The Bottom Line: With additional room for growth for sustainable bond funds, investors can expect to benefit in time from additional fund offerings and categories.

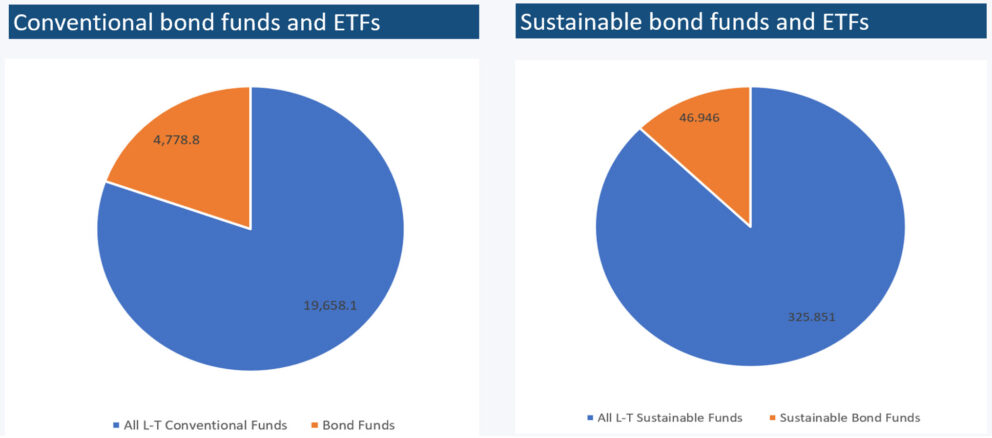

Conventional and sustainable bond funds versus their respective long-term universe of funds sustainable funds

Notes of Explanation: Data covers long-term funds (money market funds are excluded), as of December 2023. Left hand chart is in US$ billions while the right-hand chart is in US$ millions. Sources: Investment Company Institute, Morningstar Direct, Sustainable Research and Analysis LLC.

Observations:

- Conventional fixed income mutual funds and ETFs have accumulated $4.8 trillion in assets under management as of year-end 2023 and account for 24% of all long-term mutual funds and ETF assets under management—a combined total of $19.8 trillion.

- By way of comparison, sustainable bond mutual funds and ETFs, at $46.9 billion as of the same date, account for a smaller 14% of long-term sustainable fund assets under management. This suggests that there is additional room for growth for sustainable bond funds. For example, by expanding the government funds category and/or introducing various iterations of municipal bond funds along state and credit quality lines, to mention just a few, are not currently available to investors in the sustainable bond funds segment.

Sustainable bond funds are concentrated across fund firms, fund categories as well as funds. - The top 10 firms of 57 firms that offer sustainable bond funds, manage $38.4 billion and account for 82% of assets. At the same time, the top three sustainable fund categories, including Intermediate Core Bond, Intermediate Core-Plus Bond and Short-Term Bond funds, managed a combined total of $31.2 billion that account for 66% of assets under management.

- The largest ten sustainable bond funds, consisting of both active and passively managed funds, such as the TIAA-CREF Core Impact Bond Fund at $6.3 billion as well as the second largest iShares ESG U.S. Aggregate Bond ETF at $3.6 billion, manage over 50% of the segment’s assets under management.