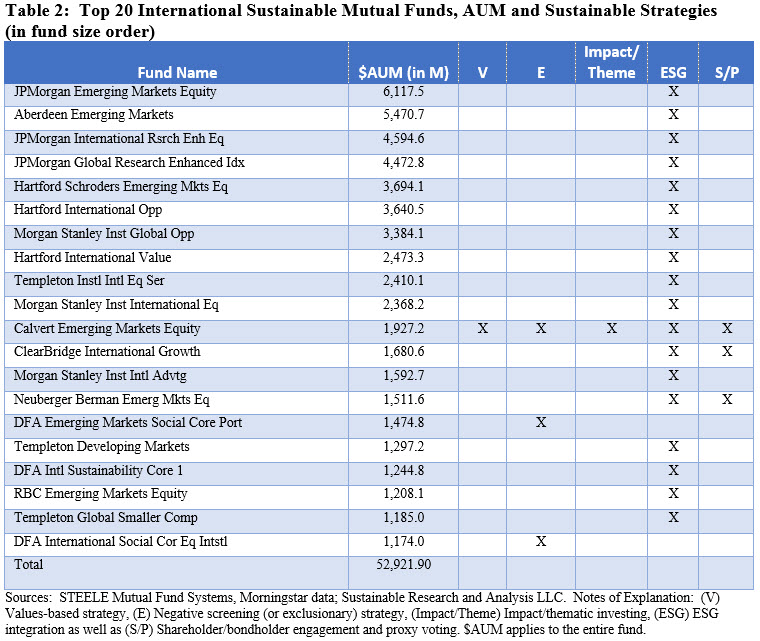

Within the top 20 ranked sustainable international fund firms, all but two fund firms formally integrate ESG factors into their investment strategy. The exceptions are the GuideStone family of funds that adheres to a faith-based approach implemented via negative screening (exclusions) and American Century Investments that imposes a limitation on tobacco stocks. Sole reliance on ESG integration is explicitly mandated by 11 fund firms that manage a combined $60.4 billion in net assets and represent over two-thirds of the assets managed by the top 20 firms and 62.4% of the segment’s total. The other seven firms either combine ESG integration with other sustainable approaches or offer thematic funds. These include two preeminent socially responsible fund firms, Calvert and Domini, that combine values-based investing and negative screening (exclusions), impact and proxy voting/shareholder engagement on top of ESG integration. Refer to Table 2 and the Funds Directory tab.

The largest 20 sustainable international mutual funds, all with over $1.0 billion and accounting for 54.7% of the segment’s total net assets, are dominated by funds that integrate ESG factors in some form into their investment management approach. Of these, three funds combine ESG with related sustainability practices, such as shareholder engagement. Two funds limit their sustainable strategy to negative screening/exclusions. Refer to Table 3.

Sustainable international funds expense ratios: Average ETF expense ratio is 0.39% versus 1.26% for mutual funds

Expense ratios applicable to sustainable international funds vary significantly between actively managed funds and index funds, both in the form of ETFs and mutual funds. Average ETF expenses are considerably lower, averaging 0.39% versus 1.26% for mutual funds . They are also considerably lower when evaluated on an asset weighted basis at an even lower 0.25% versus actively managed mutual funds at 0.90%. ETF expense ratios are also considerably lower relative to index mutual funds. The average expense ratio for this investment fund category is 0.76%, with a low value of 0.2% and a high value of 1.99%. On an asset weighted basis, the expense ratio applicable to index mutual funds is still a higher 0.44%.

ETF expenses range from a low of 0.2% to a high of 0.78% while mutual fund expense ratios range from a low of 0.01% to a high of 3.04%.

Sustainable international mutual funds investment performance: SUSTAIN Foreign Fund Index up 5.92% in June 2019

The substantial growth in both the number of funds and assets under management sourced to similarly managed sustainable foreign mutual funds has made it possible to create a sustainable mutual fund index that’s tracks the performance of funds within one or more segments of this market segment.

Launched with an effective date as of June 30, 2019, the Sustainable (SUSTAIN) Foreign Equity Fund Index, like the SUSTAIN Large Cap Equity Fund Index and the SUSTAIN Bond Fund Index, tracks the performance of the ten largest funds/share classes that make up the segment while also employing a sustainable investing strategy that extends beyond strictly applying exclusionary criteria. In total, these funds manage $14.6 billion in net assets and represent 32.8% of the segment’s assets under management at the end of June. Refer to the index description appended at the end of the article.

In its inaugural month of June, the index posted a gain of 5.92% versus 6.02% recorded by the MSCI ACWI, ex US, or a differential of 10 basis points. Five of the ten funds that make up the index added to performance with total returns ranging from 6.11% to a high of 6.5% generated by the $247.8 million Boston Common ESG Impact International. At the other end of the range, five funds detracted from June’s performance with results ranging from 4.73% to 5.96%. Refer June 2019 SUSTAIN Index performance article.

Sustainable (SUSTAIN) Foreign Equity Fund Index Explained

The index, which was initiated as of June 30, 2019 with data starting in June 2019, tracks the total return performance of the ten largest actively managed foreign equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. While methodologies vary, to qualify for inclusion in the index, funds in excess of $50 million in net assets must actively apply environmental, social and governance (ESG) criteria to their investment processes and decision making. In tandem with their ESG integration strategy, funds may also employ exclusionary strategies along with impact-oriented investment approaches as well as shareholder advocacy.

Eligible foreign mutual funds are selected from the universe of foreign funds that align themselves to the performance of the MSCI All Country World, ex US Index. The index represents either fund’s primary prospectus benchmark or has been determined to track the benchmark based on an analysis of the fund’s style composition (MPT). The MSCI ACWI ex USA Index captures large and mid-cap companies across 22 of 23 developed markets countries (excluding the US) and 26 emerging markets countries. With 2,206 constituents as of June 2019, the index covers approximately 85% of the global equity opportunity set outside the US.

Only the largest single fund or share class managed by an investment management firm is included in the index. Also, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of net assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

The combined assets associated with the ten funds that comprise the index as of June 30, 2019 stood at $14.6 billion and represent about 32.8% of the $44.5 billion in assets sourced to large cap growth, value and hybrid funds that invest in foreign securities, excluding the US.

[/ihc-hide-content]