Amazon, General Electric and Wells Fargo Attract Negative Coverage Recently and Challenge Sustainable Investors

Last weekend three prominent publicly listed companies, Amazon.com, Inc. (AMZN), General Electric Company (GE), and Wells Fargo & Company (WFC), were the focus of negative articles in The Wall Street Journal as well as The New York Times. The coverage was linked to continuing financial and non-financial sustainability oriented issues. These companies are widely held in actively managed and passively invested equity-oriented portfolios, given their sizable market capitalizations that place them in the top 20 companies of the S&P 500 Index. At the same time, their potential ownership introduces challenging questions for sustainable investors-in terms of whether to own or avoid owning stock in these companies. In the case of Amazon, on top of other past socially oriented concerns, the weekend’s reports invited further questions regarding the firm’s gender diversity and worker treatment practices. In the case of GE, where the coverage was focused on financial performance, sustainability oriented concerns are linked to the company’s involvement with the weapons industry and nuclear power plants. As for Wells Fargo, the articles surfaced new developments and renewed concerns regarding corporate governance, ethics as well as worker and customer treatment. Financial considerations aside, these recent as well as past occurrences and how they are translated into portfolio holdings provide a prism through which it’s possible to gain further insights into the varying approaches

used to evaluate sustainable corporate performance on the part of mutual fund and exchange-traded fund (ETF) managers with explicit sustainable mandates as well as index providers. Given the variations in approach and investment conclusions, in the absence of a universally accepted sustainability framework, this also serves to illustrate the challenges faced by individual and institutional investors who wish to invest sustainably through managed funds but who also want to ensure that their individual preferences are reflected in a given manager’s sustainability strategies and polices. In turn, it suggests that to do so effectively calls upon investors to conduct some degree of independent due diligence.

Sustainability Issues: Line of Business Concerns, Governance, Ethics, Gender Diversity, Worker Treatment and Worker Treatment Issues Surface

To summarize, the following developments were the subject of widespread reporting over the past weekend:

Amazon. After sexual harassment accusations going back to 2015 led to the departure last week of Roy Price, who oversaw Amazon Studios, employees expressed concerns within the firm regarding the dearth of gender diversity within the upper ranks of Amazon which might have contributed to greater leniency toward Mr. Price. This, even as Amazon has taken some steps in recent years to make working at the company more appealing to women. This new development resurfaced concerns regarding Amazon’s gender diversity and worker treatment practices.

General Electric Co. The company, which has seen its stock price drop 25% this year through last Friday and 29.7% through 10/25/2017, announced lower than expected earnings on Friday and also slashed its 2017 projections. At the same time, the company’s chief executive officer John Flannery, who succeeded Jeff Immelt in August, started to outline his plans to restructure the struggling conglomerate. While it is also engaged in such activities as renewable energy and healthcare, GE’s portfolio includes the production of military equipment, such as engines, as well as advanced atomic reactor technologies generally offered through joint ventures.

Wells Fargo & Co. The New York Times reported that a confidential Office of the Comptroller of the Currency preliminary report sent last week criticized Wells Fargo for forcing hundreds of thousands of borrowers to buy unneeded auto insurance when they took out a car loan, for ignoring signs of problems in the auto loan unit as well as its handling of the problems once they were detected. This comes on top of the weekend’s reports of potential problems within Wells Fargo’s foreign exchange business unit and last year’s scandal in which its employees allegedly created over 2 million fake credit card and bank accounts that had not been requested by its customers, eventually leading to the ouster of the bank’s chief executive and regulatory fines in the millions of dollars. Once again, this leads to concerns regarding the firm’s corporate governance, ethics as well as worker and customer treatment.

