The Bottom Line: New Direxion sustainable ETF with added twist adds to significant 13-month growth in sustainable ETFs that reaches $38.3 billion in net assets.

Sustainable ETFs reach 115 funds with $33.7 billion in assets at year-end 2019 and $38.3 billion at the end of January 2020 but represent a small 2.1% of sustainable mutual fund and ETF assets combined

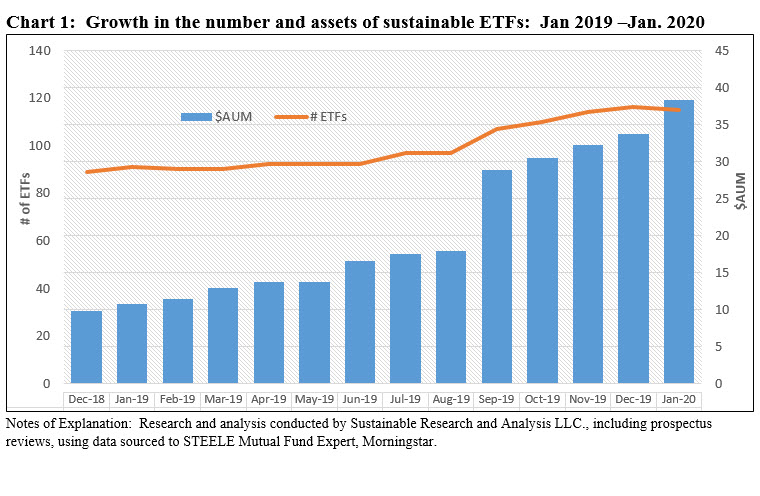

The launch in early February of the passively managed Direxion MSCI USA ESG Leaders vs. Laggards ETF (ESNG) adds a new twist to the current crop of sustainable[1] passive and actively managed exchange-traded funds (ETFs) that seek to replicate the performance results of a broad-based underlying sustainable index, pursue a thematic investment thesis, or employ an active management approach based on financial fundamentals as well as sustainability considerations. The ESNG fund attempts to capture excess returns by emphasizing the thesis that high and positively trending environmental, social and governance (ESG) ratings are correlated with superior accounting and financial results over time. And unlike the 91 passive and 24 actively managed sustainable investment ETFs on offer today, this fund amplifies the bet via leverage using a 150/50 structure, or a ratio of 3:1, to emphasize highly rated ESG companies with positive rating movement while simultaneously selling short poorly rated companies. The fund, which relies on ESG ratings assigned by a single opinion provider, is the latest in a list of 17 sustainable ETF offerings that have come to market in the last 13-months through the end of January 2020. These have elevated the total number of ETFs to 115 funds (excluding ESNG) with $33.7 billion in assets at year-end 2019 and $38.3 billion at the end of January 2020. Refer to Chart 1. Even as it’s off a small base, this represents an increase of $28.5 billion, or 292%, that is attributable to a combination of net new money, including significant investments made by a large European pension fund insurance investor, market appreciation as well as fund re-brandings. Still, at only about 2.1%, ETFs represent a much smaller component of the combined sustainable mutual funds and ETFs industry segment relative to traditional funds, however, this may be a transitionary state due to the rapid shift in sustainable assets due to re-brandings.

Direxion ETF invests in stocks of companies that are highly rated with positive trending ESG scores while shorting poor ESG rated firms

As set out in the fund’s prospectus, the Direxion ETF seeks to provide long exposure to companies with high ESG trend ratings as well as short exposure to companies with poor ESG ratings or subject to extreme controversies or violations of international norms. ESG company ratings and analysis are provided by MSCI, Inc. and the long and short exposures track the composition of the MSCI USA ESG Universal Top –Bottom 150/50 Return Spread Index. The combined index exposure is 150% weighted in favor of highly rated companies with positive trending ESG scores versus a short 50% weight position for the laggards. The index, which normalizes and maintains sector weights consistent with the MSCI USA Index, is reviewed, reconstituted, and rebalanced on a quarterly basis. It remains to be seen what the turnover is likely to be and the extent to which the long-term thesis behind sustainably managed companies may conflict with quarterly rebalancing operations based on shifting ESG scores.

High ESG trend ratings reflect a company’s ESG score based on an evaluation of 37 different key ESG related issues combined with an adjustment to account for score changes from one period to the next. For example, using a scale that ranges from downgrade, to neutral to upgrade, a company’s ESG score from one period to the next is reviewed and an upgrade score is assigned to the company in the event that the score has moved up at least on level. The score is then multiplied by the raw ESG score to arrive at the ESG trend score. On the other hand, the raw ESG score is used in connection with poor ESG scoring companies, however, the universe of poor ESG scoring firms also extends to companies that are found to be in violation of international norms (for example, facing very severe controversies related to human rights, labor rights, or the environment) and/or involved in controversial weapons (landmines, cluster munitions, depleted uranium, and biological and chemical weapons). Long positions will exclude companies assessed by MSCI to be in violation of international norms but such companies can be shorted.

The fund will invest in a basket of securities that reflects the long and short positions but may also utilize derivatives such as swaps or futures contracts to replicate the indexes. On the other hand, the fund’s short position will consist entirely of derivatives. As collateral for any derivative positions, the fund may hold money market funds or short-term debt securities. That said, the basis for qualifying counterparties on the basis of their ESG profiles is not discussed in the prospectus.

