The Bottom Line: Expressions of interest in sustainable investments may be high, but usage remains low in employer-sponsored defined contribution plans, calling for additional education.

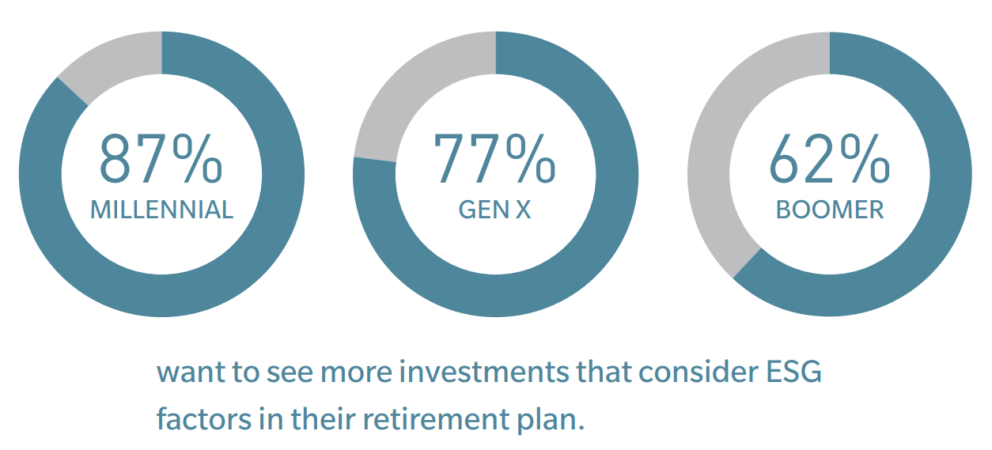

MFS US Retirement Survey, 2022: Interest in more sustainable (ESG) investments in employer-sponsored retirement plans Notes of Explanation: Percentages represent the sum of respondents that chose somewhat interested, very interested and extremely interested. Sources: MFS-The Road to Better Outcomes. Sustainable Research and Analysis LLC.

Notes of Explanation: Percentages represent the sum of respondents that chose somewhat interested, very interested and extremely interested. Sources: MFS-The Road to Better Outcomes. Sustainable Research and Analysis LLC.

Observations:

- Recently referenced, an MFS sponsored survey found that there was strong interest in ESG investments by plan participants in corporate defined contribution plans and an inclination to contribute at higher rates.

- MFS, the mutual fund management company, retained Dynata, an independent third-party research provider, to conduct a defined contribution (DC) survey to shine a light on the concerns and challenges faced by participants in their savings journeys. The survey, conducted between March 15 and April 13, 2022, covered 1,001 DC plan participants. To qualify, DC plan participants had to be ages 18+, employed at least part-time and actively contributing to a 401(k), 403(b), 457, or 401(a). The survey respondents were divided into generational cohorts, as follows: Millennial ages 23-38, Generation X ages 39-54, and Baby Boomer ages 55-73.

- The survey results published by MFS identify two ESG related questions. The first is how interested participants are in seeing more sustainable (ESG) investments offered in their employer-sponsored retirement plan. The second question addressed the likelihood that plan participants would contribute at a higher rate to their workplace retirement fund if the plan offered or included investment options that consider sustainability issues.

- According to MFS, the survey results demonstrate strong participant interest across generational cohorts for investments that consider environmental, social and governance (ESG) factors in the workplace retirement plan. The results show that 87% of millennial investors surveyed want to see more investments that consider ESG factors in their retirement plan and as many as 77% and 62% of Generation X and baby boomers. Most participants indicate that they would contribute at a higher rate if offered investment options that consider ESG issues. On this basis, MFS suggests that plan sponsors should consider the administration of a survey to gauge employee appetite for investments that embrace ESG factors and also offer educational materials that explore the different approaches to sustainable investing.

- Other DC surveys have reached similar conclusions in terms of interest by participants in sustainable fund options. That said, ESG fund options have yet to make significant inroads into the line-up of investment options in corporate defined contribution plans and usage remains low. This may be due to the confusion and misunderstanding that exists in the marketplace regarding sustainable investing as well as the broad variation in sustainability preferences expressed by individuals. As such, DC employer sponsors may wish to lead off with an educational effort at the end of which engaged plan participants should be surveyed regarding their sustainable preferences and expected levels of participation.