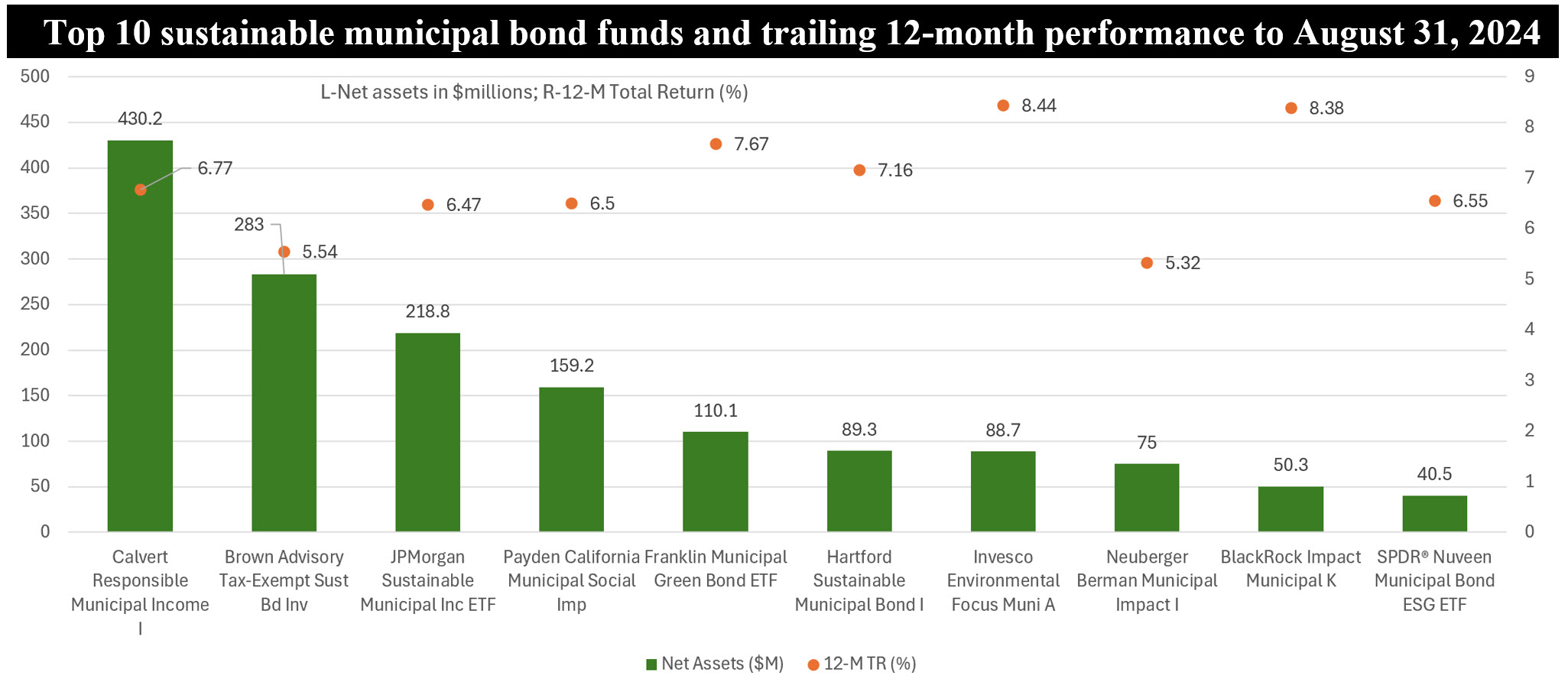

The Bottom Line: Returns of sustainable municipal bond funds, a small $1.7 billion category with room to grow, rebounded from a poor 2024 first half.

Notes of explanation: Notes of explanation: Top 10 municipal bond funds as of August 31, 2024. Returns are to August 31, 2024. Sources Morningstar Direct, fund prospectuses, Sustainable Research and Analysis LLC.