Examining the Holdings of Sustainable Funds for Insights into these Issues

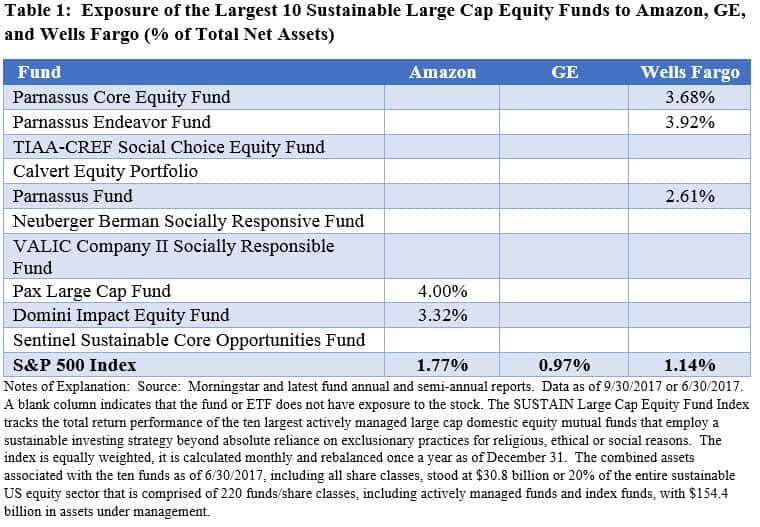

Unless deferring to index providers to construct index funds, each investment management firm offering sustainable mandates will typically frame its distinctive sustainable investing philosophy, develop analytical methods, define relevant and material sustainability factors, identify relevant key performance indicators and data sources, analyze and weight these to arrive at results that are translated into portfolio decisions within the context of a portfolio’s overall investment strategy. That said, financial considerations aside, developments affecting the three companies provide a prism through which it’s possible to gain further insights into the variety of practices that characterize how investors approach the assessment of sustainable corporate performance. To do so, an examination was conducted of the most recent and past holdings of the largest 10 sustainable large cap equity oriented funds with explicit sustainable mandates to identify their positions relative to Amazon, GE and Wells Fargo. These funds are the largest actively managed large cap domestic equity mutual funds that employ a broad-based sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. The funds comprise the SUSTAIN Large Cap Equity Fund Index and account for around 20% of the entire sustainable US equity sector’s assets under management. Refer to Table 1 and also article entitled “Introducing the Sustainable Large Cap Equity Fund Index (SUSTAIN Large Cap Equity Fund Index).

Five Funds Have Exposure to Amazon or Wells Fargo; None to GE

The following observations are based on the examination of the most recent and past holdings of the largest 10 sustainable large cap equity oriented funds with explicit sustainable mandates for the purpose of identifying their positions, if any, in Amazon, GE and Wells Fargo:

- None of the funds have exposure to GE stock. While there may be financial reasons for avoiding GE, especially given recent developments and announcements, each of the ten funds employ exclusionary screens that preclude investments in companies involved in certain activities, including the manufacturing of weapons—which is the case with GE. Some funds, but not all, also explicitly reference the exclusion of companies involved in the construction of nuclear power plants. For example, Neuberger Berman Socially Responsive Fund notes that while these judgments are inevitably subjective, the fund “endeavors to avoid companies that derive revenue from gambling or the production of alcohol, tobacco, weapons, or nuclear power. The fund also does not invest in any company that derives its total revenue primarily from non-consumer sales to the military.” It should be noted that a company’s eligibility for exclusion is determined based on the level of revenue derived from restricted activities. In the absence of specific financial thresholds, such determinations are subject to judgments on the part of the investment advisory firm.

- Two of the eight funds have exposure to Amazon. For years, Amazon has weathered criticism over its worker treatment, recycling practices, its practices with regard to the sale of certain weapons (its prohibited weapons policy has been amended), as well as other sustainability metrics. Financial considerations aside, because of Amazon’s performance around these issues, some sustainable funds do not invest in Amazon. At the same time, other investment management companies will do so, as is the case with Pax and Domini. Domini, for example, holds the view that “sustainability is a journey, and no company is perfect.” Domini is willing to work with companies that face significant challenges but demonstrate a commitment to improve. It does so through its corporate engagement efforts. In the case of Amazon, for example, Domini in 2014 reported that following a Domini-authored letter on behalf of institutional investors as well as further conversations with Domini, Amazon agreed to remove several categories of semi-automatic weapons accessories from its website and to amend its prohibited weapons policy.

