The Bottom Line: Methodologies used to analyze the outperformance or underperformance of sustainable and conventional mutual funds and ETFs may produce distortions and skew outcomes.

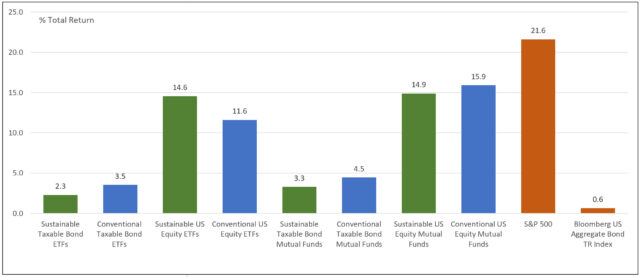

Average 12-month performance of actively managed sustainable and conventional funds-Taxable bond funds and US equity funds across mutual funds and ETFs  Notes of Explanation: Sustainable funds based on Morningstar’s classification. Data as of September 30, 2023, and performance results represent the arithmetic average. Sources: Sustainable Research and Analysis, Yahoo Finance and Morningstar Direct.

Notes of Explanation: Sustainable funds based on Morningstar’s classification. Data as of September 30, 2023, and performance results represent the arithmetic average. Sources: Sustainable Research and Analysis, Yahoo Finance and Morningstar Direct.

Notes of Explanation: Sustainable funds based on Morningstar’s classification. Data as of September 30, 2023, and performance results represent the arithmetic average. Sources: Sustainable Research and Analysis, Yahoo Finance and Morningstar Direct.

Notes of Explanation: Sustainable funds based on Morningstar’s classification. Data as of September 30, 2023, and performance results represent the arithmetic average. Sources: Sustainable Research and Analysis, Yahoo Finance and Morningstar Direct. Observations:

- Sustainable funds outperformed their conventional counterparts over the twelve-month period ended September 30, 2023 across just one out of four broad categories consisting of actively managed mutual funds as well as ETFs. The two broad categories that are examined here are restricted to taxable bond funds as well as US equity funds, further dimensioned into ETFs and mutual funds. In these instances, the average performance of actively managed sustainable US equity ETFs exceeded the average total return results achieved by their conventional counterparts by 3 percent. Otherwise, conventional funds outperformed. Average weighted calculations did not change relative results.

- That said, comparative results regarding the outperformance or underperformance of sustainable mutual funds and ETFs that key off reliance on entire asset classes or broad fund categories such as taxable bond funds or US equity funds, to name just two, may be subject to distortions that will influence the outcomes.

- Even before examining structural market factors that may contribute to periods of outperformance or underperformance, how various issues such as how to define sustainable funds, the inclusion or exclusion of actively managed and passively managed funds, combining ETFs and mutual funds into one group, including and excluding open-end funds and closed end funds, can lead to different and skewed results. In addition, reliance on averages, selection of time horizon(s) under consideration, differences in the profile of fund categories, including significant variation in fund sizes and differences in the number of funds in each category, will also impact fund level results. The latter are especially important because sustainable funds are not as mature as conventional funds and fund categories, number of funds and fund sizes, which tend to me much smaller, can vary significantly and tilt the results.

- As a result, studies claiming trends of outperformance by sustainable funds compared to conventional funds should be approached cautiously and examined very critically by investors.