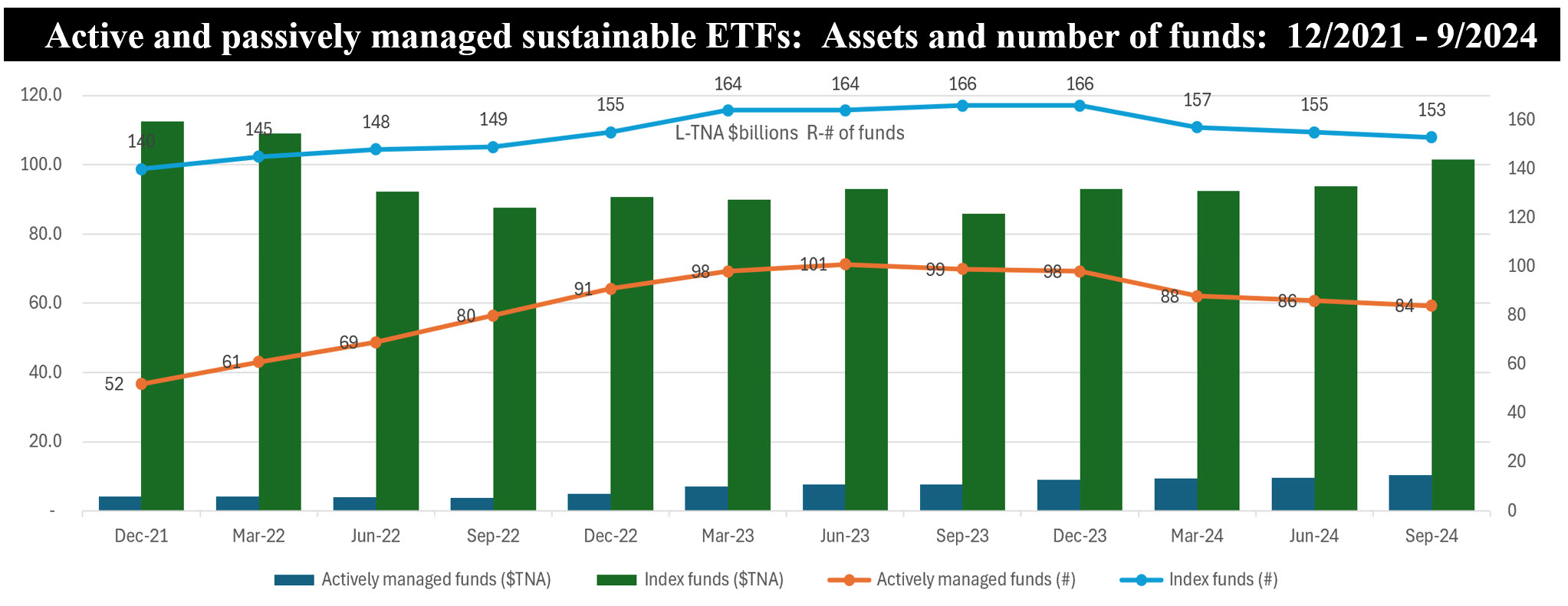

The Bottom Line: Actively managed sustainable ETFs have also been gaining, even as higher priced active management fail, in most cases, to beat the market.

Notes of explanation: The decline in the number of passive and actively managed ETFs funds is due to fund liquidations, most typically because funds fail to achieve scale to break even economically (net of seed capital). Sources Morningstar Direct, fund prospectuses, Sustainable Research and Analysis LLC.