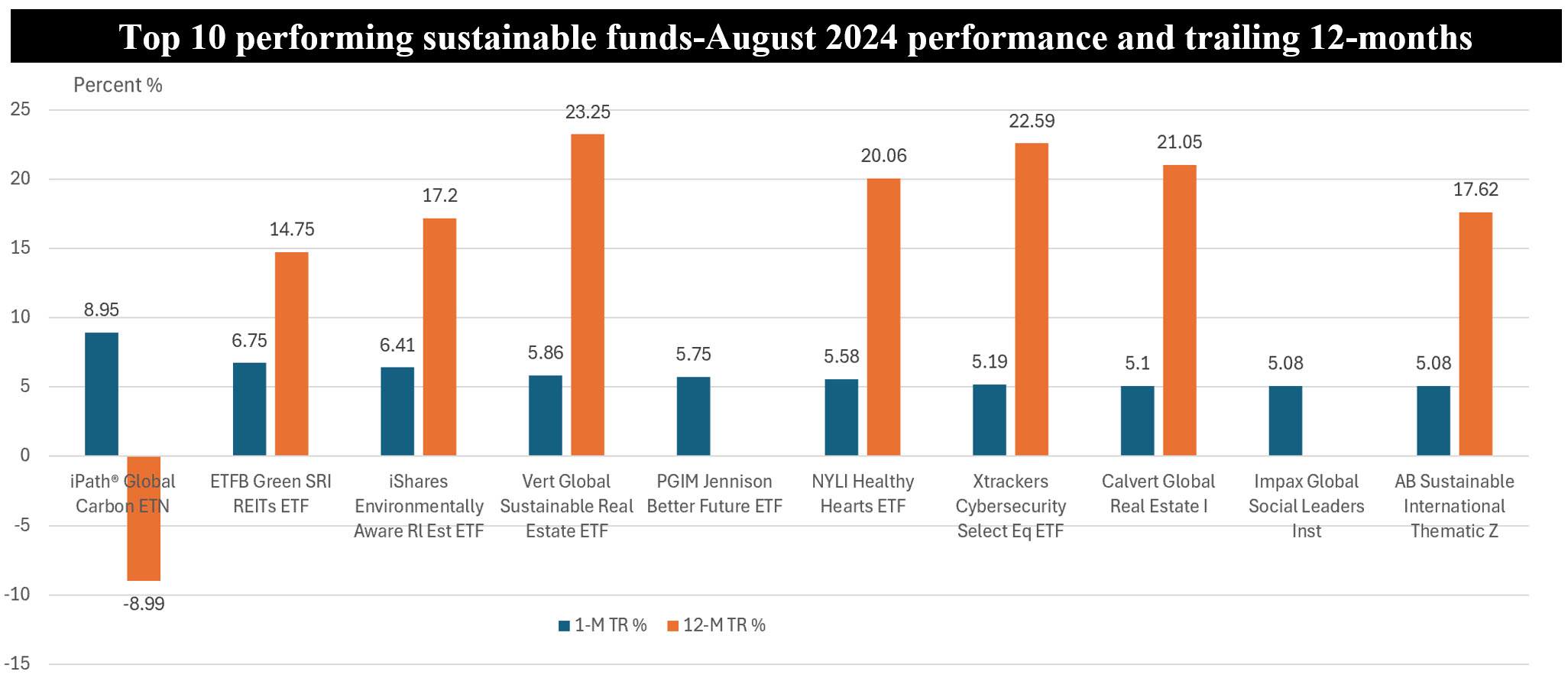

The Bottom Line: Top 10 performing funds in August were led by real estate funds that could further benefit from lower interest rates and inflation.

Notes of explanation: Funds arrayed in order of August 2024 total return performance results. PPGIM Jennison Beter Future ETF and Impax Global Social Leaders Institutional Fund were launched within the last year and have not as yet established a full-year’s track record. Sources: Sustainable Research and Analysis LLC., fund prospectus documents and Morningstar Direct.