By way of illustration, the fund’s assets as of February 14, 2020 stood at $13.5 million, of which $12.3 million is invested in 99 long individual company positions while another $6.7 million is invested in the form of a long swap contract to supplement the fund’s position in highly trending ESG scoring companies, for a combined long position of $19.0 million. Conversely, the fund shorted poor scoring ESG companies via a swap contract in the amount of $6.1 million. In addition, a cash position in the form of about a $529,000 investment in the Bank of New York Cash Reserve Fund serves as collateral for the swap positions.

ETFs and ETF assets expanded in 2019, benefiting from net new money, fund re-brandings and market appreciation, in that order, including the addition of 17 new funds and $4.4 billion in AUM through January 2020

Starting at a low base, ESG ETF offerings and assets under management experienced significant growth in 2019 through January 2020. Assets expanded from $9.8 billion at December 31, 2018 to end year-end 2019 at $33.7 billion and $38.3 billion by January 31, 2020. The number of funds expanded by 29% while assets under management added $28.5 billion, or an increase of 292%.

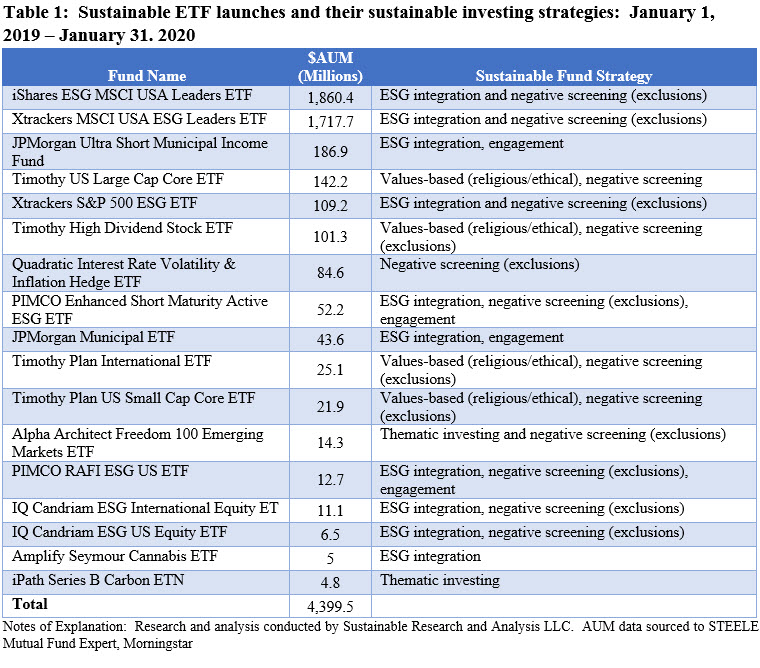

That said, $9.4 billion of the growth was attributable to fund re-brandings while the rest, or $19.1 billion is attributable to market appreciation, and net new money, including new fund formations. Just focusing on 2019 results, a back of the envelope calculation indicates that market appreciation, given 2019’s extraordinary stock and bond market gains, accounted for about 30% of the growth while 70% or so was attributable to net new money. This includes 17 newly launched funds during the course of the year which had risen to register $4.4 billion in assets by the end of January. In this regard, it should be noted that two recent successful launches were jump-started by a single large ESG supportive asset owner. These included the launch of iShares ESG MSCI USA Leaders ETF (SUSL) with $1860.4 million in assets as of January 31 that received an investment of $1.3 billion by Ilmarinen Mutual Pension Insurance Company. In a similar vein, the successful $1.7 billion Xtrackers MSCI USA ESG Leaders Equity Fund, managed by DBX Advisors, a unit of DWS, also benefited from a $1.4 billion investment by the same insurance company. And just this month, it was also reported that BlackRock’s latest ESG ETF offering, the MSCI EM Leaders ETF, was also bolstered by an equally sizable investment made by lmarinen.

Notwithstanding the strong growth registered in 2019 and the first month of January 2020, sustainable ETFs still represent a small 2.1% fraction of the total sustainable mutual funds and ETFs segment relative to the 8X higher 17.1% ratio of ETFs to the conventional mutual funds and ETFs segment combined. This, however, may be a transitory state attributable to the rapid shift in sustainable assets due to re-brandings that occurred starting at the start of 2018.

17 new ETFs in 2019 and 8 ETF liquidations

As noted above, 17 sustainable ETFs were launched in 2019 and through the first month of 2020. 10 of these ETFs adopted an ESG integration approach to sustainable investing, either exclusively or in combination with exclusions or company engagements. These were followed by four values-based investing funds, two thematic funds and one fund employing negative screening (exclusions). Refer to Table 1. There were also 8 ETF closures during the same time interval, consisting of small funds that didn’t manage to lift their assets above $25 million for the largest of the seven funds and marginally, or not at all, operating at break-even. Six of these were thematic funds.

The newly launched Direxion ETF adds yet another fund to the ESG integration roster and it will be instructive to track its performance over time given the fund’s heavy reliance on ESG ratings, amplified positions via leverage and quarterly rebalancing.

[1] While the definition continues to evolve, sustainable investing refers to a range of overarching investing approaches or strategies that encompass values-based investing, negative screening (exclusions), thematic and impact investing, environmental, social and governance (ESG) integration, company engagement and proxy voting. These are not mutually exclusive.