The Bottom Line: The segment of sustainable municipal ETFs expanded in May and turned in positive monthly performance results for the first time in 2022.

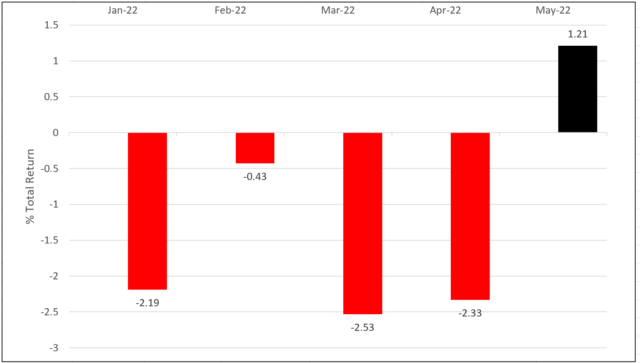

Sustainable municipal ETFs: Average total return performance January 1, 2022 – May 31, 2022

Notes of Explanation: The segment, identified by Sustainable Research and Analysis, consists of five funds: Franklin Municipal Green Bond ETF (FMLB), JPMorgan Municipal ETF (JMUB), JPMorgan Ultra-Short Municipal Income ETF (JMST), SPDR Nuveen Municipal Bond ESG ETF (MBNE) and VanEck HIP Sustainable Municipal ETF (SMI). Total returns source: Morningstar Direct.

Observations:

- After registering four successive monthly total return declines, sustainable municipal ETFs turned positive in May. The five funds in the segment recorded a positive average return of 1.21% in May, ranging from 0.35% registered by the JPMorgan Ultra-Short Municipal Income ETF (JMST) to 1.46% posted by the VanEck HIP Sustainable Municipal ETF (SMI).

- Notwithstanding the negative results, the segment’s assets have expanded, reaching $3.6 billion, largely due to positive net flows into JMST.

- A secondary factor is the expansion of the segment. In May, the SPDR Nuveen Municipal Bond ESG ETF (MBNE) was launched—one of seven new ETF listings during the month. Offered at 43 bps (1.6X higher than the next highest expense ratio), this actively managed municipal bond fund is managed by SSGA Funds Management and sub-advised by Nuveen Asset Management. Another actively managed ETF also joined the mix in May when Franklin Templeton rebranded the Franklin Liberty Federal Tax-Free Bond ETF into the Franklin Municipal Green Bond ETF (FMLB), shifting with it some $101.9 million in net assets.¹

- The five ETFs, all actively managed, embody three varying approaches to sustainable investing, ranging from a thematic (FMLB) approach to two varieties of ESG integration, including ESG materially-based risk assessment (JMUB and JMST) and ESG screening combined with thematic alignment (MBNE and SMI).

¹FMLB is excluded from the number of new ETF launches in May.