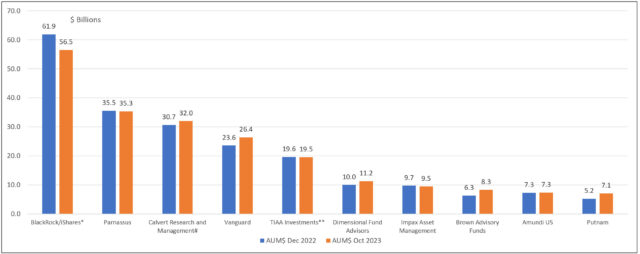

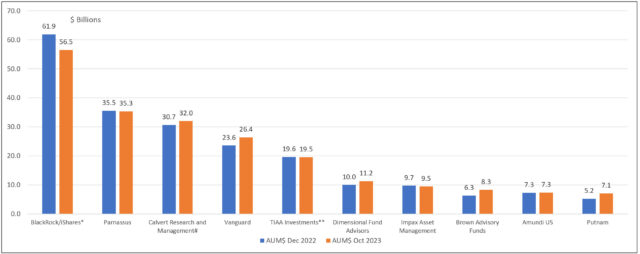

The Bottom Line: Lineup and assets of the top 10 managers of sustainable funds have experienced some but limited changes since the start of year.

Net assets attributable to the top 10 sustainable mutual fund and ETF managers: December 31, 2022, and October 31, 2023  Notes of Explanation: Net assets as of December 31, 2022 and October 31, 2023. *BlackRock and iShares assets combined. #Owned by Morgan Stanley. **TIAA and Nuveen assets combined. Source: Morningstar Direct, Sustainable Research and Analysis LLC..

Notes of Explanation: Net assets as of December 31, 2022 and October 31, 2023. *BlackRock and iShares assets combined. #Owned by Morgan Stanley. **TIAA and Nuveen assets combined. Source: Morningstar Direct, Sustainable Research and Analysis LLC..

Notes of Explanation: Net assets as of December 31, 2022 and October 31, 2023. *BlackRock and iShares assets combined. #Owned by Morgan Stanley. **TIAA and Nuveen assets combined. Source: Morningstar Direct, Sustainable Research and Analysis LLC..

Notes of Explanation: Net assets as of December 31, 2022 and October 31, 2023. *BlackRock and iShares assets combined. #Owned by Morgan Stanley. **TIAA and Nuveen assets combined. Source: Morningstar Direct, Sustainable Research and Analysis LLC.. Observations:

- Since the start of the year to the end of October, the lineup in the roster consisting of the top 10 managers of sustainable mutual funds and ETFs has experienced some, but limited changes. At the end of October, the top 10 firms managed $213.1 billion in sustainable fund assets under management, out of $305 billion invested in the segment. This is down from $213.4 billion at year-end 2022. The firms retain their dominance in the sustainable investing sphere, accounting for a market share of 70% in net assets versus 71% at the end of 2022.

- Sustainable mutual funds and ETFs posted an average gain of 0.39% since the start of the year. At the same time, the top 10 sustainable fund firms experienced estimated net withdrawals of $1.5 billion, or 0.70%. This is calculated assuming the lineup of funds remained the same over the two time periods.

- The composition of the top 10 firms experienced two changes. Invesco, which had been the 8th largest sustainable fund firm at the end of 2022 dropped out and was replaced by Putnam Investments with $7.1 billion in assets under management. Invesco gave up $2.2 billion in net assets, largely attributable to the decline in assets experienced by Invesco Solar ETF which dropped $1.2 billion due to market depreciation. The fund, along with other sustainable energy funds and their stock holdings suffered from higher interest rates, supply-chain issues, inadequate electric transmission infrastructure and competition from China, posted a significant year-to-date decline of 42.6%. At the same time, Brown Advisory moved up to take Invesco’s spot with its gain of some $2.0 billion. Brown Advisory ended October with $8.3 billion in sustainable fund assets under management.

- Firms gaining the most assets during the ten-month interval were Vanguard, Brown Advisory and Calvert Research & Management, in that order. At the same time, assets under management at BlackRock, including iShares, and Invesco, dropped by $5.4 billion and $2.2 billion, respectively.