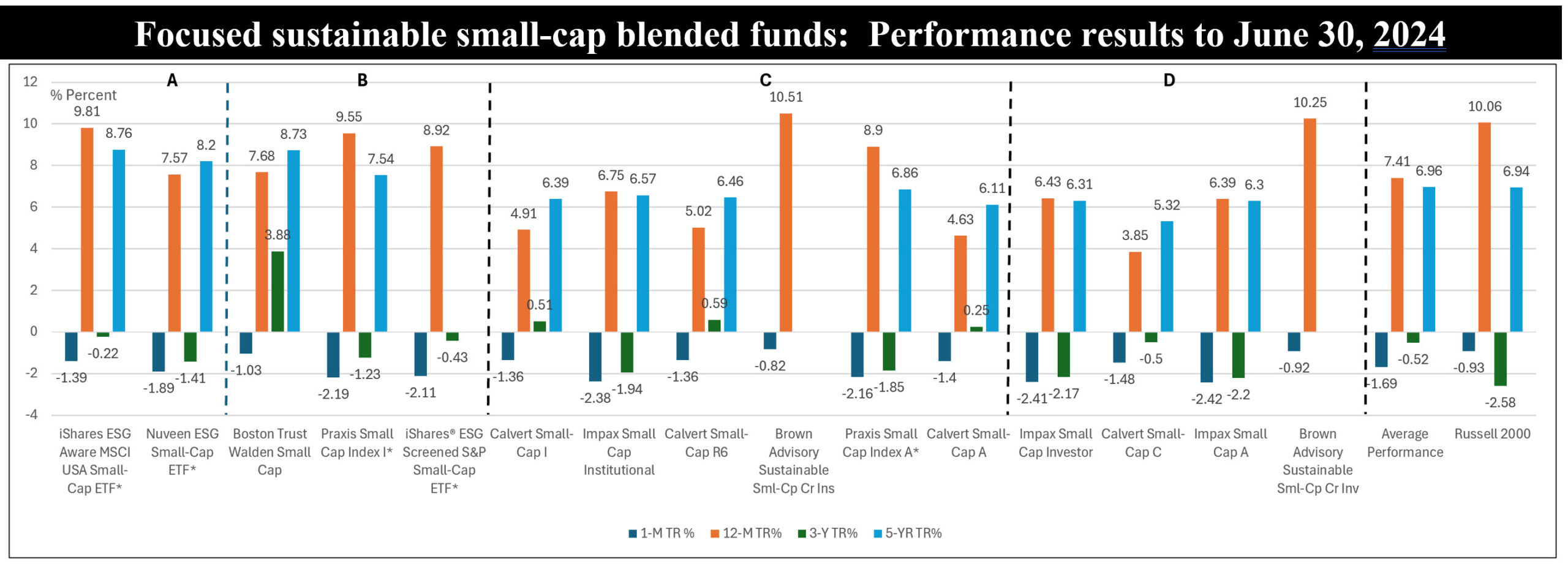

The Bottom Line: A limited number of focused sustainable small-cap blended funds is available to investors in pursuit of exposure to the recent market rotation.

Notes of explanation: Notes of explanation: Funds arrayed using a ranking scale that runs from A (highest ranking) to D (lowest ranking) based on a screening and evaluation methodology that accounts for management company considerations, years in operations, fund size, performance track record and expense ratio. Funds with less than $35 million in net assets are excluded. Small-cap blended funds consist of non-thematic small cap funds defined by their prospectus. * Indicates index fund. Total return results to June 2024, 3 and 5-year results annualized. Sources: Sustainable Research and Analysis LLC., fund prospectus documents and Morningstar Direct.