The Bottom Line: Moody’s latest report shows the varying credit impacts of environmental, social and governance (ESG) considerations applicable to more than 10,400 rated entities.

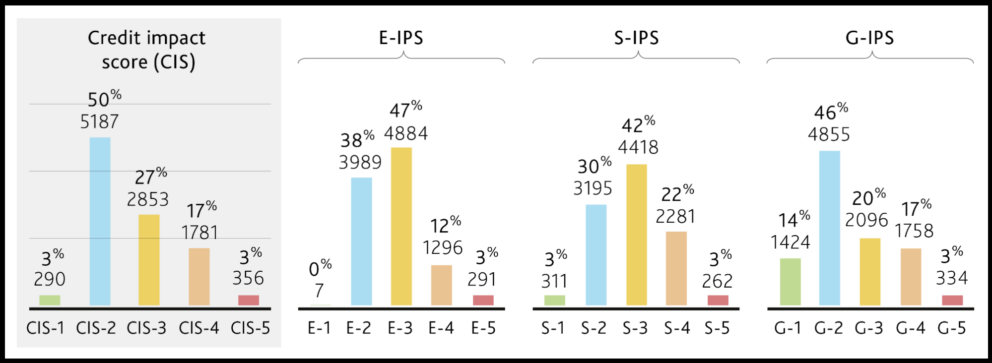

Distribution of Moody’s credit impact scores and issuer profile scores as of March 31, 2023

Notes of Explanation: Based on ESG scores of 10,467 rated entities, as of 31 March 2023. IPS scores measure issuer’s exposure to ESG considerations that could be material to credit risk, while CIS gauges the impact those ESG considerations have on an issuer’s credit rating. Both CIS scores and ESG scores run on a five-point scale: 1 is positive, 2 is neutral-to-low, 3 is moderately negative, 4 is highly negative and 5 is very highly negative. Source: Moody’s Investors Service

Notes of Explanation: Based on ESG scores of 10,467 rated entities, as of 31 March 2023. IPS scores measure issuer’s exposure to ESG considerations that could be material to credit risk, while CIS gauges the impact those ESG considerations have on an issuer’s credit rating. Both CIS scores and ESG scores run on a five-point scale: 1 is positive, 2 is neutral-to-low, 3 is moderately negative, 4 is highly negative and 5 is very highly negative. Source: Moody’s Investors Service

Observations:

- Last week Moody’s Investors services published its observations as of March 31, 2023 of the credit impact of environmental, social and governance (ESG) considerations applicable to more than 10,400 rated entities, including corporates, sovereigns, sub-sovereigns as well as project and infrastructure finance. These cut across both investment and non-investment grade credits and are based on Moody’s assigned credit impact scores and issuer profile scores. The distributions by number of entities or assets covered, by sector or credit rating categories are not provided.

- According to Moody’s, ESG risks do not have a material impact on the ratings of half of rated entities. As for the rest, ESG considerations have a material credit impact on nearly a quarter of rated entities. The impact is highly negative or very highly negative for 20% of rated entities and positive for 3% – that is, their credit ratings are lower or higher because of ESG considerations. For 27% of rated entities, ESG risks have a limited impact on the current rating, with potential for greater adverse impact over time.

- The credit impact of ESG risks is most pronounced for corporates, sovereigns and sub-sovereigns, with nearly 50% of corporates and about 30% of sovereigns and sub-sovereigns affected either positively or negatively. On the other hand, ESG considerations, according to Moody’s, do not have a material impact on the ratings of most financial institutions and US public finance entities.

- Non-investment grade entities have a greater risk exposure to ESG considerations.

- Governance issues tend to have more influence on credit strength and ratings than environmental and social risks.

- For fixed income investors, fundamental factors such as interest rates, general market conditions, maturity, structure, call provisions and liquidity, in addition to credit ratings, all contribute to bond valuations and understanding how these factors interact play a role in informing investment decisions. Adding another level of transparency to the impact that material ESG issues can have on issuer credit assessments is informative and valuable. At the same time, issuer level ESG risk assessments must be disentangled on a case-by-case basis to account for issue level characteristics, such as structure and maturity, as part of the fixed income security evaluation and selection process.