The Bottom Line: Sustainable large cap growth funds exposure to some of the market’s top performers so far in 2023 drove their average 14.9% results.

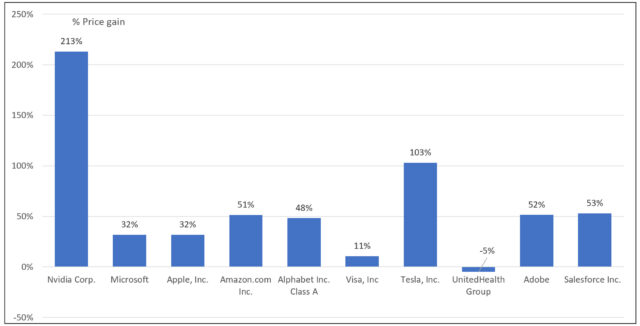

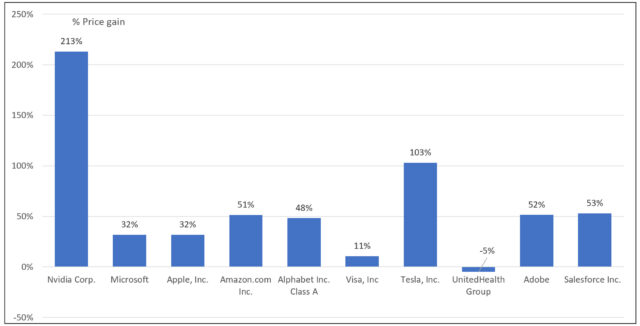

Top 10 stocks held by the best performing sustainable large cap growth funds: September 30, 2023 Notes of Explanation: Stocks listed based on the number of top performing funds holding the stock as of September 30, 2023. For example, each of the top 10 sustainable large cap growth funds held Nvidia, Inc. Percentage gain has been rounded. Top 10 performing sustainable large cap growth funds include: Invesco ESG NASDAQ 100 ETF, Xtrackers S&P 500 Growth ESG ETF, ClearBridge Large Cap Growth ESG ETF, BlackRock Sustainable US Growth Equity Fund, Parnassus Growth Equity Fund, American Century Sustainable Growth ETF, Fisher IIG US Large Cap Eq Env & Social Val Fund, ClearBridge All Cap Growth ESG ETF, Nuveen ESG Large-Cap Growth ETF and US Vegan Climate ETF. Data as of September 30, 2023. Sources: Sustainable Research and Analysis, Yahoo Finance and Morningstar Direct.

Notes of Explanation: Stocks listed based on the number of top performing funds holding the stock as of September 30, 2023. For example, each of the top 10 sustainable large cap growth funds held Nvidia, Inc. Percentage gain has been rounded. Top 10 performing sustainable large cap growth funds include: Invesco ESG NASDAQ 100 ETF, Xtrackers S&P 500 Growth ESG ETF, ClearBridge Large Cap Growth ESG ETF, BlackRock Sustainable US Growth Equity Fund, Parnassus Growth Equity Fund, American Century Sustainable Growth ETF, Fisher IIG US Large Cap Eq Env & Social Val Fund, ClearBridge All Cap Growth ESG ETF, Nuveen ESG Large-Cap Growth ETF and US Vegan Climate ETF. Data as of September 30, 2023. Sources: Sustainable Research and Analysis, Yahoo Finance and Morningstar Direct.

Notes of Explanation: Stocks listed based on the number of top performing funds holding the stock as of September 30, 2023. For example, each of the top 10 sustainable large cap growth funds held Nvidia, Inc. Percentage gain has been rounded. Top 10 performing sustainable large cap growth funds include: Invesco ESG NASDAQ 100 ETF, Xtrackers S&P 500 Growth ESG ETF, ClearBridge Large Cap Growth ESG ETF, BlackRock Sustainable US Growth Equity Fund, Parnassus Growth Equity Fund, American Century Sustainable Growth ETF, Fisher IIG US Large Cap Eq Env & Social Val Fund, ClearBridge All Cap Growth ESG ETF, Nuveen ESG Large-Cap Growth ETF and US Vegan Climate ETF. Data as of September 30, 2023. Sources: Sustainable Research and Analysis, Yahoo Finance and Morningstar Direct.

Notes of Explanation: Stocks listed based on the number of top performing funds holding the stock as of September 30, 2023. For example, each of the top 10 sustainable large cap growth funds held Nvidia, Inc. Percentage gain has been rounded. Top 10 performing sustainable large cap growth funds include: Invesco ESG NASDAQ 100 ETF, Xtrackers S&P 500 Growth ESG ETF, ClearBridge Large Cap Growth ESG ETF, BlackRock Sustainable US Growth Equity Fund, Parnassus Growth Equity Fund, American Century Sustainable Growth ETF, Fisher IIG US Large Cap Eq Env & Social Val Fund, ClearBridge All Cap Growth ESG ETF, Nuveen ESG Large-Cap Growth ETF and US Vegan Climate ETF. Data as of September 30, 2023. Sources: Sustainable Research and Analysis, Yahoo Finance and Morningstar Direct. Observations:

- Sustainable large cap growth funds gave up an average of 5.6% in September when the S&P 500 recorded a decline of 4.9%, its worst month this year as concerns regarding economic growth, inflation and higher for longer interest rates overtook market sentiment. Still, outside the long-short equity fund segment consisting of one sustainable fund that registered an average year-to-date gain of 17.3% across its three share classes, sustainable large cap growth funds are the best performing segment year-to-date.

- Comprised of some 76 mutual funds/share classes and ETFs with $27.1 billion in net assets, the segment registered an average gain of 14.9% since the start of the year. Returns ranged from a low of 9.3% recorded by the Mirova US Sustainable Equity Fund C to a high of 35.2% registered by Invesco ESG NASDAQ 100 ETF. The top 10 funds in the segment posted an even more impressive average gain of 25.7% year-to-date.

- Like the limited number of stocks that had been driving the performance of the broad market since the start of the year, for example, stocks like the best performing Nvidia Corp., up 213%, Meta Platforms, Inc Class A, up 149% or Tesla, Inc., up 103%, the best performance results year-to-date posted by sustainable large cap active and passively managed mutual funds and ETFs were recorded by funds with investments concentrated in some of the best performing growth stocks.

- Nvidia, Inc., benefiting from the artificial intelligence boom, was the most widely held stock, found in each one of the top 10 performing sustainable large cap growth funds, with levels of investment ranging from a low of 4.33% in the Parnassus Growth Equity Fund to a high of 7.19% held in the BlackRock Sustainable US Growth Equity Investment Fund.

- Nvidia was followed by holdings across eight to nine funds of Microsoft, Apple and Amazon with exposures of fund assets ranging from 2.57% to a high of 14.4%.