The Bottom Line: Direct indexing is an option for qualifying passive investors seeking to customize portfolios to more precisely meet their sustainability values and preferences.

An introduction to direct indexing

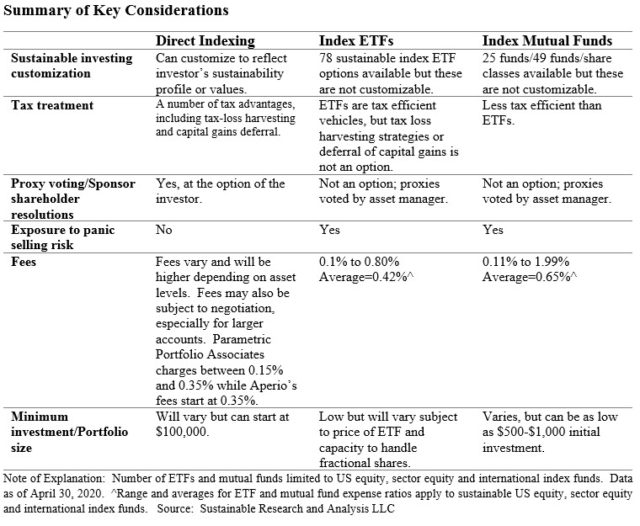

The dislocations in the equity and fixed income markets during the February-March 2020 coronavirus-related market rout brings to mind another potential advantage offered by direct indexing that qualifying sustainable long-term investors, particularly taxable investors, may wish to consider as an alternative or supplement to sustainable passive investing[1] through ETFs or mutual funds. Direct indexing, which refers to the investing approach of owning shares directly by creating a dedicated portfolio of securities to track the performance of an index, avoids the risk of exposing the portfolio to forced selling. That is, investors are insulated from any panic selling on the part of other shareholders in a pooled investment vehicle, such as an ETF or a mutual fund that, in turn, forces managers to sell securities at disadvantageous times and prices as was reported to be the case in some instances during the pandemic induced market panic. Importantly for sustainable index-oriented investors, the direct indexing approach catalyzes the ability to integrate an investor’s financial goals and objectives and their distinctive set of personal sustainable values and preferences. In addition, direct indexing allows investors to take advantage of unique tax benefits and the option to directly exercise their proxy voting rights if they choose to do so. That said, there are some drawbacks that should also be considered. Not only do investors have to be comfortable with the idea of owning securities directly, but this option is currently limited to equity investing and the cost, provided the minimum portfolio size is met, is higher than investing in an index tracking ETF or mutual fund. These considerations are explored below.

Direct indexing is an alternative to passively managed ETFs and mutual funds

Direct indexing represents an alternative to pooled investment vehicles like ETFs and mutual funds while also complementing these as well as investments in actively managed funds. Direct indexing allows investors to establish an individual separately managed account customized to meet the unique needs of each client based on their sustainability values or preferences. Once these have been identified along with the desired market segment exposure, such as a large cap stock segment via the S&P 500, large and medium sized stock segment through the Russell 1000 or foreign stocks via the MSCI EAFE Index, to mention just a few, a subset of securities is created, qualified by the client’s values. This is achieved by using a mathematical optimization program designed to deliver index like results with limited tracking error. Indeed, the key is being able to reach the optimal balance between the investor’s values and tracking error, or correlation between the portfolio and its underlying index. The individual securities are held directly by the investor in a separately managed account.

Recent technological innovations have made it possible to automate much of the direct indexing workload and, in the process, to deliver the product to a broader base of investors, with smaller account minimums and lower fees. However, this is not an option for all investors as it’s only practical for investors that meet the minimum portfolio level requirements. Also, this approach is largely, if not entirely, limited to equity portfolios since direct indexing has not as yet been extended to fixed income.

Owning a stock portfolio directly insulates investors from market volatility and investor panics

As news regarding the spread of the coronavirus and its potential impact began to sink in, markets started to plunge, volatility spiked and investors sought safety in US Treasury securities and liquidity options such as money market funds. For example, on March 11th the Dow Jones Industrial Average dropped 1,400 points, or 5.6%, as the World Health Organization declared the fast-spreading coronavirus a global pandemic. Investors raised cash and de-risked while redemptions from mutual funds and ETFs spiked. In the process, portfolio managers had to sell stocks and bonds to liquefy portfolios and meet investor redemptions. In fixed income, some bond ETFs were highlighting signs of liquidity stress in broader markets, with cash prices trading at persistent and deep discounts to the value of the underlying assets. Some money market funds froze and had to be bailed out.

Whereas mutual fund and ETF investors are, in any case, exposed to the risks of price declines, they also have to bear the consequences of portfolio selling in a stressful market that results in wider bid-asked spreads and the realization of gains or losses allocated to all shareholders. In a mutual fund, these are normally distributed at year-end to all investors. This is also the case for ETFs, however, these are structured to operate as more tax-efficient investment vehicles by limiting the realization of gains or losses via the share creation/redemption process that mitigates the consequences of selling and buying securities directly. A dedicated direct indexing portfolio doesn’t protect a client from price declines, but it does mitigate against having to incur losses by selling securities to meet redemptions.

