The Bottom Line: Institutional share classes with minimum investments of $100,000 or mor account for over 50% of assets attributable to focused sustainable mutual funds.

Notes of Explanation: Size=total net assets by share class as of May 31, 2024. Sources: Morningstar Direct; Sustainable Research and Analysis LLC.

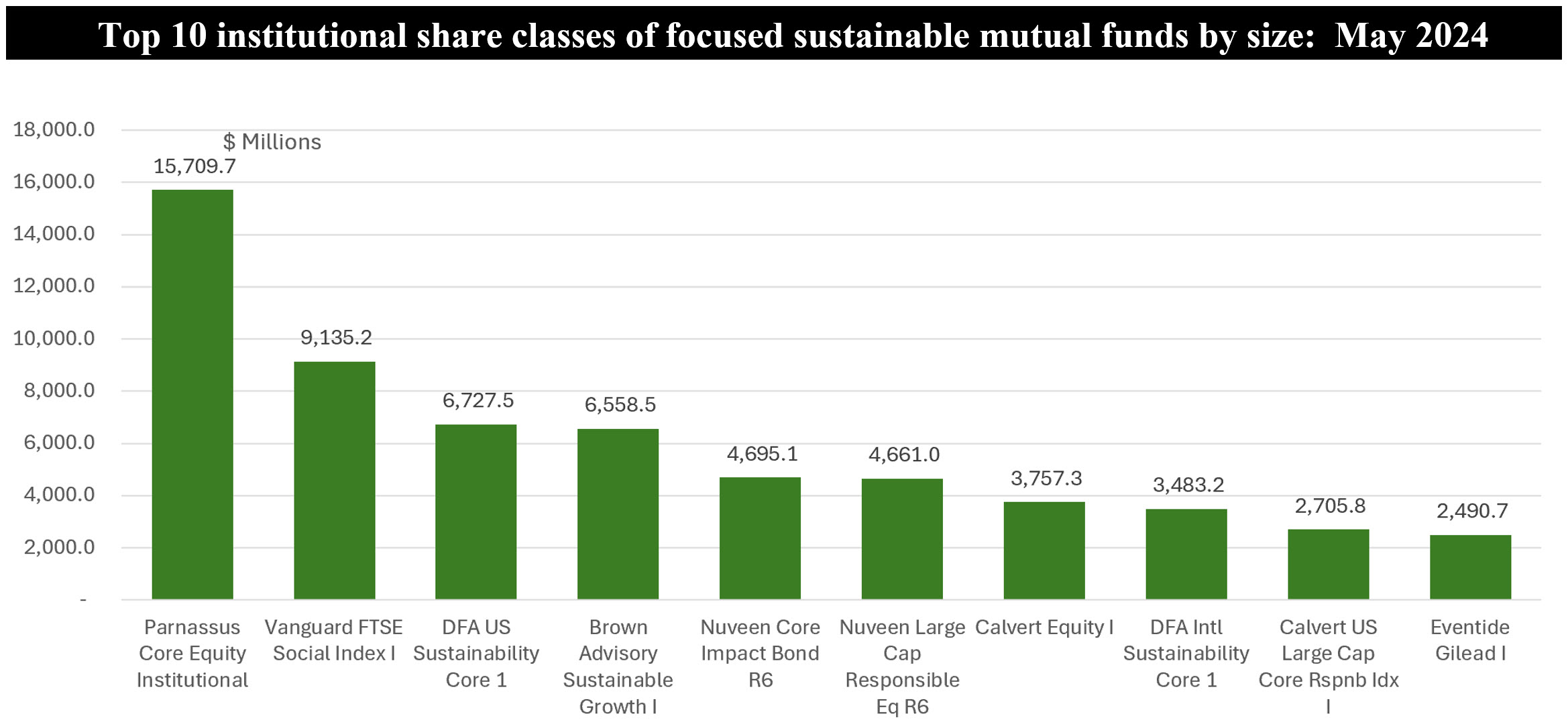

Focused sustainable mutual funds are dominated by institutional investors

Focused sustainable mutual funds are dominated by institutional investors, including both direct investments by asset owners as well as investments via financial intermediaries.

Focused sustainable long-term mutual fund assets reached $236.2 billion at the end of May 2024. The segment, which includes 1,231 long-term mutual funds and share classes, accounts for 70% of focused sustainable long-term fund assets that includes ETFs. As of the same date, institutional mutual fund share classes, which are dominated by actively managed funds, stood at $135.5 billion or 57.3% of the total, with equity funds making up the largest share at $103.6 billion, or 76%, followed by fixed income funds with almost $37 billion in assets or 20% of the total. The institutional mutual funds segment is concentrated, with the top ten funds/share classes accounting for 44% of the segment’s net assets.

Institutional fund share classes typically require shareholders to invest a minimum of $100,000 directly or shares may be purchased through financial intermediaries who also are subject to the same minimum investment requirement.

Investors via institutional share classes benefit from lower expense ratios and higher total returns. The average expense ratio for institutional share classes is 0.70%, ranging from a low of 0.12% to a high of 2.57%. On the other hand, all other share classes, largely retail, are subject to an average expense ratio of 1.04%, or 34 basis points higher. These range from the lowest 0.19% to a high of 2.25%.

Retail investors can take advantage of a greater number of lower cost mutual funds options if they are investing through financial intermediaries or by focusing on lower cost sustainable ETFs, in particular passively managed funds. On average, these investment funds are subject to an average expense ratio of 0.41%. These start as low of 0% to 0.5%, with low expense ratios available for passively managed funds in core investment categories, such as large and small-cap blended equity funds and investment-grade intermediate bond funds.