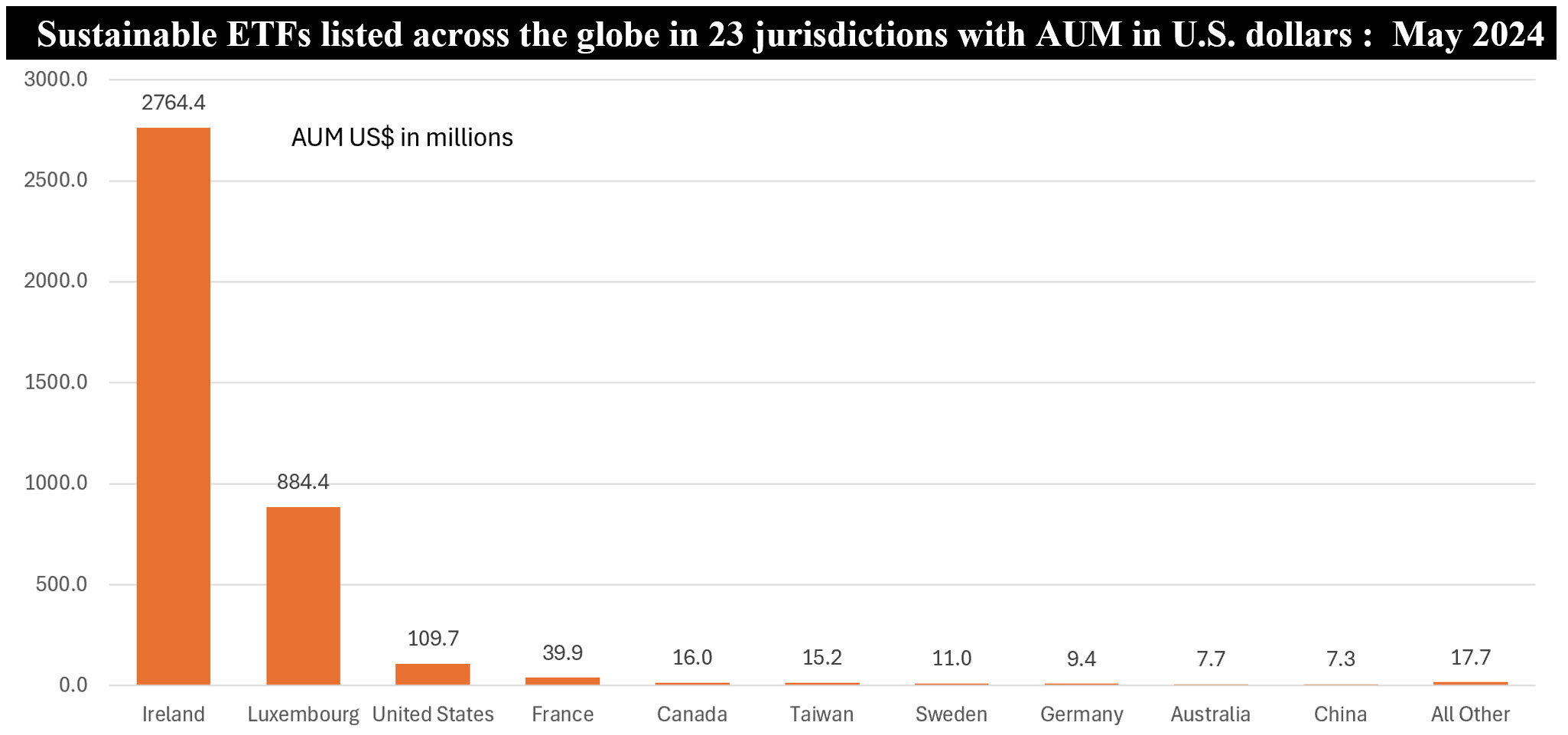

The Bottom Line: Sustainable ETFs listed across the globe in 23 jurisdictions with $US3.9 trillion in assets under management are dominated by 10 management firms.

Notes of explanation: Assets under management denominated in US dollars as of early May 2024. All Other includes Netherlands, Switzerland, Japan, Mexico, Singapore, South Korea, HK, New Zealand, South Africa, India, Brazil, Chile and Indonesia, listed in descending order. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

Global sustainable ETFS stood at $US 3.9 trillion at the start of May 2024

Global sustainable fund assets managed through ETFs stood at $US 3.9 trillion at the start of May 2024, based on Morningstar classifications. 4,590 funds are listed across 23 domiciles, including cross border listings in Luxembourg and Ireland.

The top 10 domiciles, including Ireland and Luxembourg, account for just about 100% of assets with which, in descending order, are led by Ireland (71%), Luxembourg (23%), U.S. (3%) and France (1%). The top 10 domiciles account for almost $US3.9 trillion in assets under management while the top four domiciles make up $US 3.8 trillion in assets under management.

Index tracking and equity funds dominate globally

Index tracking funds dominate globally, by fund count and assets under management, with 4,022 ETFs and $US3.6 trillion in assets under management. On the other hand, there are 569 actively managed sustainable ETFs with $US320 billion in assets, led by Ireland with $US302.5 billion, followed by the U.S. with 92 funds and $US9.1 billion and Canada with 46 funds and $6.0 billion in assets under management

Globally, equity oriented sustainable ETFs account for almost $US3.1 trillion in assets and make up 79% of assets under management. Fixed income ETFs and fund vehicles investing in commodities follow, with 21% and a distant 0% share, respectively. But there are significant variations by domicile. For example, South Korea equity ETFs hold 54% of assets while fixed income ETFs make up 39%. In the US, on the other hand, sustainable equity ETFs maintain an 89% share while fixed income falls just short of 10%.

BlackRock dominates by assets and the largest funds

While about 234 firms worldwide offer sustainable ETF investment products distributed under 186 brand names, the top 10 branded offerings account for $US3.6 trillion or 92% of assets under management. Global leaders include BlackRock that towers over the rest of the field with US$1.5 trillion, followed by Amundi and UBS with $US633.5 billion and $US528.6 billion, respectively. Together, there three firms manage over two-thirds of global sustainable ETFs.

BlackRock also rules the listing of the largest managed funds, offering six of the largest ten funds globally. These are all index funds, the largest being the $90.7 billion iShares MSCI USA ESG Enhanced ETF USD. Deutsche Bank, UBS and J.P. Morgan Asset Management also land spots with some of the world’s largest sustainable ETFs which, except for the tenth largest actively managed $US42.5 billion JPM US Research Enhanced Equity ESG ETF USD, are also MSCI index tracking funds.