Direct indexing permits customization to suit an investor’s sustainability values and preferences

In the case of index tracking sustainable mutual funds or ETFs, an underlying conventional index such as the S&P 500 is modified pursuant to a set of guidelines or sustainable principles formulated by the index provider using a proprietary set of rules, including, as applicable, reliance on environmental, social and governance (ESG) scores to qualify securities. For example, sustainable indexes might be limited or qualified as to companies with the highest or best ESG scores in each industry or sector, companies deemed to be low carbon emitters, or firms engaged in renewable energy, to mention just a few. At the same time, such indexes may avoid certain companies based on their line of business, as defined by the index provider, such as tobacco companies, alcohol producers or utilities operating nuclear power plants. In any case, the guidelines and any restrictions are defined by the index provider. Direct indexing, on the other hand, enables each individual client to formalize their own sustainable investing principles and values and create an index portfolio that more precisely meets their sustainability preferences. Financial considerations aside, clients can emphasize particular themes, exclude individual securities or companies, sectors or industries ranging from weapons to oil and gas exploration companies, or emphasize investing in companies that are aligned with broad societal goals to address poverty, hunger, education or climate, to mention just a few. Yet another approach may be to invest in companies with high ESG scores or companies whose scores are on the rise. The possibilities are many and are only constrained by the trade-off between an investor’s values and the portfolio’s tracking error.

Tax minimization benefits include tax loss harvesting and tax management

Direct indexing offers a number of tax advantages, including enabling tax‑loss harvesting. For taxable investors, one of the key benefits to direct indexing is the ability to maximize after tax-returns by taking advantage of tax efficient trading methodologies such as tax-loss harvesting. Tax loss harvesting refers to selling a security that has lost value in order to offset capital gains on the investor’s tax return. This can take effect regardless of the overall market movement, either flat or up. Another tax minimization strategy accrues to investors in that they have the ability to set parameters around the amount of capital gains they will incur per year. This allows the capital gains to be spread out across a period of time, rather than realized all at once.

Direct indexing investors may exercise voting rights and initiate shareholder actions

Because investors directly own the underlying securities in their portfolio, they are entitled to vote on matters of corporate policy, including decisions on the makeup of the board of directors, issuing securities, selection of public accounting firms, executive compensation, initiating corporate actions and making substantial changes in the corporation’s operations, in proportion to the number of shares they own. Sustainable investors in particular will have the opportunity to vote on various ESG issues that have increasingly found their way into corporate proxy statements. Or investors can take advantage of another avenue to become change agents by becoming sponsors, co-sponsors or endorsers of specific shareholder resolutions. These options are not available to investors in mutual funds or ETFs.

According to a recent report published by Harvard University, between 2015 and 2019, 1,033 shareholder-initiated ESG resolutions were voted on at U.S. company annual General Membership Meetings, an average of 207 per year. Investors can exercise their votes on these as well as additional ballot items. Alternatively, this responsibility may be delegated to the chosen service provider.

In addition to voting proxies, direct shareholders can become sponsors, co-sponsors, or endorsers of specific shareholder resolutions to drive further change at companies.

Leading direct indexing providers: Parametric Portfolio Associates and Aperio Group

There is now a growing list of firms, large and small, that offer a direct indexing service. These range from Charles Schwab to a 2015 start-up, Ethic, Inc., now indirectly owned by Fidelity Management (FMR). That said, the two largest and oldest firms operating in this space with an emphasis on sustainable investing are Parametric Portfolio Associates and Aperio Group.

Parametric Portfolio Associates is a Seattle, Washington-based company that was founded in 1987 and now operates as a wholly-owned indirect subsidiary of Eaton Vance Corp. (EVC), a publicly held asset management company. Parametric lists a combined total of 512 employees and $266 billion in assets under management as of May 1, 2020. Its stated fees for direct indexing services typically range between 0.15% and 0.35% of assets under management. Other service fees may apply.

Aperio Group is a Sausalito, California-based firm that was founded in 1999. It operated as an independent company until the purchase of a majority of its outstanding equity by a private equity group in a transaction that closed in October 2018. Aperio’s combined staff consists of 100 employees and the firm is reported to manage $34.5 billion as of March 13, 2020. Aperio focuses on the higher end of the ultra-net worth space and customizes portfolios for each client. Its fees for direct indexing services start at 0.35% and are subject to various considerations that should be discussed with the company.

Conclusion

Direct indexing is an option available to all qualified passive investors, but for sustainable investors in particular, this investing option empowers them to integrate a set of uniquely personal sustainable values and preferences on top of meeting financial goals and objectives into the portfolio construction process. In addition, direct indexing allows investors to insulate their portfolios from the risks due to forced selling, take advantage of unique tax benefits and offers the option to directly exercise their proxy voting rights if they choose to do so. That said, there are some drawbacks that should also be considered. Not only do investors have to be comfortable with the idea of owning securities directly, but this option is currently limited to equity investing and the cost, provided the minimum portfolio size is met, is higher relative to investing in an index tracking ETF or mutual fund.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. Each of these may also employ shareholder/bondholder engagement and proxy voting strategies. These are not mutually exclusive.