The Bottom Line: Investors in sustainable taxable mutual funds and ETFs exhibited a level of stickiness during a very challenging six-month period for fixed income.

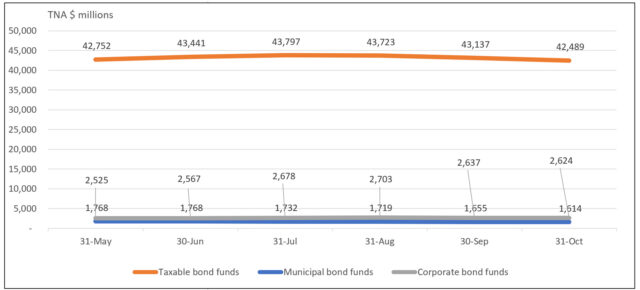

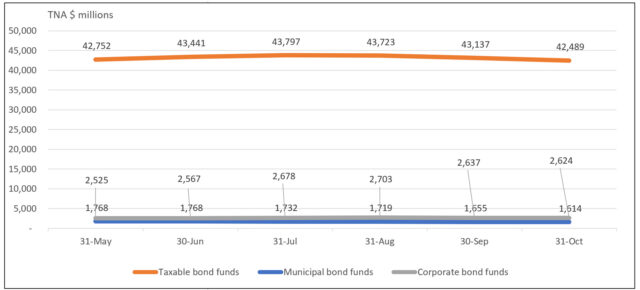

Net assets of sustainable taxable and municipal bond funds: May 31, 2013 – October 31, 2013

Notes of Explanation: Bond funds include mutual funds and ETFs. Source: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Bond funds include mutual funds and ETFs. Source: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Bond funds include mutual funds and ETFs. Source: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Bond funds include mutual funds and ETFs. Source: Morningstar Direct, Sustainable Research and Analysis LLC. Observations:

- With concerns in October centered on Q3 corporate earnings and projected earnings, interest rates and the state of the economy, stocks fell for the third consecutive month while bonds experienced their sixth consecutive monthly decline. Short-dated government instruments aside, the bond market gave up almost 1.6% in October, based on the Bloomberg US Aggregate Bond Index total return results, as 10-year treasury yields briefly touched 5% mid-month before settling at 4.88% on October 31st. For the trailing 6-month period, bonds posted a decline of 6.13%.

• Against this backdrop, the FT reported on Friday that investors, according to data compiled by BlackRock, withdrew a record $9.4 billion from corporate bond exchange-traded funds in October, “shifting to lower-risk government bonds as lending rates hit 16-year highs.”

• Unlike conventional funds, sustainable taxable bond funds, including sustainable corporate bond funds, which posted six-month average declines of 3.1% and 4.8%, respectively, exhibited a high level of stickiness during this interval. On the other hand, sustainable municipal bond funds registered withdrawals. The segment, which gave up 4.1% over the trailing six months, recorded a decline in net assets in the amount of $154 million or 9%.

• Sustainable corporate bond mutual funds and ETFs actually experienced a pick-up in assets, gaining $98 million or 4%. The gains were registered by both mutual funds and ETFs.

• A more stable shareholder base limits the need to sell securities at reduced prices to meet redemptions and preserves the opportunity to benefit from a turnaround in bond prices.