- Parnassus and its three sustainable equity funds listed in Table 1 is currently the only management company, out of eight firms, with exposure to Wells Fargo. Parnassus began to accumulate Wells Fargo stock back in May 2016 just ahead of the bank’s initial fake credit card and bank account announcement in September 2016.

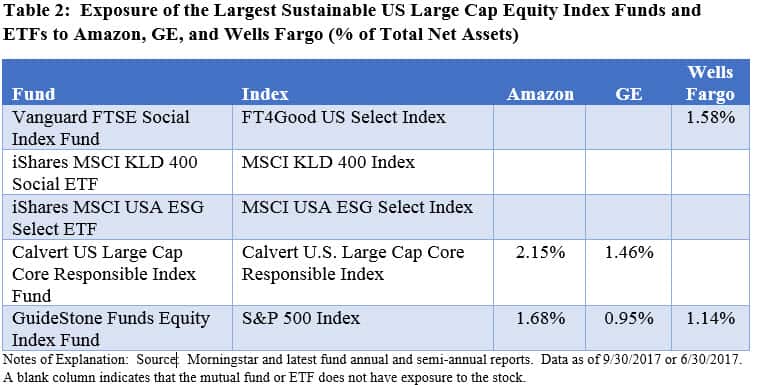

Passively managed sustainable funds, or funds that attempt to replicate the performance of securities market indices, and their securities holdings also illustrate variations based on the index provider’s rules-based evaluation of sustainability and the equities held in the funds. A similar review of recent investments held by the five largest broadly diversified US-based sustainable equity index funds, representing about $7.0 billion and accounting for approximately 82% of the net assets in this segment, illustrates the variation in approaches. Funds tracking the MSCI KLD 400 Index and MSCI USA ESG Select Index did list any exposures to the three companies. On the other hand, three of the five underlying indexes and, in turn, the index funds themselves, maintained exposure to one or more of the three companies. The GuideStone Funds Equity Index Fund, a Christian faith based/ethical index fund with a mandate that relies largely on industry and company exclusions that is overlaid on top of the S&P 500 Index, had exposure to each of the three companies, Amazon, GE and Wells Fargo, as of 9/30/2017. Refer to Table 2.

Aligning Positive Outcomes with a Portfolio Requires Some Investor Due Diligence

When it comes to investing in line with personal values or desired societal outcomes, no two investors, either individual or institutional investors, are expected to be exactly alike. Some may be passionate about mitigating climate change but at the same time they may wish to avoid investing in companies engaged in building atomic power plants while others might be especially concerned about governance, gender diversity and business ethics. Some investors might have an aversion to firms engaged in the production of alcohol, guns, gambling, and tobacco while others may not hold such views or advocate for a different set of excluded industries or companies. Still other investors may gravitate to companies that provide clean water and clean energy while others may be more committed to firms building electric cars or constructing and installing wind turbines.

At the same time, sustainable investors, regardless of whether they choose to invest via actively or passively managed funds, have to recognize that there are variations in the way sustainable investing can be implemented. This, in turn, introduces challenges for investors who have to take an extra step to ensure that their societal goals and objectives are aligned with their investment choices. In addition to conducting financial due diligence either on their own or via the assistance of third parties, investors have to assess and clearly define their sustainability preferences, goals, and objectives. Once they have done so, they will be in a better position to evaluate each investment manager’s/funds’ approaches to sustainable investing to ensure that their individual preferences are aligned with a given manager’s sustainability strategies and polices. Some managers may offer complete and satisfactory levels of transparency in their published documents. In the absence of same, however, a conversation with the management company may be required. Sometimes, it will not be possible to achieve complete alignment between an investor’s personal values or desired societal outcomes. In that case, some compromises will have to be made along the way or a target portfolio might have to be created—one consisting of funds, managed accounts and/or individual securities.