The Bottom Line: The nine sustainable index ETFs launched so far this year indicate lower average expense ratios relative to funds listed prior to 2022.

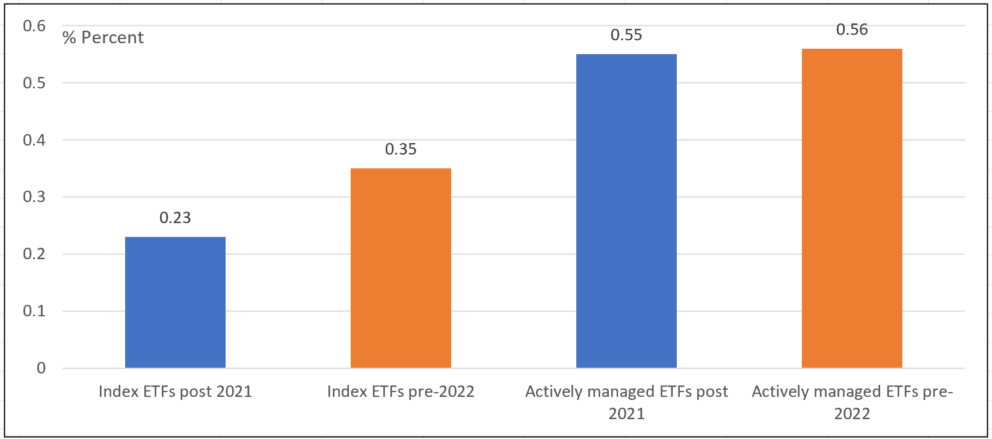

Average expense ratios of exchange traded funds launched prior to 2022 and 2022 Y-T-D Notes of Explanation: Expense ratios = arithmetic average, covering a total of 232 ETFs. Source: Morningstar Direct

Notes of Explanation: Expense ratios = arithmetic average, covering a total of 232 ETFs. Source: Morningstar Direct

Observations:

- Newly launched sustainable ETF index tracking funds in 2022 to-date are subject to lower expense ratios relative to the universe of ETFs listed prior to 2022. At the same time, newly listed sustainable actively managed ETFs indicate similar expense ratios, on average, relative to their pre-2022 counterparts.

- A total of 26 sustainable ETFs have been launched in 2022 to June 16, dominated by 17 actively managed ETFs and 9 index tracking funds.

- The sustainable index tracking funds reflect an average expense ratio of 23 bps or an average of 12 bps lower than the average 35 bps attributable to sustainable index tracking ETFs launched prior to 2022.

- Five of the nine funds, or 56%, were launched by BlackRock and SSGA whose funds carry the lowest expense ratios ranging from 1 bps (iShares Paris-Aligned Climate MSCI USA ETF (PABU) and SPDR MSCI USA Climate Paris Aligned ETF (NZUS)) to no more than 16 bps. The other five funds are subject to expense ratios ranging from 18 bps to 45 bps.

- The newly launched funds offer investors additional attractively priced sustainable investing options, including, for the first time, funds investing in U.S. large- and mid-capitalization stocks compatible with the objectives of the Paris Agreement to limit the increase in the global average temperature to well below 2 degrees Celsius (preferably 1.5 degrees Celsius) above pre-industrial levels. Reported progress relative to these objectives, if any is to be provided, will be beneficial for investors.